Protecting TLT

ORLA: The Industry’s Watchdog

The Oregon Restaurant & Lodging Association (ORLA) champions the responsible use of Transient Lodging Taxes (TLTs) to support tourism and related infrastructure. With over $220 million in TLTs generated annually across 110+ Oregon jurisdictions, ORLA works to ensure these funds are used as intended—not diverted for unrelated spending.

Fighting for Fair Use of TLTs: Some cities and counties have unusually high percentages of unrestricted TLT revenue. ORLA actively monitors these areas to ensure transparency and compliance with state law. Regular education is also vital, as turnover in local government often leads to gaps in understanding of TLT rules.

Explore More:

- ORLA’s Position on Local Lodging Taxes

- ORLA's Position on Statewide Lodging Taxes

- 10 Jurisdictions with High Unrestricted TLT Use

- The Truth About Tourism, Taxes & Community Investment

- Watch: How Local Lodging Taxes Must Be Spent

Legal Advocacy in Action

In 2021, ORLA secured a major legal victory against the City of Bend, reaffirming our authority to hold local governments accountable. This win underscores ORLA’s role as the trusted voice for Oregon’s lodging operators and the broader tourism economy.

Why Protecting Tourism Dollars Matters

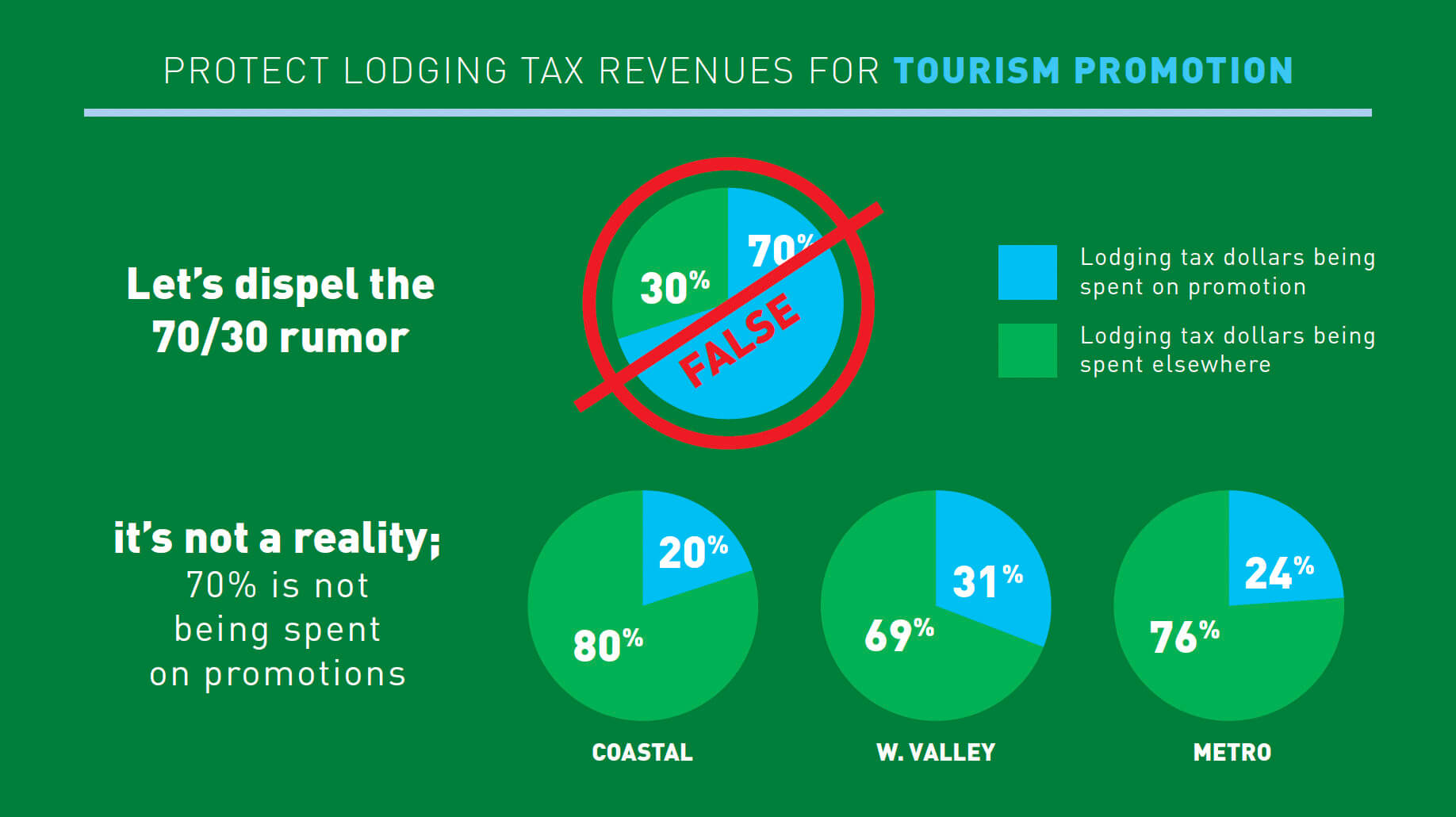

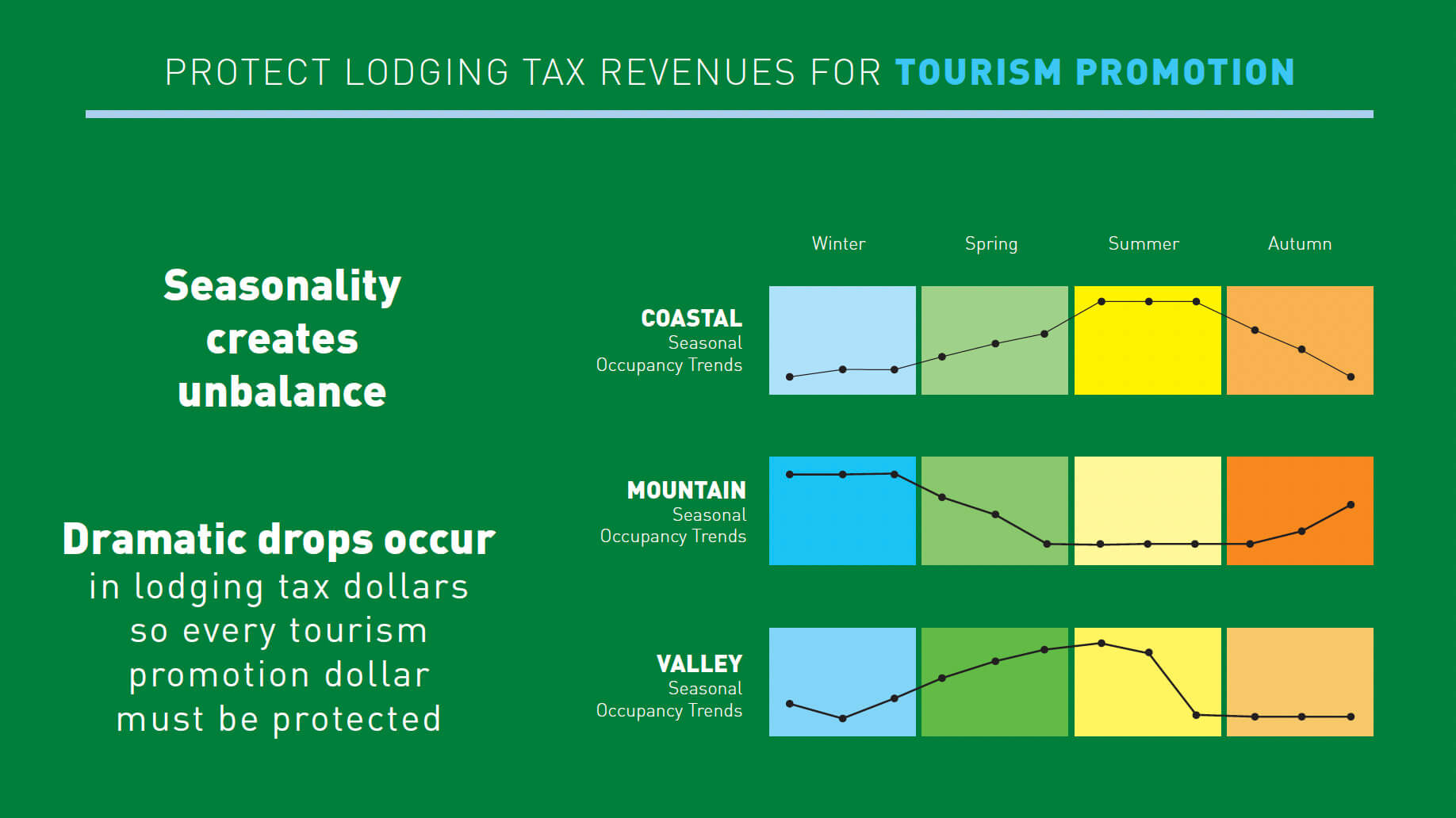

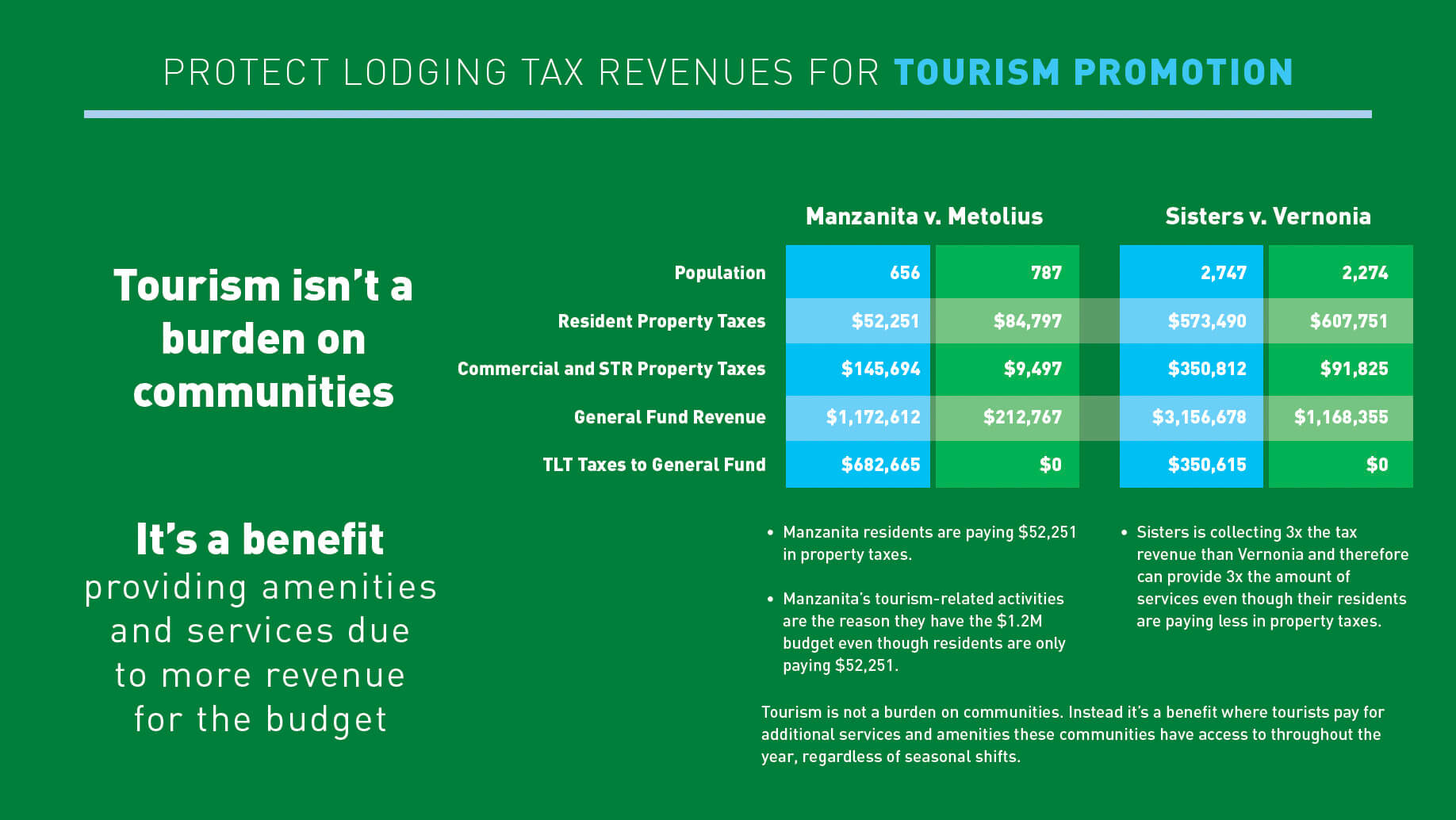

These infographics tell the real story behind how local Transient Lodging Taxes (TLTs) are spent—and why every tourism promotion dollar must be protected. From seasonal revenue challenges to misconceptions about spending ratios, ORLA sheds light on the critical role TLTs play in supporting communities, not burdening them. Dive into the data and see why ORLA continues to lead the charge in holding local governments accountable.