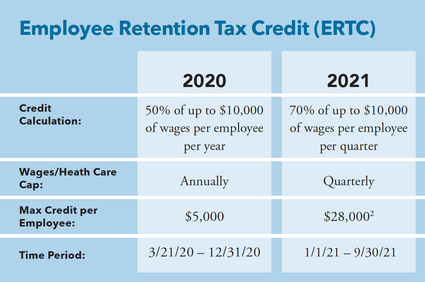

Since its rollout last year, ORLA has consistently reported on the potential benefits of the Employee Retention Tax Credit (ERTC). The benefit is still available but time, and patience, is critical. Application for ERTC is open to any qualified employer who has filed a 941 tax form from March 12, 2020 (when the program started) through September 30, 2021 (when the program ended). This credit helps any qualified employer– not just restaurants and lodging operators– put their hard-earned money back into operations. Just ask John Barofsky, current ORLA Chair and co-owner of Beppe & Gianni’s Trattoria in Eugene. “Being a small independent operator, the ERTC was an unexpected but welcome boost to my operation’s ability to stay open and maintain staff through the pandemic. Although at first the process of the credit seemed daunting, the time I spent was well worth the return. The ability to defray payroll costs and tax payments had a great impact on my cash flow and bottom line.” Another ORLA member who benefitted from ERTC is Drew Roslund with the Overleaf Lodge & Spa and The Fireside Motel, both in Yachats, Oregon. “The ERTC was comparable in size and scope to the Paycheck Protection Program for many organizations. It was tough waiting seven to eight months for refunds but just knowing that we qualified gave us enough confidence to keep team members employed and increase wages, especially during the busy summer season on the Oregon coast. Roughly the equivalent of a month’s worth of gross revenue, we were able to lock in some necessary incentive pay for key staff and even tackle a few deferred maintenance projects.” To review, the original ERTC program was enacted by the CARES Act in 2020 and allows a tax credit of up to 50 percent of each employee’s share of social security qualified wages, per year. With the Consolidated Appropriations Act of 2021, the ERTC program was expanded to allow a tax credit of up to 70 percent of each employee’s share of social security qualified wages, per quarter. The 2021 Act added a 500-employee maximum [1] for employers who could access the ERTC program. As of this writing, the final change in the ERTC storyline came with the passage of the Infrastructure Investment and Jobs Act in 2021, which terminated the ERTC on 9/30/21, instead of terminating on 12/31/21. That last change effectively repealed an employer’s tax credit for Q4-2021, but ORLA members are strongly encouraged to research and apply for all ERTC benefits that are due to you. Even though the program ended one quarter earlier than originally planned, ERTC is available to qualified employers and wages for a portion of seven quarters - March 12, 2020, through September 30, 2021. Employers that did not claim the ERTC on their original Form 941 may retroactively claim the credit by filing Form 941-X. It is important to note that employers have three years from the date the original return was filed, or two years from the date the taxes were paid, to file Form 941-X and claim the full credit. Two areas of caution for operators: First, with the high volume of ERTC applications pouring in across all industries, it is not uncommon to wait nine months or more for refunds to be processed and received. Second, for those operators who applied for and received a tax credit for Q4-2021, the repeal of ERTC for that particular quarter triggers a negative situation where employers that already claimed an advance payment of the credit for wages paid after September 30, 2021 and received a refund on those wages must repay that refund. Employers that held back payroll tax deposits for Q4-2021 in anticipation of the ERTC for that period must deposit those amounts retained on or before the relevant due date for wages paid on December 31, 2021 (regardless of whether the employer actually pays wages on that date).[3] Note, this article serves as a general guideline and should not be construed as tax advice. Owners/operators should always seek their own tax counsel to take full advantage of accounting treatments, including ERTC, that minimizes tax liability and maximizes tax credits and refunds. If you are looking for assistance with this process, consider reaching out to Adesso, a new ORLA partner helping industry members navigate the complex and time-consuming ERC filing process. Visit AdessoCapital.com/ORLA for more information or contact your ORLA Regional Representative. You can also listen to ORLA's Boiled Down podcast episode #41, ERC: How to Get the Money You May Be Owed. ORLA hopes you are able to join many other operators who have found profitable results from the Employee Retention Tax Credit program. Good luck and many happy returns. | Tom Perrick, Advocate for the Hospitality Industry This article originally appeared in the Spring issue of Oregon Restaurant & Lodging Association Magazine, pg. 16. 1 How To Claim The Employee Retention Credit For The First Half Of 2021, Journal of Accountancy, April 5, 2021 2 Tri-Merit, LLC 2021 3 BDO U.S., For Employers Who Took ERTC for Fourth Quarter 2021 Wages, December 2021). Comments are closed.

|

Categories

All

Archives

June 2024

|

Membership |

Resources |

Affiliate Partners |

Copyright 2024 Oregon Restaurant & Lodging Association. All Rights Reserved.

8565 SW Salish Lane Suite 120 | Wilsonville, OR 97070-9633 | 503.682.4422 | 800.462.0619 | Contact Us

Site Map | Accessibility | Privacy Policy

8565 SW Salish Lane Suite 120 | Wilsonville, OR 97070-9633 | 503.682.4422 | 800.462.0619 | Contact Us

Site Map | Accessibility | Privacy Policy

RSS Feed

RSS Feed