|

Below are some highlights from the 2022 Regular Session. A more comprehensive list of bills ORLA tracked can be found in the Bill Tracking Report.

SB 1514 – Pay Equity Originally a placeholder bill, ORLA monitored this bill as it became a vehicle to extend the ability of employers to offer hiring and retention bonuses. Because of the pandemic and government shutdowns of Oregon restaurants, many operators found themselves needing to offer hiring and retention bonuses to staff or prospective staff. The extension allows for businesses to continue to offer these bonuses without running afoul of Oregon’s Pay Equity Law until September 28, 2022, or 180 days beyond the expiration of the Governor’s Emergency Declaration which occurs April 1, 2022. HB 4015 – Entrepreneurial Loans ORLA supported this bill to help expand eligibility for state entrepreneurial loans and raise the per-loan limit from $500,000 to $1 million. This bill passed and was signed by the Governor on March 2, 2022, becoming effective immediately. HB 4101 – Smoking Bill ORLA initially opposed this bill which would have increased the distance from businesses at which someone could smoke from 10 to 25 feet. After an amendment in the House excluding OLCC-licensed businesses was passed, ORLA was neutral on the bill, but it died in the Senate. HB 4152 – Franchise Bill This was essentially the same bill that was introduced last session. ORLA opposed this bill which, among other provisions, would have allowed franchisees to use the brand name but nothing else related to the brand identity, quality, or reputation. Although the bill died in committee, we do expect the bill to return in the future and there is the possibility an interim legislative session committee or workgroup might review this issue. HB 4153 – Creative Opportunity Fund This bill established an “Opportunity Fund” equal to a dedicated two percent portion of the overall Oregon Production Investment Fund (OPIF) each year that could then be used for workforce development, employment training and mentorship, project and filmmaker grants, content and creator development, small business and regional production development, amongst other things. ORLA supported the bill for the economic and tourism opportunities available when these investments occur. The bill passed the House and Senate and as of this writing, was waiting for the Governor’s signature. Questions? Contact ORLA Director of Government Affairs, Greg Astley.  This week, Congress finally reached a bipartisan agreement on their annual spending bill. However, the agreement is silent on replenishing the Restaurant Revitalization Fund (RRF), meaning no new funds will be directed to complete the mission and fund the 177,000 applications still pending. Over 2,500 of those applications still pending are here in Oregon. We are waiting for the dust to settle in Washington to identify if there are other avenues to replenish this much-needed program. Unfortunately, this decision from Congress is a huge blow to our efforts and the path forward is very uncertain. From the start of this pandemic, ORLA and our partners at the National Restaurant Association have pursued an “all-of-the-above” strategy for the industry, diving into every issue at the federal, state, and local level that could help or hurt us. From cocktails-to-go to worker shortages, we have had a seat at the table for every major policy debate underway and we will continue to advocate on behalf of our industry and its members. You’ll be hearing more from us and the National Restaurant Association on the outlook for RRF, but in the meantime, there are plenty of other issues we will be focused on and we will continue to need your input and your help along the way. If you have any questions, please reach out to your Regional Representative or ORLA Director of Government Affairs, Greg Astley.  The Oregon Health Authority (OHA) announced today Oregon will remove general mask requirements for indoor public places no later than March 31. This would include restaurant customers and employees. OHA shared in a release, "By late March, health scientists expect that about 400 or fewer Oregonians would be hospitalized with COVID-19, the level of hospitalizations the state experienced before the Omicron variant began to spread. Mask requirements for schools will be lifted on March 31." State health officials say Oregon "needs to keep mask requirements in place for now as COVID-19 hospitalizations crest and Oregon’s health care system strains to treat high numbers of severely ill patients." Officials at OHA also filed a permanent rule requiring masks indoors in public places. This new rule replaces a temporary rule that expires tomorrow, February 8. As a reminder, the filing of a permanent rule was the only way health officials could extend the current temporary mask rule past its expiration date and until mask rules would no longer be needed to reduce transmission of COVID-19 and prevent the Omicron crisis from further overwhelming Oregon’s health care system. For questions or for more information, contact your Regional Representative. The Circuit Court decision has been affirmed by the State of Oregon Court of Appeals

FOR IMMEDIATE RELEASE: August 19, 2021 Contact: Jason Brandt, President & CEO, ORLA 503.302.5060 | jbrandt@oregonrla.org Wilsonville, OR– The importance of appropriately spending local tourism tax revenue was affirmed on August 11 by the State of Oregon Court of Appeals after a case brought forth by Bend lodging operators and the Oregon Restaurant & Lodging Association (ORLA) against the City of Bend. The original suit was argued on May 8, 2018, in Deschutes County Circuit Court with Judge Beth M. Bagley presiding. In the suit, the hospitality industry plaintiffs represented by Josh Newton of Karnopp Petersen LLP argued the City unlawfully redirected restricted Transient Lodging Tax (TLT) revenue, which state law required to be spent on tourism and tourism promotion. The court reasoned that a local ordinance passed in the City of Bend violated ORS 320.350 by decreasing the percentage of total local TLT revenues expended to fund tourism promotion from 35.4 percent to 31.2 percent. “The affirmation by the Oregon Court of Appeals this month upholding the Deschutes County Circuit Court decision means strong protections remain in place for how local lodging tax dollars can be spent across Oregon,” said Jason Brandt, President & CEO of the Oregon Restaurant & Lodging Association. “Our goals remain the same which start with the importance of working with local administrators and elected leaders when disagreements arise. Filing a lawsuit against a local government partner is a last resort and we look forward to turning the page and focusing in on what we can do across Oregon to invest our limited local lodging tax dollars on promotional strategies proven to boost our state’s local tourism economies.” The August 11 decision and details pertaining to the case can be found here. In 2003, the Oregon State Legislature passed lodging tax reforms meant to protect a percentage of revenues for hospitality industry reinvestment. As a result of the reforms, lodging tax collections spent by local jurisdictions on tourism promotion and facilities were ‘locked in’ as a percentage based on what a jurisdiction had been spending or agreed to spend as of July 1, 2003. July 2, 2003 represented a new chapter in Oregon whereby any new increase in a local lodging tax rate or any newly established local lodging tax would have to be spent on tourism promotion or tourism related facilities with 70 percent of revenue collected. The remaining 30 percent can and is commonly spent however a local jurisdiction sees fit free of any restrictions. You can view a short video created by ORLA which works to explain local lodging tax restrictions here: https://bit.ly/TLTdefined. “My firm and I are pleased with the decision by the Oregon Court of Appeals affirming Judge Bagley,” said Josh Newton, attorney for ORLA and the Bend lodging operators. “It is important that local governments abide by state law and honor their agreements with local business.” For more information on the efforts of the Oregon Restaurant & Lodging Association please visit OregonRLA.org. ### The Oregon Restaurant & Lodging Association is the leading business association for the foodservice and lodging industry in Oregon, which before COVID-19 provided over 180,000 paychecks to working Oregonians. The latest available data from the Oregon Employment Department shows current employment levels in the accommodations and foodservice industry totaling approximately 160,000 people as hospitality like many other industries faces the disruptions caused by COVID-19. PRESS STATEMENT: August 11, 2021

Statewide Mask Mandate Must Prevent More Business Restrictions Statement from President & CEO Jason Brandt: We can’t overstate how exhausted the hospitality industry is from an unthinkable health crisis spanning 18 months and counting. A new statewide mask mandate taking effect in 2 days must not lead to any other statewide business regulations. The industry is nowhere near recovery and has a long road ahead after all statewide restrictions were officially lifted 42 days ago. ORLA will work directly with Oregon OSHA and will advocate for a focus on ensuring appropriate signage is in place at businesses in addition to their oversight role for employee safety. For more information on the efforts of the Oregon Restaurant & Lodging Association please visit OregonRLA.org. ### The Oregon Restaurant & Lodging Association is the leading business association for the foodservice and lodging industry in Oregon, which before COVID-19 provided over 180,000 paychecks to working Oregonians. The latest available data for May of 2021 from the Oregon Employment Department shows current employment levels in the accommodations and foodservice industry totaling 153,200 people. Residents Should Have Say on Sales Tax on Meals

FOR IMMEDIATE RELEASE: July 12, 2021 Contact: Greg Astley, Director of Government Affairs, ORLA 503.851.1330 | astley@oregonrla.org Wilsonville, OR– The Cannon Beach City Council voted to approve a 5% sales tax on meals by a 3-2 vote, leading to a second reading on July 14th, 2021, to either ratify the sales tax or, if it fails, open the door for the City Council to place a measure on the ballot this November. The Oregon Restaurant & Lodging Association (ORLA) opposes the sales tax on meals in Cannon Beach and believes the residents of Cannon Beach deserve to have their voices heard. “It’s unconscionable Cannon Beach City Council would even think about enacting a sales tax on restaurants after the last 16 months our industry has suffered through but it’s especially troubling they would choose to do so without asking for a vote of the people,” said Greg Astley, Director of Government Affairs for ORLA. “The restaurants fortunate enough to survive the wildfires, ice storms and global pandemic we’ve been through are still struggling to hire enough people to fully re-open and try to recover from their significant financial losses.” Astley continued, “Although one City Councilor claimed residents would not be affected by the tax and therefore the sales tax on meals should not go to a vote of the people, nothing could be further from the truth. Residents will pay the sales tax on meals every time they go out to eat with friends and family unless they choose to stop patronizing local restaurants in favor of establishments outside the city limits.” Beyond the obvious unfairness of asking one industry to shoulder the burden of paying for services everyone will benefit from, ORLA has outlined several other reasons why voters should be allowed to weigh in on a sales tax on meals:

Astley concluded, “At the very least, the people of Cannon Beach deserve to vote up or down on this sales tax on meals. An even better solution for the City of Cannon Beach would be to consider an Economic Improvement District or similar mechanism where the burden of raising revenue falls more broadly than on just the struggling local restaurants.” ### The Oregon Restaurant & Lodging Association is the leading business association for the foodservice and lodging industry in Oregon, which before COVID-19 provided over 180,000 paychecks to working Oregonians.  [update 7.1.21] 2021 Legislative Win for ORLA Senate Bill 317A passed, making permanent the ability for bars and restaurants to offer mixed drinks for takeout or delivery if the guest also purchases a substantial food item.

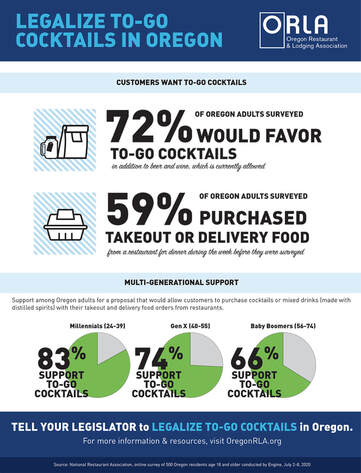

Restaurants and Bars Among Hardest Hit by COVID-19 Pandemic [July 20, 2020 - Wilsonville, OR] – The Oregon Restaurant & Lodging Association (ORLA), in partnership with the National Restaurant Association, recently completed a statistically significant survey around To-Go Cocktails, drinks made with distilled spirits for takeout, pickup or delivery to go along with meals purchased by guests. The survey, conducted July 3-6th, shows 72% or nearly three in four Oregonians, said they would favor a proposal allowing customers to purchase cocktails or mixed drinks (made with distilled spirits) with their takeout and delivery food orders from restaurants. This is in addition to beer and wine, which is currently allowed. Support is highest among those between the ages of 24-39 at 83%, with respondents between the ages of 58-74 showing the least support at 66%. Twenty-eight percent of adults said they strongly favor the proposal. Fifty-nine percent of Oregon adults said they purchased takeout or delivery food from a restaurant for dinner during the week before they were surveyed. ORLA President and CEO Jason Brandt said, “This is so encouraging for our members who have struggled just to stay open and keep people employed.” Brandt continued, “This has been an incredibly difficult time when restaurants and bars have struggled to deal with the challenges of being shut down, having to pivot to offer only takeout, pickup or delivery and then trying to invite guests back into dining rooms and make them feel safe and comfortable. Knowing almost three out of four Oregonians support the option to purchase cocktails or mixed drinks to go with their meals means some restaurants and bars who might have previously had to close down actually have a chance to make it now.” Allowing customers to purchase cocktails or mixed drinks (made with distilled spirits) for pickup, takeout or delivery requires a statutory change, meaning the Oregon Legislature would need to make the change to state law. Thirty other states currently offer To-Go Cocktails including Washington and California. “From a public safety perspective, if more businesses are able to offer the service of delivery of alcohol to their customers, the need for those customers to physically go into stores and businesses is reduced, thus reducing the risk of community spread of COVID-19,” said Brandt. Recognizing the need to help those who may have difficulty with alcohol addiction, ORLA’s website outlines a number of resources available to individuals, as well as training information to aid in prevention. More information on these resources and trainings can be found at OregonRLA.org/crisis-services-and-training. For more information please contact Greg Astley, ORLA Director of Government Affairs at 503.851.1330. ORLA Advocacy: Promoting and Advocating for Tourism Investment Plans

[update 7.1.21] - 2021 Legislative Session Win HB 2579 (Dead) – Increases state transient lodging tax rate and provides for transfer of moneys attributable to increase to county in which taxes were collected.

Background HB 2267, from Oregon’s 2003 Legislative Session, was designed to raise revenue for the promotion of tourism in Oregon. First, the bill instituted a 1 percent statewide lodging tax on all lodging properties in Oregon. This money was dedicated to the promotion of tourism through Travel Oregon, acting as Oregon’s tourism department. Second, the bill required any local governments with a lodging tax in place to determine what percentage was currently being used for tourism promotion and maintain at least that level in the future. The percentage is not allowed to decrease. The bill also required any local government that institutes a local lodging tax in the future to use at least 70 percent of the new revenue for tourism promotion. No more than 30 percent of the new revenue can be used for general funds or other non-tourism functions. The Oregon Restaurant & Lodging Association has worked with Local governments to clarify collection laws around Online Travel Companies. This should bring in millions of dollars more annually for tourism promotion. ORLA is also involved in efforts to attract events to Oregon that bring visitors and promote the state. Some examples in recent history were helping to pass legislation that added money to improve college athletic programs and allowing for NCAA March Madness games to be played in Oregon, and protecting tax credit programs that bring film and video production to Oregon. Issue ORLA must ensure that these state statutes remain in place. Any lodging taxes, state or local, need to bring travelers and businesses to Oregon. All retail businesses profit from increased travel; additionally, local government must be encouraged to keep promotional dollars directed to these efforts. Finally, there are always opportunities to attract more events like feature films, major sporting events, concert venues, and wine tours that benefit the industry as a whole. ORLA will work to enhance these efforts, which bring people to Oregon and encourage Oregonians to travel more in and around the state. Position Oregon Restaurant & Lodging Association supports current laws that protect lodging tax dollars going to tourism promotion and tax credits that encourage film and video attraction to Oregon. ORLA believes in protecting the dedicated tourism funds to ensure they continue to be allocated to tourism promotion at the state and local levels. This effort will benefit all retail businesses and local economies throughout our state. The 2021 Oregon Legislative Session was held remotely for the most part because of COVID-19 interruptions. The inability to meet in person coupled with the introduction of almost 4,000 bills this session meant there was a lot that did not get done. Legislative leadership primarily focused on police reform, housing, and social justice. For the hospitality industry, ORLA gained some victories to help our members and managed to help kill some bad bills that would have negatively impacted operators. Below is a summary of the key legislation from the 2021 session for our sector. Legislative Wins SB 317A – Allows holder of full on-premises sales license to make retail sales of mixed drinks in sealed containers for off-premises consumption.

HB 3361 (Passed) – Requires third-party food platform to enter into agreement with food place before arranging delivery of orders from food place or listing food place on application or website.

HB 3178 (Passed) – Temporarily removes condition for being deemed "unemployed" that individual's weekly remuneration for part-time work must be less than individual's weekly unemployment insurance benefit amount.

HB 3389 – Extends look-back period used to determine Unemployment Compensation Trust Fund solvency level from 10 years to 20 years.

HB 2205 (Dead) – Establishes procedure for person to bring action in name of state to recover civil penalties for violations of state law.

HB 2365 (Dead) – Prohibits food vendor from using single-use plastic food service ware when selling, serving or dispensing prepared food to consumer.

HB 2521 (Passed) – Requires transient lodging tax collector to provide invoice, receipt or other similar document that clearly sets forth sum of all transient lodging taxes charged for occupancy of transient lodging.

HB 2579 (Dead) – Increases state transient lodging tax rate and provides for transfer of moneys attributable to increase to county in which taxes were collected.

HB 2593 - Permits Office of Emergency Management to enter into agreement with nonprofit organization representing sheriffs under which organization is authorized to administer program to produce and sell outdoor recreation search and rescue cards.

HB 2818 – Allows payment from Wage Security Fund to be made to wage claimant for wages earned and unpaid in event that Commissioner of Bureau of Labor and Industries has obtained judgment in action or has issued final order in administrative proceeding for collection of wage claim.

HB 2966A – Extends grace period for repayment of nonresidential rent between April 1, 2020, and September 30, 2020, until September 30, 2021, for certain tenants.

HB 3058 (Dead) – Increases distance from certain parts of public places and places of employment in which person may not smoke, aerosolize or vaporize from 10 feet to 25 feet.

HB 3296 (Dead) – Increases privilege taxes imposed upon manufacturer or importing distributor of malt beverages, wine, or cider.

HB 3351 (Dead) – Establishes increase in statewide minimum wage rate beginning on July 1, 2022.

SB 650 (Dead) – Creates Public Assistance Protection Fund.

SB 750 (Passed) – Authorizes Oregon Liquor Control Commission to grant temporary letter of authority to eligible applicant for any license issued by commission.

HB 3177 (Dead) – Limits types of restrictions that Governor may impose on certain businesses during state of emergency related to COVID-19 pandemic.

SB 483A (Passed) – Creates rebuttable presumption that person violated prohibition against retaliation or discrimination against employee or prospective employee if person takes certain action against employee or prospective employee within 60 days after employee or prospective employee has engaged in certain protected activities.

SB 582A - Establishes producer responsibility program for packaging, printing and writing paper and food serviceware.

Other Bills SB 515 (Passed) – Requires employee of certain licensed premises who is permittee to make report if permittee has reasonable belief that sex trafficking is occurring at premises or that minor is employed or contracted as performer at premises in manner violating Oregon Liquor Control Commission rules.

SB 569A (Passed) – Makes unlawful employment practice for employer to require employee or prospective employee to possess or present valid driver license as condition of employment or continuation of employment.

For more information on ORLA's policy positions and priorities, reach out to Greg Astley, Director of Government Affairs.

National Restaurant Association Provides State and Local Lawmakers Blueprint for Rebuilding5/26/2021

Blueprint includes funded and unfunded tools to accelerate the industry’s economic recovery

Washington, D.C. (May 26, 2021) - The National Restaurant Association today sent a State and Local Blueprint for Rebuilding to the National Governors Association, the United States Conference of Mayors, and the National Council of State Legislators, encouraging their members keep the restaurant industry at the forefront of their conversations about how to accelerate the recovery of their economies. “State and local lawmakers have the power to make a real difference in their local industry’s recovery,” said Mike Whatley vice president for State Affairs and Grassroots Advocacy for the Association. “Decisive action on this proposal would provide critical tools and opportunities for the hardest hit restaurants struggling to find a new normal. They could help address some of our long-term obligations and the recruitment challenge, which we expect will continue into our busiest months later this summer.” The Blueprint includes 12 detailed steps lawmakers can take, including:

“The Association appreciates the efforts of leaders at the state and local level to work with the restaurant industry throughout the pandemic. Their creativity and commitment to our survival has been vital to the survival of restaurants large and small in every community. As we now begin to rebuild our industry, we encourage all legislative leaders to work with the Association and our 52 state restaurant association partners on ideas to help restaurants thrive once again in the future,” concluded Whatley. Read the full letter here. For more information about the Association’s advocacy, go to RestaurantsAct.com. ### About the National Restaurant Association Founded in 1919, the National Restaurant Association is the leading business association for the restaurant industry, which comprises 1 million restaurant and foodservice outlets and a workforce of 15.6 million employees. We represent the industry in Washington, D.C., and advocate on its behalf. Hospitality Operators are Encouraged to Help Staff Get Vaccinated

FOR IMMEDIATE RELEASE: May 11, 2021 Contact: Greg Astley, Director of Government Affairs, ORLA 503.851.1330 | astley@oregonrla.org Wilsonville, OR– Governor Kate Brown’s announcement today that once 70% of the state’s residents 16 and older have received at least one dose of the COVID-19 vaccine she’ll eliminate most statewide restrictions meant to thwart the spread of the disease, is welcome news to Oregon’s hospitality sector. “Oregon’s hospitality industry has been repeatedly hammered by the openings, closings, and changes to how we can operate over the last 13 months,” said Greg Astley, Director of Government Affairs for ORLA. “Hearing the plan for Oregon’s restaurants to be able to fully reopen and welcome back guests gives hope to those who have remained closed since the beginning of this pandemic and those who have struggled to remain open and keep people employed.” The Governor’s plan includes the lifting of limits on seating capacity for restaurants, bars, and other venues previously impacted by the risk levels. It also means no counties would remain under the current risk level tiers based on rates of infections. Physical distancing and face-covering mandates while indoors may still be in place for some time. The Governor has stated she will follow recommendations from the Centers for Disease Control and Prevention as to when face coverings may no longer be required. “ORLA is encouraging restaurants to help employees find vaccination sites for themselves and their families,” said Astley. “The sooner we can meet the goal of having 70% or more of Oregonians partially vaccinated, the sooner we can open back up our dining spaces and welcome guests back in to share food and make memories with their families and friends.” ### The Oregon Restaurant & Lodging Association is the leading business association for the foodservice and lodging industry in Oregon, which before COVID-19 provided over 180,000 paychecks to working Oregonians. Poll shows the vast majority of people are relieved the Governor’s latest indoor dining ban has ended

FOR IMMEDIATE RELEASE: May 7, 2021 Contact: Greg Astley, Director of Government Affairs, ORLA 503.851.1330 | astley@oregonrla.org Wilsonville, OR– A recent poll shows, 88% of Oregonians say they should be able to make their own decision about dining indoors at restaurants as more people become vaccinated. This comes as Gov. Kate Brown ended her ban on indoor dining in 15 counties starting today. “With Oregonians continuing to get vaccinated each week, my expectation is that we will not return to Extreme Risk again for the duration of this pandemic,” Brown said. Polling nearly 1,000 Oregonians, between April 26 to May 5, 2021, 88% said they want the option to dine indoors as more than 1 million people have been fully vaccinated in the state. “It is clear Oregonians understand what is at stake for their favorite local restaurants,” said Greg Astley, Director of Government Affairs for the Oregon Restaurant & Lodging Association. “We have 88% of survey respondents stating they feel they should have the choice whether to dine inside a restaurant or not right now. The sentiment against indoor dining closures at this stage is clearly reaching a feverish pitch.” Oregon has already seen more than 1,000 restaurants close because of the pandemic recession. The reopening of indoor dining ahead of the largest sales day of the year – Mother’s Day – will hopefully help some local restaurants continue to survive during this tough time. “These are the places where you’ve celebrated your birthday, had your first date, and enjoyed Mother’s Day brunch every year. More indoor dining restrictions would result in more permanent closures of these businesses that are part of the fabric of our lives and communities,” said Astley. “Now that everyone older than 16 is eligible, help us move away from future government restrictions by getting vaccinated. And please continue to support local restaurants this Mother’s Day by celebrating at you mom’s favorite place.” The recent poll we announced today was authored by ORLA and promoted on OregonLive.com. For more information on the efforts of the Oregon Restaurant & Lodging Association please visit OregonRLA.org. ### The Oregon Restaurant & Lodging Association is the leading business association for the foodservice and lodging industry in Oregon, which before COVID-19 provided over 180,000 paychecks to working Oregonians. The Governor’s announcement ending Extreme Risk in 15 counties will help restaurants at a critical time ahead of Mother’s Day – typically the top sales day of the year.

FOR IMMEDIATE RELEASE: May 5, 2021 Contact: Jason Brandt, President & CEO, ORLA 503.302.5060 | jbrandt@oregonrla.org Wilsonville, OR– Oregon restaurants struggling to survive welcome Gov. Kate Brown’s recent announcement ending the Extreme Risk category for 15 counties, allowing them to resume some indoor dining ahead of their busiest day of the year – Mother’s Day. On Tuesday, Gov. Brown stuck to her commitment to use statewide metrics announcing that because COVID-19 hospitalization rates have leveled, restaurants and their patrons can return to limited indoor dining starting Friday, May 7. “With Oregonians continuing to get vaccinated each week, my expectation is that we will not return to Extreme Risk again for the duration of this pandemic,” Brown said. This is welcome news to the thousands of local restaurants barely holding on during the pandemic recession.Oregon has seen more than 1,000 restaurants close in the past year. “With indoor dining coming back online across Oregon, ORLA’s focus now moves to two crucial fronts – supporting efforts to continue relaxing restrictions and finding solutions for lodging and restaurant employers struggling to get their employees back on the schedule,” said Jason Brandt, President & CEO of the Oregon Restaurant & Lodging Association. “The workforce shortage crisis is the challenge of our day outside government restrictions and it’s a national crisis. We look forward to working with our national partners on legislation to turn extended unemployment benefits through September into upfront cash bonuses to accelerate the industry’s recovery.” Restaurant and lodging operations continue to take all necessary precautions to ensure the safety of their employees and customers. Oregon public health officials have confirmed only 3% of the new COVID-19 cases were traced back to restaurants and bars while most of the new cases are attributed to schools. “Now that everyone older than 16 is eligible, help us move away from future government restrictions by getting vaccinated. And please continue to support local restaurants this Mother’s Day by celebrating at your mom’s favorite place,” said Brandt. For more information on the efforts of the Oregon Restaurant & Lodging Association please visit OregonRLA.org. ### The Oregon Restaurant & Lodging Association is the leading business association for the foodservice and lodging industry in Oregon, which before COVID-19 provided over 180,000 paychecks to working Oregonians. Restaurant Operators Remain Baffled by Disproportionate, Inequitable Restrictions

FOR IMMEDIATE RELEASE: May 3, 2021 Contact: Jason Brandt, President & CEO, ORLA 503.302.5060 | jbrandt@oregonrla.org Wilsonville, OR– This past week, Oregon State Epidemiologist Dr. Dean Sidelinger provided a COVID update to the Oregon Senate Committee on Health Care alongside Oregon Health Authority Director Patrick Allen. As part of the official testimony, Dr. Sidelinger and Director Allen were asked a series of questions by members of the State Senate serving on the committee. Of particular importance was the answer to a question about environments deemed responsible for increased case counts. Dr. Sidelinger referenced spread in multiple settings and cited 257 new outbreaks during the course of the past week. He said 30% of cases are attributed to single case outbreaks associated with schools, 12% are attributed to two or more case outbreaks associated with schools, 4.5% of cases are attributed to recreational sports and sports teams, and only 3% are traced back to restaurants and bars. Director Allen also shared 60% of cases are sporadic with no additional information about where they originated. Testimony continued including a summary statement from Director Allen who stated, “kids going back to school has led to more coronavirus, just not in school. It’s everything around it.” If restaurants are not a leading cause of spread, owners and operators across the state are baffled why thousands of restaurants in 15 counties have indoor dining bans. “It is clear from testimony that schools, not restaurants, are driving the overwhelming majority of new COVID cases,” said Jason Brandt, President & CEO of the Oregon Restaurant & Lodging Association. “Nonetheless, restaurants, which are taking the necessary precautions to ensure the safety of their employees and customers dining indoors, are shut down indoors at thousands of locations across 15 counties despite a lack of evidence to suggest they’re the source of spread. You can’t justify putting thousands of people out of work in an entire sector of the economy when there’s no evidence it’s contributing to the spike in cases. It makes no sense.” While the Restaurant Revitalization Fund will help some restaurants, the demand and urgency for aid far outpaces the amount of funding available. The Small Business Administration admitted they expect the federal funds to go quickly as restaurants across the country struggle. For more information on the efforts of the Oregon Restaurant & Lodging Association please visit OregonRLA.org. ### The Oregon Restaurant & Lodging Association is the leading business association for the foodservice and lodging industry in Oregon, which before COVID-19 provided over 180,000 paychecks to working Oregonians. House Vote on Unemployment Insurance Tax Relief Triggers Movement to State Senate

FOR IMMEDIATE RELEASE: April 16, 2021 Contacts: Greg Astley, Director of Government Affairs, ORLA 503.851.1330 | astley@OregonRLA.org Jason Brandt, President & CEO, ORLA 503.302.5060 | jbrandt@oregonrla.org Wilsonville, OR– The Oregon House of Representatives voted overwhelmingly to move forward with bipartisan legislation which would provide millions in unemployment insurance tax relief for some of Oregon’s hardest hit industries. House Bill 3389 passed the Oregon House and will now move to the Senate for ongoing deliberation. The bill accomplishes a number of priorities for Oregon’s hospitality industry with the most important component being the removal of 2020 and 2021 employment data from the formula used to determine an employer’s applicable tax rate, starting in 2022. “We would like thank the leaders who have signed on to support this bill as sponsors and their ongoing work to shepherd it through the legislative process,” said Jason Brandt, President & CEO for the Oregon Restaurant & Lodging Association. “The deferral and forgiveness components could be stronger for this year given the impact of government restrictions on industry employment options. Having said that, the big win will prove to be solving the tax hike problem for years 2022 through 2024.” Unemployment insurance taxes are paid entirely by Oregon employers to fund Oregon’s Unemployment Insurance Trust Fund which remains the healthiest in the nation. One third of unemployment insurance taxes for 2021 can be deferred for employers with an increased tax rate of half a percent or more. If the employer’s tax rate increased more than 1 percent to 1.5 percent, 50 percent of the deferred tax would be forgiven. For tax rates which increased more than 1.5 percent to 2 percent, 75 percent of the deferred tax would be forgiven. And for employers who had a tax rate increase of more than 2 percent, the full deferred amount would be forgiven. “We know this legislation if passed has the potential to save hospitality employers tens of millions of dollars this year alone,” said Greg Astley, Director of Government Affairs for the Oregon Restaurant & Lodging Association. “That amount pales in comparison to the real impact of the relief in future years. If we can erase 2020 and 2021 from upcoming calculations as proposed in the legislation, it will have a direct impact on our industry recovery efforts.” The bipartisan Chief Sponsors of the bill in the house include Representatives Paul Holvey, Daniel Bonham, and John Lively. The bipartisan Chief Sponsors in the State Senate include Senators Bill Hansell and Chuck Riley. For more information on the efforts of the Oregon Restaurant & Lodging Association please visit OregonRLA.org. ### The Oregon Restaurant & Lodging Association is the leading business association for the foodservice and lodging industry in Oregon, which before COVID-19 provided over 180,000 paychecks to working Oregonians. The tally of restaurant closures grows every month as restrictions continue

FOR IMMEDIATE RELEASE: April 12, 2021 Contact: Greg Astley, Director of Government Affairs, ORLA 503.851.1330 | astley@OregonRLA.org Wilsonville, OR– According to CHD Expert, Oregon has lost an additional 190 foodservice locations during March as over a year of lockdowns and restrictions continue to wreak havoc on the state’s hospitality industry. “We have seen over 200 additional restaurant closures in 2021 on top of the closures experienced in 2020,” said Greg Astley, Director of Government Affairs for the Oregon Restaurant & Lodging Association. “An analysis of data compiled from sources including CHD Expert and active alcohol licenses from the Oregon Liquor Control Commission (OLCC) shows us that we have now experienced a net loss of approximately 600 to 800 permanent closures of restaurants across Oregon.” CHD Expert data for 2020 shows 1,185 closures of restaurants with 770 openings during the year for a net difference totaling 415 locations. Food service operations serving alcohol have experienced a decrease of 442 locations compared to pre-covid location totals, according to the OLCC. “Our state leaders in Oregon’s Legislature continue to look for ways to provide assistance to the hard-hit restaurant and lodging sectors,” said Astley. “We would like to recognize State Senators Betsy Johnson and Elizabeth Steiner Hayward for looking at relief options including the creation of a credit to help cover the costs of alcohol licenses for calendar year 2021.” Read more in a recent OLCC memo to Senators Johnson and Steiner Hayward outlining the costs associated with licensee credits. “The volatility due to government restrictions in Oregon is clobbering the ability of restaurant owners and managers to provide some scheduling stability for our industry employees,” said Jason Brandt, President & CEO for the Oregon Restaurant & Lodging Association. “We have a perfect storm brewing – growing checking accounts from stimulus funding, increased unemployment benefits for Oregonians, pent up demand for hospitality services from consumers, and frontline workers still pushing through the process of vaccinations. For our consumers out there, please be patient with your favorite local restaurants and lodging establishments. They will continue to do whatever they can within their control to meet your expectations.” For more information on the efforts of the Oregon Restaurant & Lodging Association please visit OregonRLA.org. ### The Oregon Restaurant & Lodging Association is the leading business association for the foodservice and lodging industry in Oregon, which before COVID-19 provided over 180,000 paychecks to working Oregonians. New ‘Extreme Risk’ Standards Will Result in Indoor Dining Continuity but More Needs to Change

FOR IMMEDIATE RELEASE: April 7, 2021 Contact: Jason Brandt, President & CEO, ORLA 503.302.5060 | JBrandt@OregonRLA.org Wilsonville, OR– The framework for mitigating Covid risk in Oregon across a variety of industries has changed once again with newly established statewide hospitalization metrics among other factors defining Oregon’s new ‘Extreme Risk’ category. As a result, all Oregon counties for the first time in many months will once again have access to indoor dining operations. “The news this week is bittersweet,” said Jason Brandt, President & CEO of the Oregon Restaurant & Lodging Association. “While five counties moved down in risk (Grant, Malheur, Umatilla, Coos, and Curry), six moved up in risk (Clackamas, Deschutes, Klamath, Linn, Multnomah, and Tillamook) which means moving down from 50% to the dreaded 25% indoor capacity restriction starting Friday, April 9. Anything less than 50% capacity poses ongoing survival challenges for our small businesses.” In a press release issued by Governor Brown’s office, Oregon’s new extreme risk category includes a new statewide metric: Covid-19 positive patients occupying 300 hospital beds or more, and a 15% increase in the seven-day average over the previous week. As of April 6, Covid-19 related hospitalizations totaled 163 in Oregon. “We are past due in developing a hospitalization metric as the central tool to determine all county risk levels,” said Brandt. “Over 2 million vaccine doses have been administered in Oregon. The risk associated with each Covid case diminishes with each vaccination and our stringent risk categories have not changed since they were implemented to mitigate the severity of Oregon’s winter surge.” Concern regarding variants have been commonly cited by health officials as the reason for ongoing economic restrictions as the majority of other states move well past Oregon’s reopening status. According to recent comments by Dr. Dean Sidelinger, initial results show all vaccines to be effective in preventing serious Covid illness even if the virus is still contracted and results in a documented case. “As we learn about the effectiveness of vaccines in protecting Oregonians against serious illness caused by variants, we should use that crucial information to change the crippling restrictions still being lived out by too many Oregonians,” said Brandt. “After reviewing all the facts, any reasonable person would conclude the vaccines are effective at keeping Oregonians out of the hospital and as a result, our risk metrics and widespread economic restrictions should change accordingly.” ORLA continues to call for a statewide indoor restaurant capacity of at least 50% including an adoption of physical distancing standards between parties that align with international health guidelines (1 meter or 3.2 feet). For more information on the efforts of the Oregon Restaurant & Lodging Association please visit OregonRLA.org. ### The Oregon Restaurant & Lodging Association is the leading business association for the foodservice and lodging industry in Oregon, which before COVID-19 provided over 180,000 paychecks to working Oregonians. DHS considering supplemental H-2B seasonal guest-worker visas

The Department of Homeland Security is “taking a very close look” at whether to issue supplemental H-2B seasonal guest-worker visas for the coming summer months. H-2B visas are reserved for seasonal jobs outside of the agriculture industry, such as landscaping, resorts, and seafood processing, with demand highest in the spring and summer season. A recent Cato Institute REPORT entitled, “H-2B Visas: The Complex Process for Nonagricultural Employers to Hire Guest Workers,” correctly concludes that the program is overly complex and burdensome and should be streamlined and reformed to benefit both employers and guest workers alike. The American Hotel & Lodging Association is part of the H-2B workforce coalition whose focus is on three strategic areas right now:

Read the coalition's letter to Secretary Mayorkas on supplemental visas. Governor Brown Announces Two-Week Extension for Counties Facing Moves Back to Extreme Risk

Today, Governor Brown announced a change to the Extreme Risk category rules impacting counties who move out of Extreme Risk only to face the prospect of entering back into the category two weeks later due to short-term case counts within county boundaries. View the Governor's press release. “We want to acknowledge the importance of this change and this response to our plea for changes to the 2-week rigmarole being experienced by too many Oregon restaurant workers and their families,” said Jason Brandt, President & CEO for the Oregon Restaurant & Lodging Association. “When we hone in on case counts as more counties enter risk categories that allow for indoor dining, the general public are starting to see firsthand what we have been saying for quite some time – indoor dining can work well and can be embraced while also mitigating virus spread in our communities. Whether our hospitality industry is operating in a low-risk county, extreme risk county, or somewhere in between, small businesses need to know what comes next after the risk categories we’ve been living with for months. Similar to the way our state leaders laid out our plans for vaccine deployment for Oregonians, we hope to learn more soon about when our industry will be given the lifeline they need. And that lifeline has everything to do with clarity about operations beyond the current county by county risk assessment system.” ORLA continues to advocate for a statewide indoor dining policy allowing at least 50% capacity like the vast majority of states across the country followed closely by an elimination of capacity restrictions when every Oregonian who wants a vaccine has access to one. Contact: Jason Brandt, President & CEO, ORLA 503.302.5060 | JBrandt@OregonRLA.org  Add Your Video, Get Your Voice Heard The restaurant industry, more than any other in Oregon and the across the nation, has suffered the most significant sales and job losses since the COVID-19 pandemic began a year ago. State and federal lawmakers want to hear from our restaurant operators and employees about how the pandemic has impacted you and your business, what changes you’ve had to make, and what your outlook is like moving forward. These are important stories to share and we're helping to ensure they get heard by policymakers. The National Restaurant Association has created an easy platform for you to record a quick selfie video and share your story. The association will be assembling an advocacy video that illustrates what this industry has endured, why we are not giving up, and what our outlook is moving forward. They will then share the finished video with Congress, policymakers and influencers in Washington. ORLA would also like to share your stories with our state lawmakers. Please consider adding your voice to this powerful tribute to the hospitality industry.

If you have questions or concerns, you can reach out to your ORLA Regional Representative or contact our Director of Government Affairs, Greg Astley. |

Categories

All

Archives

April 2024

|

Membership |

Resources |

Affiliate Partners |

Copyright 2024 Oregon Restaurant & Lodging Association. All Rights Reserved.

8565 SW Salish Lane Suite 120 | Wilsonville, OR 97070-9633 | 503.682.4422 | 800.462.0619 | Contact Us

Site Map | Accessibility | Privacy Policy

8565 SW Salish Lane Suite 120 | Wilsonville, OR 97070-9633 | 503.682.4422 | 800.462.0619 | Contact Us

Site Map | Accessibility | Privacy Policy

RSS Feed

RSS Feed