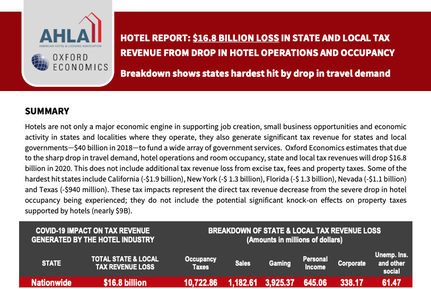

New research shows coronavirus continues to devastate restaurant industry New research from the National Restaurant Association indicates that the restaurant industry has lost $120 billion in sales during the last three months due to the impact of coronavirus in the United States. State mandated stay-at-home policies and forced closures of restaurant dining rooms resulted in losses of $30 billion in March, $50 billion in April, and another $40 billion in May. The latest operator survey conducted by the NRA drew more than 3,800 responses, illustrating the extensive damage to restaurant businesses since the outbreak began. It found that the restaurant industry, which experienced the most significant sales and job losses of any industry in the country in the first quarter of 2020, expects to lose $240 billion by the year-end.  New report by Oxford Economics with state-by-state TLT revenue breakdown As a result of the sharp drop in travel demand from COVID-19, state and local tax revenue from hotel operations will drop by $16.8 billion in 2020, according to a new report by Oxford Economics released today by the American Hotel & Lodging Association (AHLA). Hotels have long served as an economic engine for communities of all sizes, from major cities, to beach resorts, to small towns off the interstate—supporting job creation, small business opportunities and economic activity in states and localities where they operate. Hotels also generate significant tax revenue for states and local governments to fund a wide array of government services. In 2018, the hotel industry directly generated nearly $40 billion in state and local tax revenue across the country. Oregon is expected to see a total state and local tax revenue loss of $171.7 million. Download the AHLA/Oxford Economic Report of the state-by-state breakdown for tax revenue impact and revenue loss. These tax impacts represent the direct tax revenue decrease from the severe drop in hotel occupancy, including occupancy, sales, and gaming taxes. These figures do not include the potential, significant, knock-on effects on property taxes supported by hotels (nearly $9B). Get Certified through the Office for Business Inclusion and Diversity

Some government projects have specific requirements or targets for their contracts to be awarded to minority-owned, women-owned, service-disabled veteran-owned businesses, and emerging small businesses. The primary goal of Certification Office for Business Inclusion and Diversity (COBID) is to level the playing field by providing certified firms a fair opportunity to compete for government contracts regardless of owner ethnicity, gender, disability, or firm size. Discover which certifications you qualify for. Once certified, you are added to a database searched by many municipalities, state, and pseudo-government agencies, increasing your opportunities to compete for public contracting. Certifying your business for as many certifications as qualified for helps make it possible to grow and overcome barriers. Learn more about getting certified by visiting the Certification Office for Business Inclusion and Diversity online. |

Categories

All

Archives

June 2024

|

Membership |

Resources |

Affiliate Partners |

Copyright 2024 Oregon Restaurant & Lodging Association. All Rights Reserved.

8565 SW Salish Lane Suite 120 | Wilsonville, OR 97070-9633 | 503.682.4422 | 800.462.0619 | Contact Us

Site Map | Accessibility | Privacy Policy

8565 SW Salish Lane Suite 120 | Wilsonville, OR 97070-9633 | 503.682.4422 | 800.462.0619 | Contact Us

Site Map | Accessibility | Privacy Policy

RSS Feed

RSS Feed