|

By definition, a captive audience meeting is a mandatory meeting during working hours. Captive audience meetings are an important tool for employers to explain aspects and implications of unionization (and other issues) that might not be readily apparent to many workers. How these meetings are conducted will differ from workplace to workplace. In 2009, the Oregon Legislature passed SB 519, prohibiting employers from taking adverse employment action against any employee who declines to attend a meeting or participate in communication concerning an employer's opinion about religious or political matters. Employers should consider their options accordingly. The Council of State Restaurant Associations produced an issue brief that provides valuable considerations for employers. ORLA members can access this brief in the Resource Library by logging in to OregonRLA.org. Not an ORLA member yet? Visit our Membership page or reach out the ORLA Regional Representative nearest you.

Oregon’s Healthy Unemployment Insurance Trust Fund Makes Businesses and Communities Stronger7/19/2023

Oregon has one of the best unemployment insurance (UI) tax systems in the nation. While there are federal requirements all states must follow with their UI trust funds, there is room for state flexibility, and Oregon has taken advantage of this to minimize employer tax rate volatility, protect employers from additional charges, and provide a strong safety net for recessionary times. During strong economic times, the tax schedule increases so we can replenish Oregon’s UI Trust Fund. Once we have strong reserves, the tax schedule drops so employers have lower taxes. Each employer’s individual tax rate is based on the amount of UI benefits their employees receive. Also, Oregon’s UI Trust Fund’s reserves earn interest. Over the last 10 years, UI Trust Fund interest added $797 million. That means about 20 percent of the increase in the UI Trust Fund balance in the past 10 years came from interest earned — not employer payroll taxes. Due to Oregon’s self-balancing system, the more interest earned, the more likely we are to have a lower tax schedule. One way to look at it is, with Oregon’s UI tax system, employers only had to pay 80 cents on the dollar for the benefits paid out. During the Great Recession and the COVID-19 pandemic, many states had to borrow money because their UI Trust Funds were not solvent — employers in those states pay more than $1 for each dollar of benefits paid to workers. Benefits don’t just help laid-off workers. They also support communities and businesses by ensuring that money keeps flowing through the local economy during economic downturns. During the recent Pandemic Recession, Oregon’s UI Trust Fund paid out $859 million in regular UI benefits from April to June 2020 — twice as high as any calendar quarter during the Great Recession. Also, researchers have estimated that every $1 of UI benefits generates about $2 in economic activity in that community. During a recession, this can be a vital support for our economy. Thanks to Oregon's healthy UI Trust Fund, we did not have to borrow any money during the Pandemic Recession, unlike many other states. Those states also faced borrowing costs, restricted options on policy, and higher federal payroll taxes and surcharges for employers. While employers in other states saw additional UI taxes and other costs, Oregon has been a careful steward of employers’ tax dollars. With 2021’s House Bill 3389, lawmakers protected employers from increased payroll taxes that might have resulted from the unprecedented number of Oregonians who received UI benefits during the Pandemic Recession and allowed employers to defer or avoid some tax liability. In addition to short-term tax relief, HB 3389 extended the look-back period for the fund adequacy percentage ratio from 10 years to 20 years and omitted calendar years 2020 and 2021 from the formula. These changes mean:

This editorial wss provided by the Oregon Employment Department. ORLA had a very tangible return on investment proving how advocacy and relationship building efforts can drive bottom line results for businesses when House Bill 3389 passed in the 2021 legislative session. This important bill provided assistance to Oregon employers with both short- and long-term provisions, offering significant relief to employers. Read more about how ORLA's Advocacy Drives Bottom Line Results.

Legislative Progress / ORLA Testimony / Power Outages / Mergers Senate Activity Spurs Bill Passage - With the Oregon Senate officially back with a quorum to conduct business, there's been a flurry of activity at the Capitol. All 38 budget bills have passed, with over 30 agency or commission budget bills from the House awaiting Senate action. One important piece of public safety legislation that passed the Senate, SB 337, is a funding bill for increased investments to assist with the backlog of officers awaiting training at the state policy academy. The second bill, SB 5532, is the budget bill for the new commission which also passed the Senate. Read the summary from the Oregon State Bar. ORLA's government affairs team is still engaged on several other bills of importance to the hospitality industry; see the latest bill tracking online. ORLA Testimony - Throughout the year, your association engages on a number of issues with potential impact on hospitality businesses. Our government affairs team is at the table for important discussions with other business organizations, elected leaders, and agency and government representatives, oftentimes providing testimony on behalf of our members. Here's some recent activity:

Be Smart and Prepare for Power Outages - Oregon is experiencing longer and more intense wildfire seasons than ever before. Which is why businesses need to be prepared for potential wildfire and weather-related events as well as the power outages they may cause. ORLA has curated a list of helpful information and resources that provide preventative steps to help minimize disruption in case of a Public Safety Power Shutoff. From training to refrigeration, there are a number of steps you can proactively take now to prepare your staff and business for potential planned (or unplanned) power shutoffs. Webinar on Hospitality Mergers and Acquisitions Marketplace - Take a look into hospitality deal activity trends and what you should be doing now to maximize the value of your business. Join this webinar hosted by ORLA to receive industry insight on the status of the hospitality Mergers and Acquisitions marketplace and trends associated with deal structures and valuation. Industry members will also learn how to position a hospitality business to maximize its value to attract investors and buyers. Additional topics will include planning for owner transitions and succession planning, the process of executing a successful transaction, and how to prepare your business for sale. ORLA keeps members informed and educated with the latest information, industry intelligence and research via several channels. In addition to the blog, members receive more comprehensive insights via the monthly Insider e-newsletter and access to the Member Portal with data and research.

Not a member yet? Visit our Membership page or reach out the ORLA Regional Representative nearest you.  ProStart Students on Capitol Hill / Legislative Updates / Industry Workshops / Cinco de Mayo Oregon Represented at National Competition: The National ProStart Invitational wrapped up last night after two days of heated competition among 400 high school students representing 92 teams from 46 states. As Oregon state champions, Crook County and McMinnville high school teams traveled to Washington D.C. this week to compete in the culinary and management competitions, respectively. Oregon Hospitality Foundation's Courtney Smith traveled with the teams as host and to provide support at the events. Following the competition, students on McMinnville's management team met with Senator Jeff Merkley on Capitol Hill to share their restaurant concept and convey how valuable the ProStart program has been in providing training and career exploration in the hospitality industry. Way to go Oregon! Legislative Bill Deadline: Today is the Post Work Session deadline for all legislative bills. In order for a bill to be heard in committee by second chamber deadline (May 19), it has to be posted on an agenda for work session by May 5. However, this does not apply to Rules, Revenue, or Joint Committees. ORLA’s Government Affairs Committee continues to meet via Zoom every Friday for discussion and updates on legislative activity. If you are interested in joining, please sign up and we'll connect with you before next week's call. You can find the latest bill tracking on our website. "How I got Started in the Hospitality Industry:" Oregon Hospitality Foundation (OHF) Board member Paul Paz met with culinary students at Salem's CTEC (Career Technical Education Center) to facilitate a hospitality workshop and presentations earlier this week. Management and staff from the Salem Convention Center and Bentley's Grill participated by sharing their career stories and OHF's Lupe Arellano was was on hand to talk about career opportunities within the hospitality industry. This was part of the CTEC Salem-Keizer Learning that WORKS program that helps "prepare high school students for high-skill, high-wage and high-demand careers while developing the professional skills, technical knowledge, academic foundation and real-world experience to assure their success upon graduation." Whiskey Lovers Take Note: Ticket sales for ORLA's annual Swig & Savor Whiskey Event went on sale today for the August 26 event at the Portland Marriott Downtown Waterfront. Purchase your tickets now and join distillers, master blenders and other enthusiasts to taste a multitude of special whisk(e)y pours from around the world, curated into one spectacular night. National Small Business Week: Chip Rogers, AHLA President & CEO, released the following statement today marking National Small Business Week: “Six in ten hotels are small businesses, and National Small Business Week is a great opportunity to reflect on the tremendous opportunities hotels are creating for employees and other small companies to grow and thrive,” said AHLA President & CEO Chip Rogers. “Hotels support millions of good-paying jobs and generate billions in state and local tax revenue in communities across the nation. To continue doing so, we’re looking to hire more than 100,000 people around the country. With average hotel wages at near-record levels, better benefits than ever before, and unprecedented opportunity to move up the ranks, there’s never been a better time to start a hotel career.” Background Info:

Celebrate Cinco de Mayo! Oregon’s Largest Multicultural Festival is back with the Portland Guadalajara Sister City Association (PGSCA) and Treadway Events' 36th annual Portland Cinco de Mayo Fiesta May 5-7th at Tom McCall Waterfront Park in downtown Portland. The PGSCA is a non-profit organization dedicated to creating and strengthening partnerships and fostering goodwill between the City of Portland, and the City of Guadalajara, Jalisco, Mexico, since 1983. ORLA keeps members informed and educated with the latest information, industry intelligence and research via several channels. In addition to the blog, members receive more comprehensive insights via the monthly Insider e-newsletter and access to the Member Portal with data and research. Not a member yet? Visit our Membership page or reach out the ORLA Regional Representative nearest you.

Liquor Surcharge / Minimum Wage Increase / Award Nominations / Get Involved Public Comments Requested on 50-cent Surcharge Increase: OLCC is seeking public comment on a possible increase of the current 50-cent surcharge on each bottle of distilled spirits to one dollar per bottle. The Commissioners will listen to verbal comments on this at the April 20, and May 18, 2023 Commission meetings. ORLA is in alignment with the Oregon Beverage Alliance in opposing this increase and encourages industry members to take action and provide input on how this may impact your business' bottom line. Oregon's Minimum Wage Climbs: BOLI announced late last week that Oregon's minimum wage will increase by 70 cents per hour on July 1, 2023. State law requires an adjustment to the minimum wage to be calculated no later than April 30 of each year based on annualized inflation rates, rounded to the nearest 5 cents. The consumer price index climbed 5% from March 2022 to March 2023. The minimum wage rates will increase as follows:

Nominate Your Star Employees: Oregon’s hospitality industry is full of amazing individuals who go above and beyond, raising the bar for excellence in service, performance, and commitment to their team, organization, and the industry. Nominations are now open for the statewide ORLA Hospitality Industry Awards which seek to recognize some of these outstanding individuals who truly exemplify Oregon hospitality. In addition to the Employee of the Year, we are also accepting nominations for the Restaurateur of the Year, Lodging Operator of the Year, and new this year a Team Leader of the Year (mid-level employee, supervisor, or director). Submit nominations by June 30, 2023. New Oregon Hospitality Foundation Workforce Blog: The Oregon Hospitality Foundation (OHF) is laser focused on workforce development initiatives to do what we can to build bridges between hospitality industry employers and workers seeking employment opportunities. In an effort to keep lines of communication open with all industry operators interested in connecting with future employees for their operations, the Foundation has launched a new Workforce Blog. Follow what's happening in workforce development efforts and reach out to us if you're interested in getting involved. Travel & Tourism Industry Achievement Awards: Travel Oregon announced the recipients of the Oregon Travel and Tourism Industry Achievement Awards during the 2023 Oregon Governor’s Conference on Tourism at the Oregon Convention Center. Read more about all the awards winners. ORLA Members -Get Involved in Your Association: The Oregon Restaurant & Lodging Association is multi-faceted with a variety of different opportunities for professional development amongst hospitality professionals, including board and committee service, program participation, and networking. For those looking to get involved in some way in their state association, check out the numerous activities and opportunities for you to get involved and make the most out of your membership. Are You a Member Yet? The Oregon Restaurant & Lodging Association (ORLA) keeps members informed and educated on important issues impacting the hospitality industry. If you are not yet a member of ORLA, please consider joining the association in order to access the latest industry intelligence for businesses like yours. Visit our Membership page or reach out the ORLA Regional Representative nearest you.

Legislative Bill Movement / Skills Standards / Celebrating Women Restaurateurs / Webinars & Events Legislative Bill Updates: ORLA's Government Affairs Committee continues its weekly calls to review and discuss the latest activity from the legislative session. As of today, SB 619 (data privacy) has moved forward with private right of action removed; HB 3308 (alcohol delivery) has moved to rules – this would set up a "server training" program for third-party delivery companies as well as a separation of liability; SB 545 (reusable containers) is expected to pass with legislative intent to make it optional to accept those types of containers. See the latest Bill Tracking online. Hospitality Industry Standards Feedback Survey: The Oregon Hospitality Foundation has been working with the Oregon Department of Education (ODE) and Education Northwest the past couple months to help identify high school technical skills and standards for employment in the hospitality career cluster. This is critical work in getting our foot back in the door of Oregon high schools and it will also raise awareness about the intentional workforce development work through our Hospitality Foundation. Employers are encouraged to take this survey to help review and validate the technical skills we helped to identify for the ODE. Please provide your input by April 14, 2023. Biggest Industry Show in the Northwest: The Northwest Food Show kicks off Sunday, April 16 at the Portland Expo Center with hundreds of exhibit booths, emerging products and services, alcohol tasting pavilion, and Trends Center. Just announced are the educational programs in the new Trends Center each day: Explore trends to improve your business, and learn best practices from peers in these interactive presentations, designed to showcase tangible solutions you can implement tomorrow and increase your bottom line. Learn more and register online. Celebrating Women in Portland's Restaurant Industry: Plans are underway for the Women Who Stir the Pot event May 22, presented by the Portland Kitchen Cabinet and the Oregon Restaurant & Lodging Association. This event will be held at Mother’s Bistro and celebrates women in the restaurant industry, recognizing the contributions they make. Learn more. Upcoming Webinars:

ORLA in the news...

As always, should you have any questions, please reach out to your Regional Representative. Thank you for staying engaged! Are You a Member Yet? The Oregon Restaurant & Lodging Association (ORLA) keeps members informed and educated on important issues impacting the hospitality industry. If you are not yet a member of ORLA, please consider joining the association in order to access the latest industry intelligence for businesses like yours. Visit our Membership page or reach out the ORLA Regional Representative nearest you.

Legislative Update / ORLA in the News / ProStart Championships / New Mattress Stewardship Act Next Legislative Deadline Approaching: April 4, 2023, is the date bills need to be moved out of policy committees in their chamber of origin. ORLA’s Government Affairs Committee continues with Zoom meetings every Friday morning fostering good discussion and updates on legislative activity. If you are interested in joining, please sign up and we'll connect with you before next week's call. You can find the latest bill tracking on our website. All in all, we’re pleased with where we are in advocating for members at this stage in the session. ORLA in News: On several occasions these past few weeks ORLA has been tapped for industry perspective on various issues, industry events and insights. Here are some highlights:

Mattress Stewardship Act: The Department of Environmental Quality is seeking public comment on proposed rules for the Mattress Stewardship Act (SB 1576, 2022). More information on this rulemaking, including the draft rules, can be found on the Mattress Stewardship 2023 Rulemaking web page. DEQ will accept comments by email, postal mail or verbally at the public hearing on Wednesday, April 19, 2023. Start time: 9 a.m.; please register prior to the meeting, using this Zoom link. Send via postal mail to Oregon DEQ, Attn: Rachel Harding/Materials Management, 700 NE Multnomah Street, Suite 600, Portland, Oregon 97232-4100. DEQ will only consider comments on the proposed rules that DEQ receives by 4 p.m., on April 28, 2023. Are You a Member Yet? The Oregon Restaurant & Lodging Association (ORLA) keeps members informed and educated on important issues impacting the hospitality industry. If you are not yet a member of ORLA, please consider joining the association in order to access the latest industry intelligence for businesses like yours. Visit our Membership page or reach out the ORLA Regional Representative nearest you.

Bill Tracking / Third-Party Delivery Fee Cap / Capitol Day From ORLA's Advocacy Update The following are just a couple highlights from the bi-weekly Advocacy Update email sent to all ORLA members. This members-only communication dives deeper into some of the bill activity, industry positions, and upcoming work sessions for key legislative bills we're engaged on. If you are a member but are not receiving the Advocacy Update emails, please reach out to [email protected].

ORLA Day of Advocacy Fosters Relationship Building Over 300 hospitality industry members, state agency representatives, legislators and staff participated in a day of activities co-hosted by ORLA and AAHOA February 21. The Capitol Day Assembly provided for Q&A sessions with invited representatives from several state agencies. After meetings at the Capitol, attendees enjoyed hosted food and beverages at the Taste Oregon Legislative Reception presented by DoorDash. The reception provided industry members the opportunity to meet our elected leaders face to face in a casual setting. Read more. Looking for more advocacy information or wanting to engage a bit more on the issues? ORLA members are welcome to join our weekly Government Affairs meetings (via Zoom) by completing this Contact Us form. The Oregon Restaurant & Lodging Association (ORLA) keeps members informed and educated on important issues impacting the hospitality industry. If you are not yet a member of ORLA, please consider joining the association in order to access the latest industry intelligence for businesses like yours. Visit our Membership page or reach out the ORLA Regional Representative nearest you.

Oregon is officially gearing up for another Legislative Session in Salem with newly elected legislators hoping to make a difference for their constituents. As is typical with elections, results rarely if ever align on all fronts with your personal preferences. Regardless of the election outcomes this past Fall, it is our job at the association to build effective working relationships with leaders from both parties.

We had a very tangible return on investment recently which most likely stood out to you as a hospitality operator to prove how ORLA advocacy and relationship building efforts can drive bottom line results for your business – House Bill 3389 in the 2021 Legislative Session. Restaurant and lodging businesses become members of ORLA because they understand the importance of industry representation and intelligence gathering. There are of course other reasons to join ORLA but for me, House Bill 3389 takes the cake. Our hope is the updates below showcase why it is of crucial importance for us to continue to band together to protect, improve, and promote Oregon’s hospitality industry. What Was House Bill 3389? House Bill 3389 was collaborative legislation passed in 2021 to provide short- and long-term pandemic tax relief to Oregon employers while protecting the Unemployment Insurance Trust Fund. This important bill provided assistance to Oregon employers in several ways:

Combined, the short- and long-term provisions of House Bill 3389 provide significant relief to Oregon employers.

Doing our Part to Protect the Integrity of the Unemployment Insurance Trust Fund If you and others you know experienced setting up numerous job interviews for open positions only to have no one show up, you’re not alone. ORLA has been actively working with OED to make sure we’re doing our part as employers to share intelligence about job recruitment efforts. The goal is to make sure recipients of unemployment insurance benefits are actively looking for work and willing to accept work while also protecting the solvency of the trust fund which makes unemployment benefits widely available for those who qualify and need assistance during times of professional transition. The Oregon Employment Department relies on employers to help identify potential fraud and other issues with the Unemployment Insurance system. The current best route for employers to report people who do not show up for work when they are offered a job, turned down an offer of work, or who do not come back after being recalled from a temporary layoff is through the utilization of the following public website at: bit.ly/OEDrefuse. For other types of suspected fraud, the Oregon Employment Department has another, more general form (so some questions may not apply to all scenarios) at bit.ly/OEDfraud. Employers can also report suspected UI fraud to the department’s Fraud Hotline at 1.877.668.3204. | Jason Brandt, President & CEO, ORLA Election Recap: Many Close Races, Some Still Too Close to Call [Numbers updated 11/6/22 from original post on 11/14/22] Voter turnout in Oregon for midterm general elections is typically around 70%. The results below were pulled from the Secretary of State’s site as of 3:45 p.m. Tuesday, November 15, 2022, and reflect a 62% turnout. This is the first Oregon Election where ballots did not have to be received by 8:00 pm on election day, but did need to be postmarked by election day. So, there is no historical perspective if this might benefit one party over the other. On the Federal side, Oregon gained an additional Congressional seat. Although that race, the 6th Congressional, is still too close to call, it looks like the Republicans in Oregon will gain at least one seat in Congress, the redrawn 5th Congressional District. In the Governor’s race, Christine Drazan has conceded the race to Tina Kotek. Betsy Johnson conceded on Election Day after the initial returns. It appears most of the Senate races are known at this time. The Democrats held a 18-12 super majority which at this point seems to be reduced to at least 17-13, with the only race still up for grabs being the Oregon City-Gladstone seat held by Republican Bill Kennemer. Kennemer and challenger Mark Meek (D) are locked in a tight race with Meek leading by 0.68% or just 397 votes. This seat is in Clackamas County so there should be a fair number of votes still to count. The House has more races where it is too soon to call. The Democrats currently hold a 37-23 super majority. Democrats appear to have enough seats to retain control with 32 races that seem to be settled. The Republicans should win 23 seats for sure. That leaves five seats up for grabs and too close to call still. Democrats would have to win four of the five to hold the super majority in the House. Governor:

BOLI:

CD4:

CD5:

CD6:

M111 (Health Care as Right):

M112 (Slavery Language in Constitution):

M113 (Legislative Absences):

M114 (Gun Sales):

State Senate: Current balance is 18 D, 11 R, 1 I. If those currently leading below hold, balance would be at 17 D, 12 R, 1 I. It appears to be down to one competitive race – SD20. SD3:

SD10:

SD11 (open seat):

SD13 (open seat):

SD16 (open seat):

SD20:

SD26 (open seat):

State House: Current balance is 37 D, 23 R. If those currently leading below hold, balance would be at 35 D, 25 R. There are several very tight races left. Pretty Wide Margins... HD12 (open seat):

HD19 (open seat):

HD21 (open seat):

HD22 (open seat):

HD24 (open seat):

HD31 (open seat):

A Little Closer... HD7:

HD32 (open seat):

HD40 (open seat):

HD48 (open seat):

HD49:

HD50:

HD52 (open seat):

HD53 (open seat):

Other State House Races of Note These races include restaurant operators running for public office (McEntee, Nguyen, Bynum). HD10:

HD38: (open seat)

HD39:

ORLA keeps members informed and educated with the latest information, industry intelligence and research via several channels. In addition to the blog, members receive more comprehensive insights via the monthly Insider e-newsletter and access to the Member Portal with data and research.

Not a member yet? Visit our Membership page or reach out the ORLA Regional Representative nearest you. Alcohol Tax / Commission Caps on 3rd Party Deliveries / PFMLA / Tip Pooling Resources

Fighting Oregon Alcohol Tax Increases Here's a quick update on our ongoing fight to protect the industry from increased beverage taxes in Oregon. Our next fight against increased alcohol taxes will surely come up yet again in the 2023 Legislative Session. Our friends at Quinn Thomas have been working hard to keep our organizational alliance intact as well as help identify messaging relating to some of the ongoing problems with Oregon’s broken addiction treatment and recovery system. This analysis on Alcohol Price Elasticity helps shed more light on the lack of correlation between increased alcohol taxes and decreases in alcohol use. Upcoming Vote on Capping Third Party Delivery Fees at 15% Portland City Council will vote on June 15 to cap delivery fees for restaurants from third party platforms at fifteen percent. If approved, the ordinance would take effect June 29, 2022 when the emergency order capping delivery fees at ten percent expires. In addition to the fifteen percent delivery fee cap, the ordinance would allow third party delivery platforms the ability to charge:

The ordinance also prohibits:

Paid Family Leave Concerns You may recall a tough fight in the 2019 Oregon Legislative Session on Paid Family Leave. The new labor law passed before Covid and has been in hibernation mode behind the scenes as the Oregon Employment Department worked to get their ducks in a row for a 2023 launch. Of course we had this little thing called Covid which upended our world and unfortunately those unexpected challenges have not changed the state’s plan to fully implement their “Paid Leave Oregon” program in 2023. The Paid Leave Oregon programs latest round of rules addresses a variety of issues including appeals, wages, benefits, and equivalent plans. ORLA’s statewide business partner OBI has participated in the rulemaking advisory committee and submitted comments on behalf of the business community. We continue to worry about the confusion this will create for employers and employees that are also subject to the Oregon Family Leave Act and the federal Family and Medical Leave Act. OBI hopes to introduce legislation in the 2023 session to address this issue. Key date: The 1% payroll tax will begin on January 1, 2023. Employees pay 60% of the tax and employers pay the remaining 40%. However, employers with less than 25 employees are not required to contribute to the program, but their employees are. Alternatively, employers can opt to provide a private equivalent plan through insurance or by self-insuring, rather than participate in the state program (ORLA is actively looking into private sector solutions right now – any progress will move through our ORLAMS board process). Employees will be eligible to file claims under both the state and private plans in September 2023. Webinar on Tip Pooling & Overtime Compliance ORLA hosted a webinar June 2 on “How to Ensure You’re in Compliance with Overtime and Tip Pooling.” Representatives from the Department of Labor, Wage & Hour Division Portland District covered these topics and more, including fielding several situational questions from industry members. The following resources were shared:

For questions, call the WHD toll free and confidential information helpline at 1-866-4US-WAGE (1-866-487-9243), or the Portland District office directly at 503-326-3057. You can also call or visit the nearest Wage and Hour Division Office. For a copy of the webinar presentation slides, please email Lori Little. Have any questions? Feel free to reach out to ORLA Government Affairs via email. Below are some highlights from the 2022 Regular Session. A more comprehensive list of bills ORLA tracked can be found in the Bill Tracking Report.

SB 1514 – Pay Equity Originally a placeholder bill, ORLA monitored this bill as it became a vehicle to extend the ability of employers to offer hiring and retention bonuses. Because of the pandemic and government shutdowns of Oregon restaurants, many operators found themselves needing to offer hiring and retention bonuses to staff or prospective staff. The extension allows for businesses to continue to offer these bonuses without running afoul of Oregon’s Pay Equity Law until September 28, 2022, or 180 days beyond the expiration of the Governor’s Emergency Declaration which occurs April 1, 2022. HB 4015 – Entrepreneurial Loans ORLA supported this bill to help expand eligibility for state entrepreneurial loans and raise the per-loan limit from $500,000 to $1 million. This bill passed and was signed by the Governor on March 2, 2022, becoming effective immediately. HB 4101 – Smoking Bill ORLA initially opposed this bill which would have increased the distance from businesses at which someone could smoke from 10 to 25 feet. After an amendment in the House excluding OLCC-licensed businesses was passed, ORLA was neutral on the bill, but it died in the Senate. HB 4152 – Franchise Bill This was essentially the same bill that was introduced last session. ORLA opposed this bill which, among other provisions, would have allowed franchisees to use the brand name but nothing else related to the brand identity, quality, or reputation. Although the bill died in committee, we do expect the bill to return in the future and there is the possibility an interim legislative session committee or workgroup might review this issue. HB 4153 – Creative Opportunity Fund This bill established an “Opportunity Fund” equal to a dedicated two percent portion of the overall Oregon Production Investment Fund (OPIF) each year that could then be used for workforce development, employment training and mentorship, project and filmmaker grants, content and creator development, small business and regional production development, amongst other things. ORLA supported the bill for the economic and tourism opportunities available when these investments occur. The bill passed the House and Senate and as of this writing, was waiting for the Governor’s signature. Questions? Contact ORLA Director of Government Affairs, Greg Astley.

NOTE: ORLA's blog will be going offline for upgrades the last week in October.

[October 22, 2021] - Meals Tax Fight | Free Training | Continued Push for RRF Local Meals Tax Fights Continue - We are neck deep in local opposition campaigns in both Cannon Beach and Newport in support of our local restaurants doing business in those communities. As you’ve heard before, we’ll most likely know later in the evening on November 2 whether either of these proposed 5% meals tax proposals pass by will of the voters. Here’s the latest media coverage from earlier this week. Free Covid Online Training Extended – We have made the decision to extend access to the free online training we created at the association to assist restaurant and lodging operators and their staff with the challenging customer service dynamics when dealing with mask mandates across the state. We will keep these Guest Service Safety trainings (restaurant and lodging versions in both English and Spanish) available online for free through at least the end of the calendar year. Make sure to take advantage for your own operation and feel free to spread the word and share the following link so others in our industry can access this free resource thanks to a sponsorship from Anheuser Busch. ORLA Media Event – Your state association in conjunction with several other state associations around the nation will be holding media events to continue pressing the need for restaurant revitalization funding for all eligible applicants. We want to thank Gabriel Pascuzzi, Chef & Owner of Mama Bird for stepping up and representing 2,592 restaurant businesses like his who remain out in the cold with no restaurant revitalization funding after applying for federal financial relief. We’ll do our best to make an impression in the media this coming week and keep the chorus going as we press federal elected leaders to make good on their promise. Here for Oregon Partnership – The Oregonian is our latest sponsor of the Oregon Tourism Leadership Academy program and we want to thank Oregonian Media Group President John Maher and their Vice President of Brand and Strategic Partnerships Amy Lewin for thinking big and launching their “Here for Oregon” initiative. The Oregonian is launching this new effort to help share the good across our great state. Powered by the incredible teams and tools of The Oregonian/OregonLive, they are taking the stories created every day and building a new place dedicated to lifting and celebrating Oregon. This multi-media approach offers a custom blend of community-driven content that is distinctly Oregon. It's an extraordinary aggregate for joy, awareness, and connection across the state. Whether you live in Pendleton, Pleasant Hill or Portland, there’s a place for you here and we want to help celebrate what the Oregonian is working to accomplish. As they begin to roll out their efforts, John and Amy are inviting their community partners to join them in building, from the ground up, stories of the people, the places, the experiences and the diversity of culture and skills that inspire innovation and community. Share Oregon. “Like” and “Follow” @HereisOregon on Facebook, Instagram, Twitter and YouTube Get the good stuff. Subscribe to Here is Oregon weekly e-newsletter. Show you’re here and tag good news in your community with #HereisOregon.

[October 4, 2021] - Foundation Updates | Industry Recovery Trends | OTLA

Oregon Hospitality Foundation Updates - This past week, ORLA’s Executive Director of the Oregon Hospitality Foundation Wendy Popkin announced she has accepted a new role with the Washington County Visitors Association as Vice President of Destination Sales. We hope you all join us in celebrating Wendy’s contributions to the Foundation over the past nine years. In conversations with Wendy and Foundation Board members, we are moving forward with a plan to hire two new full time positions in support of the hospitality foundation. One position will be an executive coordinator for foundation governance while also serving as our ProStart Liaison for Oregon’s 40 participating high schools. The other position will be a Workforce Development Coordinator focused on creating stronger connections between industry leaders and high school and community college classrooms – think guest speaking opportunities, job shadow coordination, career/job fair involvement, and experiential field trips. Reach out to ORLA if you know someone interested in these positions. National Restaurant Trends - The latest economic trends in the restaurant survey based on a feedback from 4,000 restaurants across the nation. The NRA's infographic and associated letter sent to DC leadership focus on the importance of preventing new taxes on small businesses as our industry continues to grapple with the impacts of the enduring pandemic. Activity in DC continues to be touch and go and our Government Affairs team will continue keeping all lines of communication open with our partners at AAHOA, AHLA, and NRA as developments unfold.

[September 24, 2021] - Fight Against Meals Taxes / Chair's Getaway / Conference Program

Fights Against Meal Taxes Continue - The ORLA professional team led by Steve Scardina and Terry Hopkins in their regions of the state and supported by Greg Astley, Tom Perrick, and Glenda Hamstreet in our Government Affairs Department are working hard to defeat meals taxes appearing on the November ballot in the cities of Cannon Beach and Newport. Our websites for the campaigns are up and running and our success in defeating both proposals is largely dependent on our ability to keep local restaurants in both communities engaged and in the forefront. It is critical that ORLA take a back seat to the local names and faces that make up a local restaurant industry while fully leveraging ORLA’s association structure to assist our local members in fighting effectively against tax proposals when they are opposed by members in cases like this. In the past 4 years, we have successfully defeated two other restaurant tax proposals – one in Jacksonville and one in Hood River County. We hope to defeat these two tax proposals and should have results to share on November 2 or 3. Vote No Sales Tax on Meals! ORLA Hospitality Conference Success - Earlier this week ORLA held a 2-day in-person conference for industry members at the Riverhouse in Bend. Feedback so far has been very positive, citing keynote and breakout session messages on target and insightful for the hard-hit hospitality industry. ORLA members also had the opportunity to vote in several new members of the Board of Directors. Save the date for next year's event on Sunday & Monday, September 11 and 12 at the Graduate hotel in Eugene. Chair’s Getaway - We are off and running in creating a great experience on Oregon’s north coast for our Chair’s Getaway event on Sunday, November 7 which will be co-hosted by Incoming Chair John Barofsky and Outgoing Chair Masudur Khan. We want to take a moment to thank Shannon McMenamin and her team at the Gearhart location for working with us to put together the Reception and Multi-Course Dinner on site. Also, a big thanks to Outgoing ORLA Chair Masudur Khan for making the SaltLine Hotel available for overnight stays and our sponsors at US Foods (thanks Randy) and Pacific Seafood for their food donations. We also have America’s Hub World Tours joining us as a Transportation Sponsor this year for those who prefer a shuttle bus between the hotel and the restaurant. The Chair’s Getaway event has 50-60 people in attendance and is an opportunity to raise funds for ORLAPAC under the direction of Greg Astley, ORLA’s Director of Government Affairs. I hope you consider making a donation to ORLAPAC and join us for this great reception, dinner, and overnight stay following on November 7. Register here to reserve your seats – we expect this will sell out so act soon.

[September 17, 2021] - Win for Lottery Retailers / Vaccine Mandates / EIDL Updates

Win for Lottery Retailers – ORLA’s membership includes a segment that cares deeply about the association’s advocacy for lottery retailer issues. ORLA in partnership with many other stakeholders was able to secure a win with the Governor committing in writing to prohibit any expansion of state sponsored gambling on mobile devices with an exception for the options already available on cell phones. The following two letters spell out the request made by us and our partners to legislative leadership and the Governor’s response essentially putting a moratorium on any gambling expansions on cell phones for the duration of her term in office. Vaccine Mandates – We expect to have our hands full in the coming months as the potential for emerging vaccine mandates continues to be debated primarily at the local levels of government outside of President Biden’s announcement this past week. We have been made aware that King County in Washington State will move forward with a vaccine mandate but has decided to again target specific businesses with the mandate as opposed to all businesses. It remains unclear how the new vaccine mandate will be enforced and how the role of restaurant and other industry operators will be defined for those industries impacted. The King County mandate will go into effect in late October. Our reports show the NYC mandate has a vaccine verification compliance rate of less than 30% meaning as many as 70% of operations were not verifying vaccine status at the door. In one of ORLA’s recent surveys we asked operators what types of mandates they would proactively comply with. Under 40% said they would comply with vaccine verification and we suspect the reason is driven by the challenges posed by putting our frontline staff in the position of asking for those verifications universally to dine indoors and the uncertainty of what happens when customers are denied indoor dining service due to a mandate. As a reminder, we openly shared our survey results and our deep concerns about compliance rates with Multnomah County Chair Kafoury and the Governor’s Office. We’re hoping that step keeps the industry from being targeted while we continue our advocacy and support for vaccines and their importance. EIDL Program Updates – The Small Business Administration’s Deputy District Director for Portland Sam Goldstein provided us at ORLA with the latest updates on EIDL. The SBA's COVID EIDL Program Summary serves as a review of where we are to date on EIDL expansion. Another webinar presentation is coming up on September 23; register here. The SBA is continuing to accept loans and modification to existing loans. New applications and increases in existing loans resulting in total amounts to be approved >$500K can be submitted immediately. Decisions on requests >$500K will begin October 8, 2021. Main Update: Increase in maximum loan amount from $500,000 to $2,000,000 (policy) Key Changes in Effect as of September 8, 2021:

[Click the "Read More" link for archived blog updates]

[update 7.1.21] 2021 Legislative Win for ORLA Senate Bill 317A passed, making permanent the ability for bars and restaurants to offer mixed drinks for takeout or delivery if the guest also purchases a substantial food item.

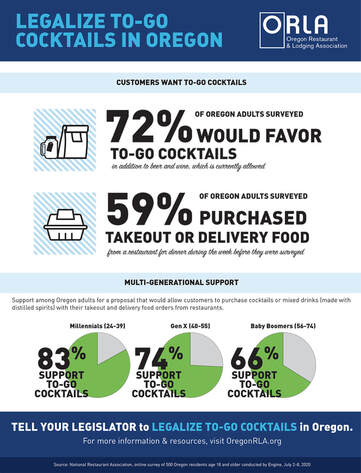

Restaurants and Bars Among Hardest Hit by COVID-19 Pandemic [July 20, 2020 - Wilsonville, OR] – The Oregon Restaurant & Lodging Association (ORLA), in partnership with the National Restaurant Association, recently completed a statistically significant survey around To-Go Cocktails, drinks made with distilled spirits for takeout, pickup or delivery to go along with meals purchased by guests. The survey, conducted July 3-6th, shows 72% or nearly three in four Oregonians, said they would favor a proposal allowing customers to purchase cocktails or mixed drinks (made with distilled spirits) with their takeout and delivery food orders from restaurants. This is in addition to beer and wine, which is currently allowed. Support is highest among those between the ages of 24-39 at 83%, with respondents between the ages of 58-74 showing the least support at 66%. Twenty-eight percent of adults said they strongly favor the proposal. Fifty-nine percent of Oregon adults said they purchased takeout or delivery food from a restaurant for dinner during the week before they were surveyed. ORLA President and CEO Jason Brandt said, “This is so encouraging for our members who have struggled just to stay open and keep people employed.” Brandt continued, “This has been an incredibly difficult time when restaurants and bars have struggled to deal with the challenges of being shut down, having to pivot to offer only takeout, pickup or delivery and then trying to invite guests back into dining rooms and make them feel safe and comfortable. Knowing almost three out of four Oregonians support the option to purchase cocktails or mixed drinks to go with their meals means some restaurants and bars who might have previously had to close down actually have a chance to make it now.” Allowing customers to purchase cocktails or mixed drinks (made with distilled spirits) for pickup, takeout or delivery requires a statutory change, meaning the Oregon Legislature would need to make the change to state law. Thirty other states currently offer To-Go Cocktails including Washington and California. “From a public safety perspective, if more businesses are able to offer the service of delivery of alcohol to their customers, the need for those customers to physically go into stores and businesses is reduced, thus reducing the risk of community spread of COVID-19,” said Brandt. Recognizing the need to help those who may have difficulty with alcohol addiction, ORLA’s website outlines a number of resources available to individuals, as well as training information to aid in prevention. More information on these resources and trainings can be found at OregonRLA.org/crisis-services-and-training. For more information please contact Greg Astley, ORLA Director of Government Affairs at 503.851.1330. The 2021 Oregon Legislative Session was held remotely for the most part because of COVID-19 interruptions. The inability to meet in person coupled with the introduction of almost 4,000 bills this session meant there was a lot that did not get done. Legislative leadership primarily focused on police reform, housing, and social justice. For the hospitality industry, ORLA gained some victories to help our members and managed to help kill some bad bills that would have negatively impacted operators. Below is a summary of the key legislation from the 2021 session for our sector. Legislative Wins SB 317A – Allows holder of full on-premises sales license to make retail sales of mixed drinks in sealed containers for off-premises consumption.

HB 3361 (Passed) – Requires third-party food platform to enter into agreement with food place before arranging delivery of orders from food place or listing food place on application or website.

HB 3178 (Passed) – Temporarily removes condition for being deemed "unemployed" that individual's weekly remuneration for part-time work must be less than individual's weekly unemployment insurance benefit amount.

HB 3389 – Extends look-back period used to determine Unemployment Compensation Trust Fund solvency level from 10 years to 20 years.

HB 2205 (Dead) – Establishes procedure for person to bring action in name of state to recover civil penalties for violations of state law.

HB 2365 (Dead) – Prohibits food vendor from using single-use plastic food service ware when selling, serving or dispensing prepared food to consumer.

HB 2521 (Passed) – Requires transient lodging tax collector to provide invoice, receipt or other similar document that clearly sets forth sum of all transient lodging taxes charged for occupancy of transient lodging.

HB 2579 (Dead) – Increases state transient lodging tax rate and provides for transfer of moneys attributable to increase to county in which taxes were collected.

HB 2593 - Permits Office of Emergency Management to enter into agreement with nonprofit organization representing sheriffs under which organization is authorized to administer program to produce and sell outdoor recreation search and rescue cards.

HB 2818 – Allows payment from Wage Security Fund to be made to wage claimant for wages earned and unpaid in event that Commissioner of Bureau of Labor and Industries has obtained judgment in action or has issued final order in administrative proceeding for collection of wage claim.

HB 2966A – Extends grace period for repayment of nonresidential rent between April 1, 2020, and September 30, 2020, until September 30, 2021, for certain tenants.

HB 3058 (Dead) – Increases distance from certain parts of public places and places of employment in which person may not smoke, aerosolize or vaporize from 10 feet to 25 feet.

HB 3296 (Dead) – Increases privilege taxes imposed upon manufacturer or importing distributor of malt beverages, wine, or cider.

HB 3351 (Dead) – Establishes increase in statewide minimum wage rate beginning on July 1, 2022.

SB 650 (Dead) – Creates Public Assistance Protection Fund.

SB 750 (Passed) – Authorizes Oregon Liquor Control Commission to grant temporary letter of authority to eligible applicant for any license issued by commission.

HB 3177 (Dead) – Limits types of restrictions that Governor may impose on certain businesses during state of emergency related to COVID-19 pandemic.

SB 483A (Passed) – Creates rebuttable presumption that person violated prohibition against retaliation or discrimination against employee or prospective employee if person takes certain action against employee or prospective employee within 60 days after employee or prospective employee has engaged in certain protected activities.

SB 582A - Establishes producer responsibility program for packaging, printing and writing paper and food serviceware.

Other Bills SB 515 (Passed) – Requires employee of certain licensed premises who is permittee to make report if permittee has reasonable belief that sex trafficking is occurring at premises or that minor is employed or contracted as performer at premises in manner violating Oregon Liquor Control Commission rules.

SB 569A (Passed) – Makes unlawful employment practice for employer to require employee or prospective employee to possess or present valid driver license as condition of employment or continuation of employment.

For more information on ORLA's policy positions and priorities, reach out to Greg Astley, Director of Government Affairs.

House Vote on Unemployment Insurance Tax Relief Triggers Movement to State Senate

FOR IMMEDIATE RELEASE: April 16, 2021 Contacts: Greg Astley, Director of Government Affairs, ORLA 503.851.1330 | [email protected] Jason Brandt, President & CEO, ORLA 503.302.5060 | [email protected] Wilsonville, OR– The Oregon House of Representatives voted overwhelmingly to move forward with bipartisan legislation which would provide millions in unemployment insurance tax relief for some of Oregon’s hardest hit industries. House Bill 3389 passed the Oregon House and will now move to the Senate for ongoing deliberation. The bill accomplishes a number of priorities for Oregon’s hospitality industry with the most important component being the removal of 2020 and 2021 employment data from the formula used to determine an employer’s applicable tax rate, starting in 2022. “We would like thank the leaders who have signed on to support this bill as sponsors and their ongoing work to shepherd it through the legislative process,” said Jason Brandt, President & CEO for the Oregon Restaurant & Lodging Association. “The deferral and forgiveness components could be stronger for this year given the impact of government restrictions on industry employment options. Having said that, the big win will prove to be solving the tax hike problem for years 2022 through 2024.” Unemployment insurance taxes are paid entirely by Oregon employers to fund Oregon’s Unemployment Insurance Trust Fund which remains the healthiest in the nation. One third of unemployment insurance taxes for 2021 can be deferred for employers with an increased tax rate of half a percent or more. If the employer’s tax rate increased more than 1 percent to 1.5 percent, 50 percent of the deferred tax would be forgiven. For tax rates which increased more than 1.5 percent to 2 percent, 75 percent of the deferred tax would be forgiven. And for employers who had a tax rate increase of more than 2 percent, the full deferred amount would be forgiven. “We know this legislation if passed has the potential to save hospitality employers tens of millions of dollars this year alone,” said Greg Astley, Director of Government Affairs for the Oregon Restaurant & Lodging Association. “That amount pales in comparison to the real impact of the relief in future years. If we can erase 2020 and 2021 from upcoming calculations as proposed in the legislation, it will have a direct impact on our industry recovery efforts.” The bipartisan Chief Sponsors of the bill in the house include Representatives Paul Holvey, Daniel Bonham, and John Lively. The bipartisan Chief Sponsors in the State Senate include Senators Bill Hansell and Chuck Riley. For more information on the efforts of the Oregon Restaurant & Lodging Association please visit OregonRLA.org. ### The Oregon Restaurant & Lodging Association is the leading business association for the foodservice and lodging industry in Oregon, which before COVID-19 provided over 180,000 paychecks to working Oregonians.  Join the National Restaurant Association and the Oregon Restaurant & Lodging Association for a virtual conference on April 20, 2021 Every spring, the restaurant industry comes together in Washington D.C., to meet with Congress on issues impacting our industry. The 2021 Public Affairs Conference may look different this year, but it provides the National Restaurant Association and state restaurant associations like ORLA with an opportunity to expand our reach and impact with more attendees and more meetings on Capitol Hill. As an industry leader, your attendance is critical to the success of the Conference. With new party leadership in D.C. and our industry suffering from this unprecedented pandemic, our collective voices are needed now more than ever. We have to educate our lawmakers—new and established—on the impact of COVID-19 to our industry and what steps Congress should (or shouldn’t) take to help us survive and then thrive once the pandemic has passed. Click the Register button below and use the code PAFCMEMBER to receive your member discount. The cost for members is $50 and $75 for non-members. You will hear from political analysts, industry leaders, and lawmakers on key issues impacting the restaurant industry. If you’ve never attended the conference in the past, this virtual Public Affairs Conference is a great way to get involved for the first time.

If you have any questions, contact ORLA's Director of Government Affairs, Greg Astley. Oregon’s Legislature will meet on Monday, December 21 for a one-day Special Session to discuss four specific issues including To-Go Cocktails and Commission Caps on Third Party Deliveries. Read the draft of Legislative Concept (LC 10).

We realize this legislation won’t fix everything so we are still working with the Governor’s office, Oregon Health Authority and Legislators to find ways to re-open dining rooms sooner and safely. You can help by contacting the Governor and your Legislators (find your legislator here) to let them know how little time you have left before you have to close your doors because of the restrictions on indoor dining. Public hearings have now been posted for Thursday evening (6:00-9:00pm) and Saturday morning (10:00am-1:00pm). You may provide written or oral testimony at these meetings. For more information on these public hearings and to sign up to testify, please visit the following websites:

Written Testimony:

Oral Testimony (Live Remotely):

Important note about testimony: Neither registration nor use of the public access kiosk is a guarantee that you will be able to testify during the meeting. The chair may determine that public testimony must be limited. For this reason, written testimony is encouraged even if you plan to speak. The Presiding Officers are extending the period for public comment. The public record is open when a meeting is posted until 24-hours after the committee is scheduled to meet. For example, this means written testimony can be submitted now until 6:00pm on Friday for the public hearing on Thursday. Our Industry Needs Your Voice at the Table! We need your voice at the Capitol to help pass this legislation. We need you to share your story of how the shutdowns, freezes and restrictions have impacted you and your employees and why this legislation would help you survive! If you are not already signed up for ORLA’s Text Alerts, please take a minute to text “ORLA” to 52886 today and sign up for important notices regarding key legislation and how you can help. Thank you in advance for taking action. Creation of a $75 Million Hospitality Relief Fund is Needed for Industry to Survive

FOR IMMEDIATE RELEASE: November 17, 2020 Contact: Jason Brandt, President & CEO, ORLA 503.302.5060 | [email protected] Wilsonville, OR– Another shutdown of Oregon’s restaurants, bars and foodservice establishments is crippling an already broken and damaged industry. While other industries in Oregon have experienced revenue losses on average of five percent from last year, the hospitality industry in Oregon has experienced revenue losses on average of at least thirty percent. Because of this massive economic disparity, the Oregon Restaurant & Lodging Association (ORLA), the leading business association for the foodservice and lodging industry in Oregon, has sent a letter to the Legislative Joint Emergency Board asking for the immediate creation of a $75 million Hospitality Relief Fund to help operators and their employees survive another shutdown. “There is no federal relief package waiting to be voted on and distributed from Congress or the White House,” said Jason Brandt, President & CEO for the Oregon Restaurant & Lodging Association. “There are no stimulus checks being printed to help Oregon families pay their bills. There is no weekly check for $600 available for those servers, cooks, hosts and hostesses about to lose their jobs or have their hours cut again because restaurants can’t survive on takeout and delivery if they can do it at all.” Restaurants and bars are still paying rent and there has been no extension of the commercial rent moratorium even though revenue has been cut by as much as 65% for some operators because of the shutdowns, “pause” and now a “freeze.” Restaurants and bars are still paying OLCC license fees even though they are not able to serve hard alcohol or offer cocktails to go for customers doing pickup or delivery. They are still paying health inspection fees based on the number of seats they have in their establishment even though they cannot seat anyone in their establishment. There are payroll taxes, corporate activity taxes, property taxes on property they cannot fully use and commercial personal property taxes on property restaurants own. In addition to the immediate creation of the $75 million Hospitality Relief Fund, ORLA is recommending several other solutions to the Legislature to help the hospitality industry survive. Those solutions include:

“We were already hearing from members they were concerned about what another shutdown would do to their chances of staying open,” said Brandt. “Without significant help from the state, the hospitality industry in Oregon–many of your favorite restaurants, hotels, bars and other places– will have to permanently close their doors, putting tens of thousands of people out of work.” “Hospitality businesses need immediate help. We cannot wait for February and hope a relief package will materialize and be approved at the federal level,” said Brandt. “This is an emergency and we need the Joint Emergency Board to take action now to save our industry and the tens of thousands of Oregonians who rely on it to put food on the table, pay their rent or mortgage and provide for their families’ needs.” ### The Oregon Restaurant & Lodging Association is the leading business association for the foodservice and lodging industry in Oregon, which is comprised of approximately 10,000 foodservice locations and 2,000 lodging establishments with a workforce prior to COVID of 183,191.  Watch Now: "No Recess Without Relief" Watch Now: "No Recess Without Relief" New Coalition Of Public And Private Sector Leaders Call On Congress To Act On COVID Relief Before Election Washington, D.C. (September 30, 2020) – COVID RELIEF NOW, a new coalition of nearly 200 major public and private sector groups across the U.S., today called for “No Recess without Relief” imploring Congress to not leave town for the 2020 elections without passing additional COVID economic relief – stating millions of jobs and survival of small businesses as well as vital government services are on the line. The coalition stated that if Congress fails to act, millions of employees will be furloughed or terminated; millions of unemployed Americans will lose their unemployment insurance pandemic benefits; hundreds of thousands of companies will be at risk of closing their doors forever; and the vast majority of state and local governments will have to curtail critical services in order to balance budgets due to a decline in tax revenue. Read the letter signed by coalition members, including the Oregon Restaurant & Lodging Association, that was sent to Congress today: This week is pivotal for COVID relief legislation and we must do everything we can to make sure our voice is heard. We need you to add your voice to ours. Write, call, and tweet your elected officials and tell them that the hotel industry’s needs must be included in any final bill. Take action and share this message with your colleagues! |

Categories

All

Archives

June 2024

|

Membership |

Resources |

Affiliate Partners |

Copyright 2024 Oregon Restaurant & Lodging Association. All Rights Reserved.

8565 SW Salish Lane Suite 120 | Wilsonville, OR 97070-9633 | 503.682.4422 | 800.462.0619 | Contact Us

Site Map | Accessibility | Privacy Policy

8565 SW Salish Lane Suite 120 | Wilsonville, OR 97070-9633 | 503.682.4422 | 800.462.0619 | Contact Us

Site Map | Accessibility | Privacy Policy

RSS Feed

RSS Feed