|

FOR IMMEDIATE RELEASE Media Contact: Jason Brandt, President & CEO, ORLA, 503.302.5060 Remaining funds present unique opportunities to invest in tourism initiatives Wilsonville, OR – Salem’s Budget Committee approved a stop-gap solution to fund the library through a Cultural and Tourism Fund, finding access to American Rescue Plan Act (ARPA) dollars outside of any restricted lodging tax revenues. The Oregon Restaurant & Lodging Association (ORLA) confirmed with the City Attorney the ARPA funds will be used as a one-time resource to backfill their library shortfall, a legal move within the rules for those federal dollars. Coming out of the pandemic, Oregon received $4.262 billion in ARPA funding, with approximately $2.76 billion going to the state and $1.5 billion distributed to Oregon cities and counties. After Salem uses $1.2 million of their ARPA funds to preserve staff and services for the library for a year, it’s anticipated there will still be close to $2 million remaining in the Cultural and Tourism Fund. “Having such a robust beginning balance in this fund is a great opportunity for us to assist Salem’s hospitality industry in their ongoing recovery efforts post pandemic while potentially driving new lodging tax revenue for the City in support of future fiscal years,” said Jason Brandt, President & CEO of the Oregon Restaurant & Lodging Association. “This is a strategic moment for the region and city collaborations with Travel Salem, the Salem Area Lodging Association, and the Salem Area Chamber of Commerce should be put in motion to invest in creative tourism programs or initiatives local stakeholders feel can drive new tourism traffic.” ORLA continues to support and protect tourism funding across the state, ensuring appropriate, strategic investments are made to drive tourism year-round and help build stronger economies. When tourism investments are driven through collaborative efforts involving all stakeholders, everyone benefits. New tourists result in more dollars through visitor spending and lodging taxes, bringing more revenue to local economies. For more information on the importance of protecting transient lodging tax revenues, visit the Oregon Restaurant & Lodging Association’s website at OregonRLA.org/tlt. Read more on ORLA’s public policy proposals for how ARPA funds could best be leveraged for Oregon’s tourism and hospitality industries. About

The Oregon Restaurant & Lodging Association is the leading business association for the foodservice and lodging industry in Oregon, which is comprised of over 10,220 foodservice locations and 2,000 lodging establishments. As of December 2023, the Oregon Employment Department reports the Leisure and Hospitality workforce totals 208,700 with a total economic impact of over $13.8 billion in annual sales for Oregon. FOR IMMEDIATE RELEASE: April 17, 2024 Media Contact: Jason Brandt, President & CEO, ORLA, 503.302.5060 Mayor proposes dipping into transient lodging tax dollars to fund city’s library Wilsonville, OR– The Oregon Restaurant & Lodging Association (ORLA) is proactively looking into a proposal by Salem Mayor Chris Hoy to use transient lodging taxes to fund around $1.2 million in the library’s budget. Under his proposal, the city would access lodging tax dollars from Salem’s Cultural and Tourism Fund to cover the shortfall in library operations. “Each jurisdiction with a transient lodging tax has both restricted and unrestricted parameters for how our industry tax money can be spent,” said Jason Brandt, President & CEO for the Oregon Restaurant & Lodging Association. “The question here is whether the City of Salem has $1.2 million in unrestricted funds from the transient lodging tax to spend however they deem appropriate. If the City uses the portion of industry taxes restricted by state law for tourism, then ORLA will need to take appropriate action against this proposal.” Reforms passed in the 2003 Oregon Legislative Session established rules for how local governments can spend industry tax dollars. In short, spending on tourism promotion and tourism-related facilities (defined in state statute) was locked in as a percentage of total lodging tax collections on July 1, 2003. And on July 2, 2003, moving forward, any increase in a local lodging tax rate or establishment of a new lodging tax not already in existence must allocate 70 percent of revenues to tourism promotion and tourism-related facilities with the remaining 30 percent serving as unrestricted revenue for the local government to spend however they see fit. Diverting lodging taxes in support of other local government priorities essentially shortchanges the Oregon hospitality industry’s ability to bring visitor dollars to restaurant, lodging, and retail businesses year-round. Protection of industry tax dollars is a priority for ORLA as we remain focused on embracing shoulder and off-season promotions to entice visitors to local communities across Oregon year-round. ORLA serves as the industry’s watchdog on lodging tax spending by local governments across Oregon. We produced a helpful video that our industry members and local government stakeholders can review that explains how local lodging taxes must be expended in accordance with Oregon's state law. View the Oregon Lodging Tax Defined video and visit the Oregon Restaurant & Lodging Association’s website at OregonRLA.org for more information. About

The Oregon Restaurant & Lodging Association is the leading business association for the foodservice and lodging industry in Oregon, which is comprised of over 10,220 foodservice locations and 2,000 lodging establishments. As of December 2023, the Oregon Employment Department reports the Leisure and Hospitality workforce totals 208,700 with a total economic impact of over $13.8 billion in annual sales for Oregon.  Meals Tax Goes Down at Council, Will Likely Move to Ballot Last night the Grants Pass City Council voted 5-3 in opposition of adopting the ordinance at Council level for a food and beverage tax, flipping their previous vote earlier this month. Restaurant operators showed up in droves with signs and buttons as well as to testify alongside ORLA and its members, clearly demonstrating how our industry is well organized and willing to do what it takes to protect our businesses. Despite the Council voting against enacting the tax, they may decide to place it on the ballot in November for voters to decide. Council Considered General Sales Tax, Utility Fee, and Meals Tax The City of Grants Pass is looking for funding sources to increase service levels of public safety. A general sales tax, a prepared meals tax on restaurants, and a utility fee were all being considered. And on February 7, City Council voted 5-3 to pursue a 3% meals tax in addition to a utility fee. Grants Pass’ city charter allows Council to legally pass this tax without the vote of the people, though it is very uncommon for new taxes to be passed without a ballot vote. Based on draft language for the new food and beverage tax ordinance, increases in the 3% tax would be allowed at any time and to any amount without the vote of the people. We strongly feel the Council’s decision to place the burden of paying for services everyone will benefit from on a single industry segment is inequitable and dangerous. Brief History:

ORLA has outlined several reasons why voters should be allowed to weigh in on a sales tax on meals:

At the very least, the people of Grants Pass deserve to vote up or down on this sales tax on meals. An even better solution for the City would be to consider an Economic Improvement District or similar mechanism where the burden of raising revenue falls more broadly than on just the struggling local restaurants. If you have any questions or want to get engaged in this issue, reach out to ORLA Regional Representative, Terry Hopkins. ORLA is a trade organization for the foodservice and lodging industry in Oregon, formed for the purposes of promoting the common business interests of its membership and to improve business conditions of the foodservice and lodging industry. If you are not currently a member of ORLA and would like to learn more, visit our Membership page and reach out to us via email.

Tell Congress to Pass New Tax Legislation Benefiting Hospitality Businesses New legislation would restore expired tax deductions for many operators who are investing in their businesses. This legislation would extend 100% bonus depreciation for qualifying property, increase the maximum depreciation expense amount, and extend the inclusion of depreciation and amortization in business interest expense calculations. By restoring business interest expensing, this bill would help many restaurant and lodging operators lower their tax burden when investing in building upgrades, remodels, expansions, and refurbishments. Members of Congress need to hear directly from operators like you, so please take two minutes to add your voice. Take action today to ensure Congress acts quickly to pass this bill: Hotels Will Pay Historic Wages, Generate Record Level of Tax Revenue in 2024 Despite labor shortages and persistent inflation, hotels are projected to pay a record amount of wages and generate a record level of tax revenue in 2024, according to the American Hotel & Lodging Association’s 2024 State of the Hotel Industry report. Top findings include:

Questions? Contact Pete Kasperowicz, American Hotel & Lodging Association, with any questions at (202) 289-3155. OHA Buried Report Citing Taxes Don't Curb Excessive Alcohol Use The Oregon Health Authority (OHA) commissioned EcoNorthwest to produce a report on the cause and effect of increasing alcohol taxes in an attempt to curb heavy drinking amongst the Oregon populous. The study, which should have been published in 2021, concluded alcohol taxes do not change consumer habits or significantly reduce abuse. The Oregon Beverage Alliance is voicing their concern and that this publicly funded report was intentionally withheld by the Oregon Health Authority, as uncovered by the Oregonian. While Oregon’s breweries, wineries and cideries continue to face major challenges with record closures rates and reduced volume sales, the Oregon Beverage Alliance says "the last thing any local business needs are tax increases.” Introducing Tip Tax Credit by ORLA Hospitality Partner, Adesso Did you know your employees’ tips can get you money back from the IRS? With Tip Tax Credit by Adesso, employers can get tax credits for tips your employees earn. The FICA Tip Credit is a federal tax credit available to employers who have employees who receive tips as a significant part of their income. FICA stands for the Federal Insurance Contributions Act, which includes Social Security and Medicare taxes. The credit allows employers to claim a portion of the FICA taxes paid on employees' tips as a credit against their own tax liability. If your business is tip-driven, tips are reported by your employees, and FICA taxes have been paid on those reported tips, your business may qualify. To learn more, visit our Adesso partner page to get started with Tip Tax Credit. ORLA keeps members informed and educated with the latest information, industry intelligence and research via several channels. In addition to the blog, members receive more comprehensive insights via the monthly Insider e-newsletter and access to the Member Portal with data and research.

Not a member yet? Visit our Membership page or reach out the ORLA Regional Representative nearest you. Oregon’s Healthy Unemployment Insurance Trust Fund Makes Businesses and Communities Stronger7/19/2023

Oregon has one of the best unemployment insurance (UI) tax systems in the nation. While there are federal requirements all states must follow with their UI trust funds, there is room for state flexibility, and Oregon has taken advantage of this to minimize employer tax rate volatility, protect employers from additional charges, and provide a strong safety net for recessionary times. During strong economic times, the tax schedule increases so we can replenish Oregon’s UI Trust Fund. Once we have strong reserves, the tax schedule drops so employers have lower taxes. Each employer’s individual tax rate is based on the amount of UI benefits their employees receive. Also, Oregon’s UI Trust Fund’s reserves earn interest. Over the last 10 years, UI Trust Fund interest added $797 million. That means about 20 percent of the increase in the UI Trust Fund balance in the past 10 years came from interest earned — not employer payroll taxes. Due to Oregon’s self-balancing system, the more interest earned, the more likely we are to have a lower tax schedule. One way to look at it is, with Oregon’s UI tax system, employers only had to pay 80 cents on the dollar for the benefits paid out. During the Great Recession and the COVID-19 pandemic, many states had to borrow money because their UI Trust Funds were not solvent — employers in those states pay more than $1 for each dollar of benefits paid to workers. Benefits don’t just help laid-off workers. They also support communities and businesses by ensuring that money keeps flowing through the local economy during economic downturns. During the recent Pandemic Recession, Oregon’s UI Trust Fund paid out $859 million in regular UI benefits from April to June 2020 — twice as high as any calendar quarter during the Great Recession. Also, researchers have estimated that every $1 of UI benefits generates about $2 in economic activity in that community. During a recession, this can be a vital support for our economy. Thanks to Oregon's healthy UI Trust Fund, we did not have to borrow any money during the Pandemic Recession, unlike many other states. Those states also faced borrowing costs, restricted options on policy, and higher federal payroll taxes and surcharges for employers. While employers in other states saw additional UI taxes and other costs, Oregon has been a careful steward of employers’ tax dollars. With 2021’s House Bill 3389, lawmakers protected employers from increased payroll taxes that might have resulted from the unprecedented number of Oregonians who received UI benefits during the Pandemic Recession and allowed employers to defer or avoid some tax liability. In addition to short-term tax relief, HB 3389 extended the look-back period for the fund adequacy percentage ratio from 10 years to 20 years and omitted calendar years 2020 and 2021 from the formula. These changes mean:

This editorial wss provided by the Oregon Employment Department. ORLA had a very tangible return on investment proving how advocacy and relationship building efforts can drive bottom line results for businesses when House Bill 3389 passed in the 2021 legislative session. This important bill provided assistance to Oregon employers with both short- and long-term provisions, offering significant relief to employers. Read more about how ORLA's Advocacy Drives Bottom Line Results.

Oregon is officially gearing up for another Legislative Session in Salem with newly elected legislators hoping to make a difference for their constituents. As is typical with elections, results rarely if ever align on all fronts with your personal preferences. Regardless of the election outcomes this past Fall, it is our job at the association to build effective working relationships with leaders from both parties.

We had a very tangible return on investment recently which most likely stood out to you as a hospitality operator to prove how ORLA advocacy and relationship building efforts can drive bottom line results for your business – House Bill 3389 in the 2021 Legislative Session. Restaurant and lodging businesses become members of ORLA because they understand the importance of industry representation and intelligence gathering. There are of course other reasons to join ORLA but for me, House Bill 3389 takes the cake. Our hope is the updates below showcase why it is of crucial importance for us to continue to band together to protect, improve, and promote Oregon’s hospitality industry. What Was House Bill 3389? House Bill 3389 was collaborative legislation passed in 2021 to provide short- and long-term pandemic tax relief to Oregon employers while protecting the Unemployment Insurance Trust Fund. This important bill provided assistance to Oregon employers in several ways:

Combined, the short- and long-term provisions of House Bill 3389 provide significant relief to Oregon employers.

Doing our Part to Protect the Integrity of the Unemployment Insurance Trust Fund If you and others you know experienced setting up numerous job interviews for open positions only to have no one show up, you’re not alone. ORLA has been actively working with OED to make sure we’re doing our part as employers to share intelligence about job recruitment efforts. The goal is to make sure recipients of unemployment insurance benefits are actively looking for work and willing to accept work while also protecting the solvency of the trust fund which makes unemployment benefits widely available for those who qualify and need assistance during times of professional transition. The Oregon Employment Department relies on employers to help identify potential fraud and other issues with the Unemployment Insurance system. The current best route for employers to report people who do not show up for work when they are offered a job, turned down an offer of work, or who do not come back after being recalled from a temporary layoff is through the utilization of the following public website at: bit.ly/OEDrefuse. For other types of suspected fraud, the Oregon Employment Department has another, more general form (so some questions may not apply to all scenarios) at bit.ly/OEDfraud. Employers can also report suspected UI fraud to the department’s Fraud Hotline at 1.877.668.3204. | Jason Brandt, President & CEO, ORLA  Guest Blog | Adesso Capital We hear it all the time: Businesses aren’t filing for the Employee Retention Credit (ERC) because of the misconceptions surrounding the program. In fact, less than 20% of eligible businesses have claimed their ERC. Which is why ORLA partnered with Adesso Capital’s team of tax experts to address some common myths about the ERC: Myth 1: I can’t claim the ERC because I’ve already received PPP funds. The most frequent falsehood we hear is that retailers, restaurants, and other hospitality businesses can’t receive funds from both the Paycheck Protection Program and the ERC. This was true at one time. But a change to the CARES Act in December 2020 removed the restriction against applying for both. This vital change went largely under the radar. Myth 2: My business has grown during the pandemic. Isn’t the ERC only for businesses that are hurting? Economic injury isn’t the only condition to receive ERC credits. If your business was affected by operating restrictions or supply chain issues, you’re eligible. Myth 3: My business was deemed an essential business, so I don’t qualify. Even essential businesses were subject to reduced operating hours, or reduced capacity. Just about every “essential” business (and that definition varies from state to state) was forced to operate under pandemic restrictions at some point, making even essential businesses eligible for the ERC. Myth 4: I’m not eligible because employees I had in 2020-21 have since quit, were fired, or were replaced. The Employee Retention Credit is based on the number of employees on the payroll, not specific employees. Turnover in the restaurant business is common but it doesn’t prevent you from claiming what could be tens of thousands of dollars in taxes you’ve already paid. Myth 5: My business wasn’t shut down during the pandemic. For much of the relevant ERC time period, businesses weren’t forced to be closed. The ERC covers 2020 but also three quarters of 2021 – a timeframe when most businesses were back to business as usual. Myth 6: My business’ sales rebounded in the first quarter of 2021, so I’m not eligible. Thanks to a change to the CARES Act, you have the option to look at one quarter prior. This means Adesso can determine eligibility based on lost revenue in 2020. Also, if your business was subject to a full or partial suspension, you may qualify regardless. The truth is, filing for the ERC is complicated. We would hate to find out you missed out on receiving up to $26,000 per employee because you got some bad advice. Or because you believed the myths out there about the ERC program. We know there are tons of things your business could do with the money. Let Adesso take care of the entire refund filing process, from the initial phone call to follow-ups. All you need to do to get started is to schedule a call to see how much you qualify for. This guest blog was submitted by Adesso Capital. For more information on guest blog opportunities, contact Marla McColly, Business Development Director, Oregon Restaurant & Lodging Association.

ERC Eligibility / National CEO Presence / Board Nominations

Eligibility Clarification for 2021 Q3 Employee Retention Tax Credits The law states there are two criteria by which an employer may qualify for the Employee Retention Credit:

AHLA and NRA CEOs to Speak at ORLA's Hospitality Conference Mark your calendars and plan on attending the ORLA Hospitality Conference September 11-12 in Eugene. We are excited to host both CEOs from our national affiliates for the first time at an ORLA event. Michelle Korsmo, President & CEO for the National Restaurant Association and Chip Rogers, President & CEO for the American Hotel & Lodging Association will be speaking in person during the kickoff lunch on Sunday. This is a rare opportunity to hear insights directly from these industry leaders on legislative activity in Congress, industry trends, emerging issues, and projected industry recovery. In addition to the general sessions, we have eight breakout sessions including two that will offer a deeper dive on restaurant and lodging advocacy. ORLA Board Nominations Committee Convenes in July Active ORLA members provide the backbone for all association efforts and we remain fortunate in having committed restaurant, lodging, and allied members who serve on ORLA’s Board of Directors. The ORLA Board is made up of 10 restaurant member representatives, 10 lodging member representatives, and 3 Allied member representatives. Board members serve 3 year terms and attend 4 board meetings each year. Those serving are eligible to serve two consecutive terms before reaching their term limit. For ORLA’s upcoming fiscal year beginning October 1 there are 3 openings on the board due to term limits – 1 restaurant, 1 lodging, and 1 allied position. If you are interested in being considered for ORLA Board service please reach out to ORLA President & CEO Jason Brandt. Sysco Sponsors Teacher Flex Fund Thanks to our partners at Sysco, the Oregon Hospitality Foundation had the opportunity to extend a small grant application in support of the ProStart program across the state. The Oregon ProStart Teacher Flex Fund encouraged teachers to apply for a $500 grant for to prepare for the 2022–2023 school year. At the teacher's discretion, these funds can be spent on much-needed products or equipment within the classroom to help facilitate their culinary program. Allocations from the $5,000 Flex Fund were made on a first come, first serve basis, and will be dispersed later this month. To learn more about how ProStart is helping foster our next generation of industry leaders, or to see how you can support this valuable career technical education program, visit OregonRLA.org/prostart. Questions? Feel free to contact your association.  Since its rollout last year, ORLA has consistently reported on the potential benefits of the Employee Retention Tax Credit (ERTC). The benefit is still available but time, and patience, is critical. Application for ERTC is open to any qualified employer who has filed a 941 tax form from March 12, 2020 (when the program started) through September 30, 2021 (when the program ended). This credit helps any qualified employer– not just restaurants and lodging operators– put their hard-earned money back into operations. Just ask John Barofsky, current ORLA Chair and co-owner of Beppe & Gianni’s Trattoria in Eugene. “Being a small independent operator, the ERTC was an unexpected but welcome boost to my operation’s ability to stay open and maintain staff through the pandemic. Although at first the process of the credit seemed daunting, the time I spent was well worth the return. The ability to defray payroll costs and tax payments had a great impact on my cash flow and bottom line.” Another ORLA member who benefitted from ERTC is Drew Roslund with the Overleaf Lodge & Spa and The Fireside Motel, both in Yachats, Oregon. “The ERTC was comparable in size and scope to the Paycheck Protection Program for many organizations. It was tough waiting seven to eight months for refunds but just knowing that we qualified gave us enough confidence to keep team members employed and increase wages, especially during the busy summer season on the Oregon coast. Roughly the equivalent of a month’s worth of gross revenue, we were able to lock in some necessary incentive pay for key staff and even tackle a few deferred maintenance projects.” To review, the original ERTC program was enacted by the CARES Act in 2020 and allows a tax credit of up to 50 percent of each employee’s share of social security qualified wages, per year. With the Consolidated Appropriations Act of 2021, the ERTC program was expanded to allow a tax credit of up to 70 percent of each employee’s share of social security qualified wages, per quarter. The 2021 Act added a 500-employee maximum [1] for employers who could access the ERTC program. As of this writing, the final change in the ERTC storyline came with the passage of the Infrastructure Investment and Jobs Act in 2021, which terminated the ERTC on 9/30/21, instead of terminating on 12/31/21. That last change effectively repealed an employer’s tax credit for Q4-2021, but ORLA members are strongly encouraged to research and apply for all ERTC benefits that are due to you. Even though the program ended one quarter earlier than originally planned, ERTC is available to qualified employers and wages for a portion of seven quarters - March 12, 2020, through September 30, 2021. Employers that did not claim the ERTC on their original Form 941 may retroactively claim the credit by filing Form 941-X. It is important to note that employers have three years from the date the original return was filed, or two years from the date the taxes were paid, to file Form 941-X and claim the full credit. Two areas of caution for operators: First, with the high volume of ERTC applications pouring in across all industries, it is not uncommon to wait nine months or more for refunds to be processed and received. Second, for those operators who applied for and received a tax credit for Q4-2021, the repeal of ERTC for that particular quarter triggers a negative situation where employers that already claimed an advance payment of the credit for wages paid after September 30, 2021 and received a refund on those wages must repay that refund. Employers that held back payroll tax deposits for Q4-2021 in anticipation of the ERTC for that period must deposit those amounts retained on or before the relevant due date for wages paid on December 31, 2021 (regardless of whether the employer actually pays wages on that date).[3] Note, this article serves as a general guideline and should not be construed as tax advice. Owners/operators should always seek their own tax counsel to take full advantage of accounting treatments, including ERTC, that minimizes tax liability and maximizes tax credits and refunds. If you are looking for assistance with this process, consider reaching out to Adesso, a new ORLA partner helping industry members navigate the complex and time-consuming ERC filing process. Visit AdessoCapital.com/ORLA for more information or contact your ORLA Regional Representative. You can also listen to ORLA's Boiled Down podcast episode #41, ERC: How to Get the Money You May Be Owed. ORLA hopes you are able to join many other operators who have found profitable results from the Employee Retention Tax Credit program. Good luck and many happy returns. | Tom Perrick, Advocate for the Hospitality Industry This article originally appeared in the Spring issue of Oregon Restaurant & Lodging Association Magazine, pg. 16. 1 How To Claim The Employee Retention Credit For The First Half Of 2021, Journal of Accountancy, April 5, 2021 2 Tri-Merit, LLC 2021 3 BDO U.S., For Employers Who Took ERTC for Fourth Quarter 2021 Wages, December 2021). Residents Should Have Say on Sales Tax on Meals

FOR IMMEDIATE RELEASE: July 12, 2021 Contact: Greg Astley, Director of Government Affairs, ORLA 503.851.1330 | [email protected] Wilsonville, OR– The Cannon Beach City Council voted to approve a 5% sales tax on meals by a 3-2 vote, leading to a second reading on July 14th, 2021, to either ratify the sales tax or, if it fails, open the door for the City Council to place a measure on the ballot this November. The Oregon Restaurant & Lodging Association (ORLA) opposes the sales tax on meals in Cannon Beach and believes the residents of Cannon Beach deserve to have their voices heard. “It’s unconscionable Cannon Beach City Council would even think about enacting a sales tax on restaurants after the last 16 months our industry has suffered through but it’s especially troubling they would choose to do so without asking for a vote of the people,” said Greg Astley, Director of Government Affairs for ORLA. “The restaurants fortunate enough to survive the wildfires, ice storms and global pandemic we’ve been through are still struggling to hire enough people to fully re-open and try to recover from their significant financial losses.” Astley continued, “Although one City Councilor claimed residents would not be affected by the tax and therefore the sales tax on meals should not go to a vote of the people, nothing could be further from the truth. Residents will pay the sales tax on meals every time they go out to eat with friends and family unless they choose to stop patronizing local restaurants in favor of establishments outside the city limits.” Beyond the obvious unfairness of asking one industry to shoulder the burden of paying for services everyone will benefit from, ORLA has outlined several other reasons why voters should be allowed to weigh in on a sales tax on meals:

Astley concluded, “At the very least, the people of Cannon Beach deserve to vote up or down on this sales tax on meals. An even better solution for the City of Cannon Beach would be to consider an Economic Improvement District or similar mechanism where the burden of raising revenue falls more broadly than on just the struggling local restaurants.” ### The Oregon Restaurant & Lodging Association is the leading business association for the foodservice and lodging industry in Oregon, which before COVID-19 provided over 180,000 paychecks to working Oregonians. House Vote on Unemployment Insurance Tax Relief Triggers Movement to State Senate

FOR IMMEDIATE RELEASE: April 16, 2021 Contacts: Greg Astley, Director of Government Affairs, ORLA 503.851.1330 | [email protected] Jason Brandt, President & CEO, ORLA 503.302.5060 | [email protected] Wilsonville, OR– The Oregon House of Representatives voted overwhelmingly to move forward with bipartisan legislation which would provide millions in unemployment insurance tax relief for some of Oregon’s hardest hit industries. House Bill 3389 passed the Oregon House and will now move to the Senate for ongoing deliberation. The bill accomplishes a number of priorities for Oregon’s hospitality industry with the most important component being the removal of 2020 and 2021 employment data from the formula used to determine an employer’s applicable tax rate, starting in 2022. “We would like thank the leaders who have signed on to support this bill as sponsors and their ongoing work to shepherd it through the legislative process,” said Jason Brandt, President & CEO for the Oregon Restaurant & Lodging Association. “The deferral and forgiveness components could be stronger for this year given the impact of government restrictions on industry employment options. Having said that, the big win will prove to be solving the tax hike problem for years 2022 through 2024.” Unemployment insurance taxes are paid entirely by Oregon employers to fund Oregon’s Unemployment Insurance Trust Fund which remains the healthiest in the nation. One third of unemployment insurance taxes for 2021 can be deferred for employers with an increased tax rate of half a percent or more. If the employer’s tax rate increased more than 1 percent to 1.5 percent, 50 percent of the deferred tax would be forgiven. For tax rates which increased more than 1.5 percent to 2 percent, 75 percent of the deferred tax would be forgiven. And for employers who had a tax rate increase of more than 2 percent, the full deferred amount would be forgiven. “We know this legislation if passed has the potential to save hospitality employers tens of millions of dollars this year alone,” said Greg Astley, Director of Government Affairs for the Oregon Restaurant & Lodging Association. “That amount pales in comparison to the real impact of the relief in future years. If we can erase 2020 and 2021 from upcoming calculations as proposed in the legislation, it will have a direct impact on our industry recovery efforts.” The bipartisan Chief Sponsors of the bill in the house include Representatives Paul Holvey, Daniel Bonham, and John Lively. The bipartisan Chief Sponsors in the State Senate include Senators Bill Hansell and Chuck Riley. For more information on the efforts of the Oregon Restaurant & Lodging Association please visit OregonRLA.org. ### The Oregon Restaurant & Lodging Association is the leading business association for the foodservice and lodging industry in Oregon, which before COVID-19 provided over 180,000 paychecks to working Oregonians. A new law signed in late December 2020 makes hospitality businesses eligible for an employee retention tax credit, even if they received a PPP loan. Now, for any calendar quarter between March 13 and Dec. 31, 2020, a restaurant with 100 or fewer full-time employees may be able to access the Employee Retention Tax Credit (ERTC) of up to $5,000 per employee. And, for the first two quarters of 2021, Jan. 1–March 31, and April 1–June 30, businesses with 500 or fewer full-time employees may be able to access ERTC of up to $7,000 per employee per quarter. Read more from the National Restaurant Association: Big tax credits to restaurants could support employee retention FAQ on the Employee Retention Credit

(The following information provided by Cross Financial) The eligibility criteria outlined below is referring to the Employee Retention Credit as it is revised in Bill HR 133, Taxpayer Certainty and Disaster Tax Relief Act of 2020, signed December 27, 2020. This went into affect January 1, 2021 and ends June 30, 2021. While the IRS has yet to update their webpages on the ERC, the changes outlined in the bill are as follows:

Employers need to make sure they do not claim wages that were used for family leave, PPP or other Cares act related credits. In other words, no double dipping. Employee Retention Credit 2020 (ended Dec 31, 2020) An employer with one employee making $12,000 within a quarter would be permitted to use 50% of $10,000 so the max annual employee limit of $5,000 against applicable employment taxes, if there was not enough taxes to offset against, a refund would be calculated at the time of filing form 941, or a refund can be requested earlier by filing form 7200. 1 Employee x $12,000 in quarterly wages = $12,000 $12,000 - $10,000 (max qualifying wage amount) = $10,000 $10,000 x 50% (eligible credit percentage) = $5,000 employee retention credit (ERC) $5,000 in ERC - $ (employment taxes) = Refund amount if credit exceeds employment taxes for the quarter. Employee Retention Credit 2021 (ends June 30, 2021) The Employee Retention Credit as it is revised in Bill HR 133, Taxpayer Certainty and Disaster Tax Relief Act of 2020, signed December 27, 2020 outlines updates for the calculation of the ERC. This went into affect January 1, 2021 and ends June 30, 2021. An employer with one employee making $12,000 within a quarter would be permitted to use 70% of $10,000 so the max quarterly employee limit of $7,000 against applicable employment taxes. If there is not enough taxes to offset against, a refund would be calculated at the time of filing form 941, or a refund can be requested earlier by filing form 7200. 1 Employee x $12,000 in quarterly wages = $12,000 $12,000 - $10,000 (max qualifying wage amount) = $10,000 $10,000 x 70% (eligible credit percentage for Q1) = $7,000 employee retention credit (ERC) $7,000 in ERC - $ (employment taxes) = Refund amount if credit exceeds employment taxes for the quarter. Property tax season is upon us, and many property owners will be paying very close attention to their bills in 2020. Due to Oregon’s unique property tax laws, often the real market value and the assessed value of a property are very different, which can result in bills increasing even if the real market value of a property dropped in the year assessed.

If you want to appeal your property taxes, there are three general reasons for filing:

Unfortunately, these kinds of appeals do not consider financial distress. To appeal, you must file your petition by December 31st with the Board of Property Tax Appeals (BOPTA) clerks in your county. To see contact information for clerks in each county, click here. Be sure to visit your county’s website for the correct appeal forms and fee information, or contact the clerk for them. Appeals are reviewed by your county’s Board of Property Tax Appeals, made up of members from the community appointed by your county’s Commissioners. Appeals are typically heard by the Board between February through April. If you disagree with their valuation decision, you can then appeal to the Magistrate Division of the Oregon Tax Court by filing forms and paying a fee. To appeal beyond that, this chart has more information on where and when you must file an appeal—note that some of these dates may be extended by emergency declarations due to COVID-19. If you have a special appeal situation, for example, needing to contest previous assessment years, read more guidance from the Oregon Department of Revenue on how to file an appeal.  More information is now available on the “Health, Economic Assistance, Liability Protection, and Schools (HEALS) Act” released earlier this week by Senate Republicans. As a reminder, the House introduced the HEROES Act proposal in May, which passed along party lines. Discussions are expected to now begin in earnest as Congress faces the July 31 deadline for enhanced pandemic unemployment insurance benefits. Part of the Republican proposal would reduce these benefits from $600 per week to $200 per week on top of state administered aid until the end of September at which time the maximum benefit will be 70% of the recipient current wages -- but this will be a starting point for the negotiations. Read the National Restaurant Association’s summary of the proposal and the American Hotel and Lodging Association’s analysis of the HEALS Act. Many of the hospitality industry’s priorities are included in the HEALS Act, including:

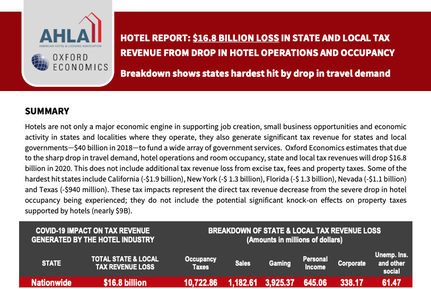

If you haven't yet, please take action on the National Restaurant Association's Blueprint for Restaurant Revival and/or the American Hotel and Lodging Association's Hotel Priorities Day of Action, thank you!  New research shows coronavirus continues to devastate restaurant industry New research from the National Restaurant Association indicates that the restaurant industry has lost $120 billion in sales during the last three months due to the impact of coronavirus in the United States. State mandated stay-at-home policies and forced closures of restaurant dining rooms resulted in losses of $30 billion in March, $50 billion in April, and another $40 billion in May. The latest operator survey conducted by the NRA drew more than 3,800 responses, illustrating the extensive damage to restaurant businesses since the outbreak began. It found that the restaurant industry, which experienced the most significant sales and job losses of any industry in the country in the first quarter of 2020, expects to lose $240 billion by the year-end.  New report by Oxford Economics with state-by-state TLT revenue breakdown As a result of the sharp drop in travel demand from COVID-19, state and local tax revenue from hotel operations will drop by $16.8 billion in 2020, according to a new report by Oxford Economics released today by the American Hotel & Lodging Association (AHLA). Hotels have long served as an economic engine for communities of all sizes, from major cities, to beach resorts, to small towns off the interstate—supporting job creation, small business opportunities and economic activity in states and localities where they operate. Hotels also generate significant tax revenue for states and local governments to fund a wide array of government services. In 2018, the hotel industry directly generated nearly $40 billion in state and local tax revenue across the country. Oregon is expected to see a total state and local tax revenue loss of $171.7 million. Download the AHLA/Oxford Economic Report of the state-by-state breakdown for tax revenue impact and revenue loss. These tax impacts represent the direct tax revenue decrease from the severe drop in hotel occupancy, including occupancy, sales, and gaming taxes. These figures do not include the potential, significant, knock-on effects on property taxes supported by hotels (nearly $9B). At their most recent meeting, the Oregon Restaurant & Lodging Association (ORLA) Board of Directors voted unanimously (with 1 abstention) to support a legislative bill which will originate from Governor Brown’s office in support of a permanent 1.8% statewide lodging tax rate during the 2020 Oregon Legislative Session. Revenue raised by the statewide lodging tax is invested in Travel Oregon’s efforts to strengthen the economic impact of our state’s tourism industry. Oregon’s statewide lodging tax is currently collected at a rate of 1.8% with a reduction in the rate scheduled to take effect as of July 1, 2020 to a permanent rate of 1.5%.

“We appreciate Governor Brown’s proactive outreach to meet with ORLA and some of our key lodging stakeholders in person to discuss the merits of keeping the statewide lodging tax rate at 1.8% permanently,” said Jason Brandt, President & CEO of ORLA. “Our goals for lodging tax rate structures in Oregon are two-fold – protecting all statewide lodging tax resources to create return on investment for the industry through the efforts of Travel Oregon and protecting local lodging tax reforms passed in the 2003 Legislative Session.” Oregon continues to experience healthy growth in tourism spending logging our ninth consecutive year of industry growth in 2018. Compared to 2017, visitor spending was up 4.2% reaching a record $12.3 billion. Industry employment was also up year over year by 2.9% to approximately 115,400. Year over year, hotel room revenue increased by 4.4% as well. “We have seen firsthand what strategic investments in tourism promotion can do when industry tax dollars are put to their most effective use,” said Brandt. “With many other competing priorities in the Capitol, it is essential the association protects the appropriate use of these dollars at both the local and state levels. The economic impacts we are seeing are significant not just for our industry but for our public sector partners as well.” The U.S. Travel Association tracks statewide economic impact throughout the country and assists states in quantifying the value of year over year tourism growth. The most recently available data notates Oregon’s tourism growth at 5.3% when comparing 2016 to 2017, further substantiating the value of healthy tourism growth for Oregon’s public sector. From 2016 to 2017, Oregon experienced visitor spending growth of $652 million. That increase in spending and associated payroll income tax increases equates to as many as 410 firefighter positions, 380 police officer positions, or 380 teacher positions. ORLA continues to focus on the protection of local lodging tax dollars for tourism promotion and tourism related facilities in addition to support given to Governor Brown’s upcoming legislative bill for the statewide resource. Oregon’s local lodging tax structure can be complicated with over 110 different city and county jurisdictions collecting a transient lodging tax outside of the 1.8% statewide tax. Important guidelines have been in place for the past 16 years for how local lodging tax dollars can be spent. To clarify those parameters, ORLA recently produced a new instructional video to assist all stakeholders and the general public in better understanding the rules which govern local lodging tax resources. The new video specific to local lodging taxes (not to be confused with Oregon’s 1.8% statewide lodging tax) can be viewed here:

For more information about the Oregon Restaurant & Lodging Association’s policies on transient lodging taxes, please reach out to Greg Astley, ORLA’s Director of Government Affairs, at [email protected] via email.  NOTE: This position statement was drafted by local restaurateurs and foodservice operations doing business in Hood River County and as a result reflects the official position of our statewide association on their behalf. Hood River County needs a solution to their budget shortfall, but this is an ill-conceived way to do it. There is still a three-year runway to find a financial solution and this measure is fundamentally flawed. Measure 14-66 is bad for Hood River County for the following reasons: Bad for Businesses - Entire tax burden carried by just one business segment – this is not a fair tax. - Restaurants are seasonal and already struggle in the winter. - Already hit by massive cost increases from higher minimum wages and unequal share of business property taxes. - Restaurant sales taxes are shown to shift demand to large corporate chains and grocery stores, hurting local restaurants and farms. - Tax is complex and hard for small restaurants to implement and comply with. Bad for Workers - Will reduce overall income and overall employment opportunities. - Will reduce tip income as customers will tip less to offset additional tax cost. - Restaurant employees already struggle with affordable housing and this will compound that, especially in winter months. Bad for Residents - Residents will shoulder most of the tax burden as they eat in restaurants all year long. Tourism is only a factor for a few months of the year. - Residents want to support and access local farmers and locally sourced food. This tax creates a headwind for that. - Restaurant sales plummet during economic downturns, making this an unstable source of income for the county. Let’s ask Hood River County to bring a fair and sustainable option for raising these funds. NoSalesTaxOnMeals Business Association Letter to the Revenue Committees

The Oregon Restaurant & Lodging Association is one of 22 business associations who signed the following letter submitted to the revenue committees on March 21, 2019. As representatives of Oregon’s leading private-sector employers, we recognize that the Legislature intends to pass significant new taxes this year, most of which will fall on Oregon’s businesses, small and large. As we consider tax proposals, our organizations will be guided by the following principles:

|

Categories

All

Archives

June 2024

|

Membership |

Resources |

Affiliate Partners |

Copyright 2024 Oregon Restaurant & Lodging Association. All Rights Reserved.

8565 SW Salish Lane Suite 120 | Wilsonville, OR 97070-9633 | 503.682.4422 | 800.462.0619 | Contact Us

Site Map | Accessibility | Privacy Policy

8565 SW Salish Lane Suite 120 | Wilsonville, OR 97070-9633 | 503.682.4422 | 800.462.0619 | Contact Us

Site Map | Accessibility | Privacy Policy

RSS Feed

RSS Feed