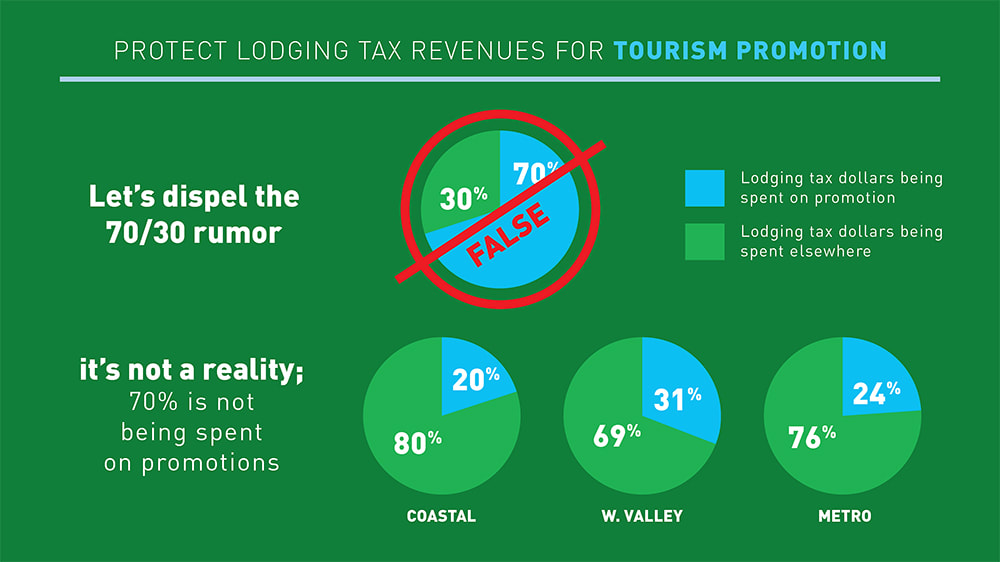

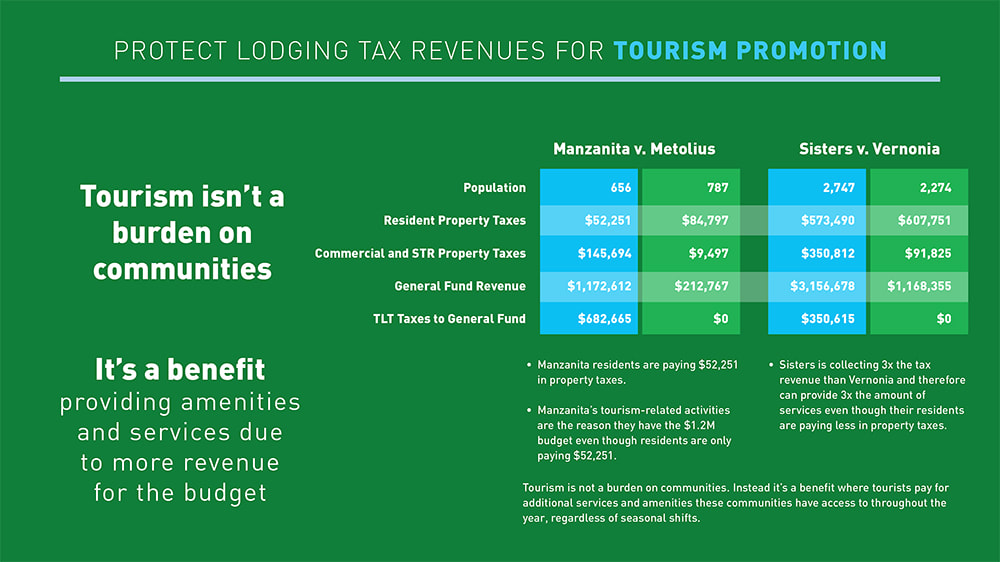

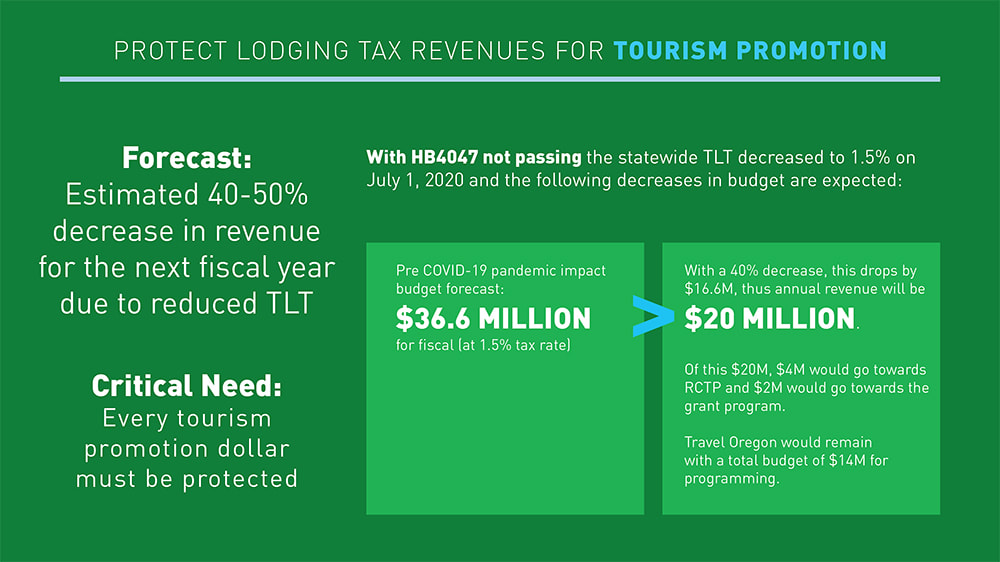

PROTECTING LOCAL LODGING TAX DOLLARS

Local Lodging Tax Watchdog Work: ORLA’s successful win in court at both the Circuit Court and Oregon Court of Appeals level has helped usher in a new chapter of relevance for the association in ramping up our watchdog role for our lodging members and the broader tourism industry. As a reminder, in August 2021, ORLA won a lawsuit on all counts against the City of Bend which helped cement our legal standing in holding local governments accountable for how they expend local lodging tax dollars even though ORLA itself does not collect local lodging taxes directly.