|

FOR IMMEDIATE RELEASE Media Contact: Jason Brandt, President & CEO, ORLA, 503.302.5060 Remaining funds present unique opportunities to invest in tourism initiatives Wilsonville, OR – Salem’s Budget Committee approved a stop-gap solution to fund the library through a Cultural and Tourism Fund, finding access to American Rescue Plan Act (ARPA) dollars outside of any restricted lodging tax revenues. The Oregon Restaurant & Lodging Association (ORLA) confirmed with the City Attorney the ARPA funds will be used as a one-time resource to backfill their library shortfall, a legal move within the rules for those federal dollars. Coming out of the pandemic, Oregon received $4.262 billion in ARPA funding, with approximately $2.76 billion going to the state and $1.5 billion distributed to Oregon cities and counties. After Salem uses $1.2 million of their ARPA funds to preserve staff and services for the library for a year, it’s anticipated there will still be close to $2 million remaining in the Cultural and Tourism Fund. “Having such a robust beginning balance in this fund is a great opportunity for us to assist Salem’s hospitality industry in their ongoing recovery efforts post pandemic while potentially driving new lodging tax revenue for the City in support of future fiscal years,” said Jason Brandt, President & CEO of the Oregon Restaurant & Lodging Association. “This is a strategic moment for the region and city collaborations with Travel Salem, the Salem Area Lodging Association, and the Salem Area Chamber of Commerce should be put in motion to invest in creative tourism programs or initiatives local stakeholders feel can drive new tourism traffic.” ORLA continues to support and protect tourism funding across the state, ensuring appropriate, strategic investments are made to drive tourism year-round and help build stronger economies. When tourism investments are driven through collaborative efforts involving all stakeholders, everyone benefits. New tourists result in more dollars through visitor spending and lodging taxes, bringing more revenue to local economies. For more information on the importance of protecting transient lodging tax revenues, visit the Oregon Restaurant & Lodging Association’s website at OregonRLA.org/tlt. Read more on ORLA’s public policy proposals for how ARPA funds could best be leveraged for Oregon’s tourism and hospitality industries. About

The Oregon Restaurant & Lodging Association is the leading business association for the foodservice and lodging industry in Oregon, which is comprised of over 10,220 foodservice locations and 2,000 lodging establishments. As of December 2023, the Oregon Employment Department reports the Leisure and Hospitality workforce totals 208,700 with a total economic impact of over $13.8 billion in annual sales for Oregon. FOR IMMEDIATE RELEASE: April 17, 2024 Media Contact: Jason Brandt, President & CEO, ORLA, 503.302.5060 Mayor proposes dipping into transient lodging tax dollars to fund city’s library Wilsonville, OR– The Oregon Restaurant & Lodging Association (ORLA) is proactively looking into a proposal by Salem Mayor Chris Hoy to use transient lodging taxes to fund around $1.2 million in the library’s budget. Under his proposal, the city would access lodging tax dollars from Salem’s Cultural and Tourism Fund to cover the shortfall in library operations. “Each jurisdiction with a transient lodging tax has both restricted and unrestricted parameters for how our industry tax money can be spent,” said Jason Brandt, President & CEO for the Oregon Restaurant & Lodging Association. “The question here is whether the City of Salem has $1.2 million in unrestricted funds from the transient lodging tax to spend however they deem appropriate. If the City uses the portion of industry taxes restricted by state law for tourism, then ORLA will need to take appropriate action against this proposal.” Reforms passed in the 2003 Oregon Legislative Session established rules for how local governments can spend industry tax dollars. In short, spending on tourism promotion and tourism-related facilities (defined in state statute) was locked in as a percentage of total lodging tax collections on July 1, 2003. And on July 2, 2003, moving forward, any increase in a local lodging tax rate or establishment of a new lodging tax not already in existence must allocate 70 percent of revenues to tourism promotion and tourism-related facilities with the remaining 30 percent serving as unrestricted revenue for the local government to spend however they see fit. Diverting lodging taxes in support of other local government priorities essentially shortchanges the Oregon hospitality industry’s ability to bring visitor dollars to restaurant, lodging, and retail businesses year-round. Protection of industry tax dollars is a priority for ORLA as we remain focused on embracing shoulder and off-season promotions to entice visitors to local communities across Oregon year-round. ORLA serves as the industry’s watchdog on lodging tax spending by local governments across Oregon. We produced a helpful video that our industry members and local government stakeholders can review that explains how local lodging taxes must be expended in accordance with Oregon's state law. View the Oregon Lodging Tax Defined video and visit the Oregon Restaurant & Lodging Association’s website at OregonRLA.org for more information. About

The Oregon Restaurant & Lodging Association is the leading business association for the foodservice and lodging industry in Oregon, which is comprised of over 10,220 foodservice locations and 2,000 lodging establishments. As of December 2023, the Oregon Employment Department reports the Leisure and Hospitality workforce totals 208,700 with a total economic impact of over $13.8 billion in annual sales for Oregon. FOR IMMEDIATE RELEASE CONTACT: Jason Brandt, Oregon Restaurant & Lodging Association 503.302.5060 | [email protected] ORLA Files Suit Against City of Albany for Tax Expenditures The motion filed in Linn County District Court alleges misuse of lodging taxes based on state law requirements Wilsonville, OR– The Oregon Restaurant & Lodging Association (ORLA) filed a lawsuit this week against the City of Albany in Linn County Circuit Court. ORLA contends the City has not reinvested lodging tax dollars originally used to pay off remaining debt for the Linn County Fair & Expo Center back into tourism promotions and/or other tourism-related facilities as required by state law. “ORLA, on behalf of our local lodging and restaurant operators, has done everything we can to find agreement with City administrators for over a year in hopes of avoiding legal action,” said Jason Brandt, President & CEO for the Oregon Restaurant & Lodging Association. “Unfortunately, City administrators appear to be undeterred and unwilling to concede dollars previously used to pay off debt for the Linn County Fair & Expo center must be reinvested in tourism promotions and/or tourism-related facilities as required by state law.” Oregon Revised Statute (ORS) 320.350 prohibits local governments from decreasing the percentage of Transient Lodging Tax (TLT) revenues spent to fund tourism promotion and tourism-related facilities once tourism-related facility debt is paid off. “The City has had two choices available to them since retiring debt associated with the Linn County Fair & Expo Center,” said Brandt. “They could have reinvested those dollars in other tourism-related facility projects or tourism promotional campaigns bringing benefits to both residents and visitors, or they could have chosen to reduce the industry tax rate after paying off the debt. Unfortunately, these options have not been embraced and our industry seeks to hold the City of Albany accountable for its failure to comply with state law.” The hospitality industry remains focused on embracing shoulder and off-season promotions to entice visitors to local communities across Oregon year-round. “We know the diversion of lodging taxes in support of other local government priorities shortchanges our ability to bring visitor dollars to our restaurant, lodging, and retail businesses year-round,” said Brandt. “Our promotional campaigns at strategic times of the year to targeted tourism markets can bring significant revenue to our local economies and sustain year-round employment for our hard-working teammates in the industry.” The lawsuit filed with Linn County Circuit Court can be viewed through the following link: Complaint: ORLA v. City of Albany Learn more about how Oregon lodging tax is defined in this video. For more information on the efforts of the Oregon Restaurant & Lodging Association please visit OregonRLA.org. The Oregon Restaurant & Lodging Association is the leading business association for the foodservice and lodging industry in Oregon. A not-for-profit trade organization, ORLA represents approximately 3,000 member units and advocates for over 10,000 foodservice locations and over 2,400 lodging establishments in Oregon.

Update August 2023:

Although the U.S Department of Labor (USDOL) issued a rule on September 24, 2021 clarifying that managers and supervisors may only keep tips that they receive from customers directly for services that the manager or supervisor directly and “solely” provides, due to increased scrutiny and enforcement by the USDOL, ORLA does not recommend managers and supervisors keep any tips received during service if the establishment has a tip pool system in place. Because managers and supervisors may set working hours, areas of service, days on or off or other functions related to an employee’s ability to earn tips, to avoid potential lawsuits, fines, penalties or other consequences, ORLA does not recommend managers and supervisors keep any tips received during service if the establishment has a tip pool system in place. ORLA in the News with U.S. Department of Labor Final Rule on Tip Pooling A final rule on tip pooling in the United States was recently released on December 22, 2020 and will go into effect across the country on February 20, 2021. The final rule further establishes the legality of overseeing and managing a tip pool that includes staff who do not customarily and regularly receive tips by directly interfacing with a customer. Managers and supervisors are still prohibited from participating in tip pools. The final rule does define further, explaining as follows: “...the final rule defines a manager or supervisor for purposes of section 3(m)(2)(B) as any employee (1) whose primary duty is managing the enterprise or a customarily recognized department or subdivision of the enterprise; (2) who customarily and regularly directs the work of at least two or more other full-time employees or their equivalent; and (3) who has the authority to hire or fire other employees, or whose suggestions and recommendations as to the hiring or firing are given particular weight. The definition also includes as managers or supervisors any individuals who own at least a bona fide 20 percent equity interest in the enterprise in which they are employed and who are actively engaged in its management.” In summary, the final rule simply codifies our collective win advocating for the importance of tip pools. Pages 11 and 12 of the Rule states: “In 2016, a divided Ninth Circuit panel upheld the validity of the 2011 regulations. See Oregon Rest. & Lodging Ass’n (ORLA) v. Perez, 816 F.3d 1080, 1090 (9th Cir. 2016). Although the Ninth Circuit declined en banc review of the decision, ten judges dissented on the ground that the FLSA authorized the Department to address tip pooling and tip retention only when an employer takes a tip credit. The dissent noted that the Ninth Circuit itself had decided in Cumbie that the FLSA ‘clearly and unambiguously permits employers who forgo a tip credit to arrange their tip-pooling affairs however they see fit.’ … In its 2018 response to the petition for a writ of certiorari in the ORLA case, the government explained that the Department had reconsidered its defense of the 2011 regulations in light of the Ninth Circuit’s ten-judge dissent from denial of rehearing in ORLA and the Tenth Circuit’s decision in Marlow … the Department published in December 2017 an NPRM that proposed to rescind the challenged portions of the regulations.” The actual regulation and a summary of the final rule can be found here: https://www.dol.gov/agencies/whd/flsa/tips. Restaurant Employee Compensation Tools With tip pooling being legal with back of the house employees, employers may have questions about what their options are. ORLA launched a Restaurant Compensation Solutions Workgroup to review tools being implemented in restaurant operations across the state, including mandatory service charges, tip pooling policies based on sales that assist in compensating kitchen staff, and dual tip lines notating tip options for both servers and kitchen staff. Tip pooling policies should be carefully reviewed with counsel before implementation to ensure compliance with all applicable requirements. For more on this subject, click the links below.

Update: December 2019 A federal spending bill passed in 2018 abolished a 2011 regulation prohibiting tip pooling; managers can now require that servers share tips with kitchen staff in states where employers do not take a tip credit. This change allows tip sharing among both customarily and non-customarily tipped employees in Oregon, including dishwashers and cooks. Managers, supervisors, and owners cannot participate in the tip sharing. A proposed rule to implement the change has been released as of October 7, 2019; comments were due by December 9, 2019. One thing this proposed rule seeks to address is that the words “supervisor” and “manager” were not defined in the 2018 spending bill. This is especially important to our industry since many have hybrid approaches to their service positions. Supervisors and managers in some of Oregon’s smallest restaurant operations commonly serve guests and have participated in front-of-the-house tip pools as a part of a team approach to foodservice. Prior to this change, the decision to participate in a tip pool was left to employees. For more context on the issue, check out Tipping the Scales (Oregon Business, April 2018). The Bureau of Labor and Industries (BOLI) FAQ may answer any additional questions regarding tips at Oregon.gov/BOLI. Resources/News:

For additional questions, contact Greg Astley, Director of Government Affairs, at 503.682.4422. This is for general informational purposes only. The information is not, and should not be relied upon or regarded as, legal advice. Please consult with your legal advisors. Local Lodging Tax Watchdog Work / The Fate of RRF / Workforce Storytelling / 77% of the Way

Yesterday, the House of Representatives approved a bill to replenish the Restaurant Revitalization Fund (RRF). Details on what to expect in DC as well as other updates from the week are below. Don’t forget to sign up and support our largest ORLAPAC fundraiser of the year, One Big Night. If you haven’t already, register to attend and/or consider donating an auction package and help us make a difference in the upcoming election cycle in support of our industry recovery efforts. Local Lodging Tax Watchdog Work ORLA’s successful win in court at both the Circuit Court and Oregon Court of Appeals level has helped usher in a new chapter of relevance for the association in ramping up our watchdog role for our lodging members and the broader tourism industry. As a reminder, ORLA won on all counts against the City of Bend which helped cement our legal standing in holding local governments accountable for how they expend local lodging tax dollars even though ORLA itself does not collect local lodging taxes directly. With the help of legal counsel, ORLA is actively seeking more transparency in the Cities of Gladstone, Gresham, Cannon Beach, and Albany. Watch ORLA's explanatory video as a refresher on how local lodging taxes are to be spent. This video has proven to be a helpful resource to help educate newly appointed local elected leaders or city administrative staff so please share with your contacts whenever helpful. The Fate of RRF Replenishment As anticipated, the U.S House of Representatives passed H.R. 3807 - replenishment of the Restaurant Revitalization Fund. The challenge of getting replenishment over the finish line continues to be in the Senate. On Tuesday, Senator Ben Cardin (D-MD) introduced The Small Business COVID Relief Act of 2022 (SBCRA) (S. 4008). The SBCRA would allocate $40 billion for RRF replenishment and $8 billion for other small businesses impacted by COVID. It would partially offset (pay for) the $48 billion through $5 billion in unspent Payroll Protection Program funds. In the interim, we will encourage Senate Republicans and Democrats to reach an agreement on replenishing the RRF. The largest hurdle remains overcoming vast differences between the parties on whether the spending must be paid for, and how. If you haven't already, tell Senators to replenish the RRF. A special thanks to a contingent of ORLA current and past board members for joining ORLA President & CEO Jason Brandt and ORLA Director of Government Affairs Greg Astley at the National Restaurant Association Public Affairs Conference coming up at the end of this month in Washington D.C. RRF, as well as several other key issues will be a part of our discussions as we meet with lawmakers. Workforce Storytelling We have a big challenge at our doorstep which revolves around reclaiming the narrative around jobs and careers in the hospitality industry. There are incredible stories all around us about the positive and lasting impact hospitality jobs have for Oregonians from all backgrounds. The Spring edition of the Oregon Restaurant & Lodging Association magazine focuses in on the importance of mentors and the opportunities we all have to do more in sharing the opportunities in our industry with both high school and community college students. On page 24 is our Industry Champions article, The Essential Role Of Industry Mentors For High School Culinary Classrooms, where four of our ProStart mentors were interviewed. They each had great stories to tell, worthy of a broader share than just in print, so we repurposed the article as a blog post as well. 77% of the Way Back The hardest hit sector, accommodation and food services, has regained 77% of the many jobs lost in the initial COVID crisis. In addition, the following article is featured on the Oregon Employment Department’s website regarding youth employment trends in our industry. It’s worth a read to learn about our history and our efforts to regain traction in employing high school youth over the course of the past decade. Oregon OSHA Fixes Workforce Housing Caps ORLA has been advocating for our hospitality businesses who provide housing for workers as a benefit of employment. This predominately impacts our resort members who leverage visas and provide work experience to citizens from other countries with those opportunities ramping up in the Spring and Summer seasons. Thankfully Oregon OSHA has answered the call to repeal the Covid rule that capped the amount of workers we were allowed to house in each dwelling unit due to concern over Covid spread. This will greatly assist members in controlling costs associated with the number of vacation homes/dwelling units that must be rented out for the purposes of workforce housing. Give us a call at 503.682.4422 or email us if you have any questions. | ORLA Below are some highlights from the 2022 Regular Session. A more comprehensive list of bills ORLA tracked can be found in the Bill Tracking Report.

SB 1514 – Pay Equity Originally a placeholder bill, ORLA monitored this bill as it became a vehicle to extend the ability of employers to offer hiring and retention bonuses. Because of the pandemic and government shutdowns of Oregon restaurants, many operators found themselves needing to offer hiring and retention bonuses to staff or prospective staff. The extension allows for businesses to continue to offer these bonuses without running afoul of Oregon’s Pay Equity Law until September 28, 2022, or 180 days beyond the expiration of the Governor’s Emergency Declaration which occurs April 1, 2022. HB 4015 – Entrepreneurial Loans ORLA supported this bill to help expand eligibility for state entrepreneurial loans and raise the per-loan limit from $500,000 to $1 million. This bill passed and was signed by the Governor on March 2, 2022, becoming effective immediately. HB 4101 – Smoking Bill ORLA initially opposed this bill which would have increased the distance from businesses at which someone could smoke from 10 to 25 feet. After an amendment in the House excluding OLCC-licensed businesses was passed, ORLA was neutral on the bill, but it died in the Senate. HB 4152 – Franchise Bill This was essentially the same bill that was introduced last session. ORLA opposed this bill which, among other provisions, would have allowed franchisees to use the brand name but nothing else related to the brand identity, quality, or reputation. Although the bill died in committee, we do expect the bill to return in the future and there is the possibility an interim legislative session committee or workgroup might review this issue. HB 4153 – Creative Opportunity Fund This bill established an “Opportunity Fund” equal to a dedicated two percent portion of the overall Oregon Production Investment Fund (OPIF) each year that could then be used for workforce development, employment training and mentorship, project and filmmaker grants, content and creator development, small business and regional production development, amongst other things. ORLA supported the bill for the economic and tourism opportunities available when these investments occur. The bill passed the House and Senate and as of this writing, was waiting for the Governor’s signature. Questions? Contact ORLA Director of Government Affairs, Greg Astley. The Circuit Court decision has been affirmed by the State of Oregon Court of Appeals

FOR IMMEDIATE RELEASE: August 19, 2021 Contact: Jason Brandt, President & CEO, ORLA 503.302.5060 | [email protected] Wilsonville, OR– The importance of appropriately spending local tourism tax revenue was affirmed on August 11 by the State of Oregon Court of Appeals after a case brought forth by Bend lodging operators and the Oregon Restaurant & Lodging Association (ORLA) against the City of Bend. The original suit was argued on May 8, 2018, in Deschutes County Circuit Court with Judge Beth M. Bagley presiding. In the suit, the hospitality industry plaintiffs represented by Josh Newton of Karnopp Petersen LLP argued the City unlawfully redirected restricted Transient Lodging Tax (TLT) revenue, which state law required to be spent on tourism and tourism promotion. The court reasoned that a local ordinance passed in the City of Bend violated ORS 320.350 by decreasing the percentage of total local TLT revenues expended to fund tourism promotion from 35.4 percent to 31.2 percent. “The affirmation by the Oregon Court of Appeals this month upholding the Deschutes County Circuit Court decision means strong protections remain in place for how local lodging tax dollars can be spent across Oregon,” said Jason Brandt, President & CEO of the Oregon Restaurant & Lodging Association. “Our goals remain the same which start with the importance of working with local administrators and elected leaders when disagreements arise. Filing a lawsuit against a local government partner is a last resort and we look forward to turning the page and focusing in on what we can do across Oregon to invest our limited local lodging tax dollars on promotional strategies proven to boost our state’s local tourism economies.” The August 11 decision and details pertaining to the case can be found here. In 2003, the Oregon State Legislature passed lodging tax reforms meant to protect a percentage of revenues for hospitality industry reinvestment. As a result of the reforms, lodging tax collections spent by local jurisdictions on tourism promotion and facilities were ‘locked in’ as a percentage based on what a jurisdiction had been spending or agreed to spend as of July 1, 2003. July 2, 2003 represented a new chapter in Oregon whereby any new increase in a local lodging tax rate or any newly established local lodging tax would have to be spent on tourism promotion or tourism related facilities with 70 percent of revenue collected. The remaining 30 percent can and is commonly spent however a local jurisdiction sees fit free of any restrictions. You can view a short video created by ORLA which works to explain local lodging tax restrictions here: https://bit.ly/TLTdefined. “My firm and I are pleased with the decision by the Oregon Court of Appeals affirming Judge Bagley,” said Josh Newton, attorney for ORLA and the Bend lodging operators. “It is important that local governments abide by state law and honor their agreements with local business.” For more information on the efforts of the Oregon Restaurant & Lodging Association please visit OregonRLA.org. ### The Oregon Restaurant & Lodging Association is the leading business association for the foodservice and lodging industry in Oregon, which before COVID-19 provided over 180,000 paychecks to working Oregonians. The latest available data from the Oregon Employment Department shows current employment levels in the accommodations and foodservice industry totaling approximately 160,000 people as hospitality like many other industries faces the disruptions caused by COVID-19.  [update 7.1.21] 2021 Legislative Win for ORLA Senate Bill 317A passed, making permanent the ability for bars and restaurants to offer mixed drinks for takeout or delivery if the guest also purchases a substantial food item.

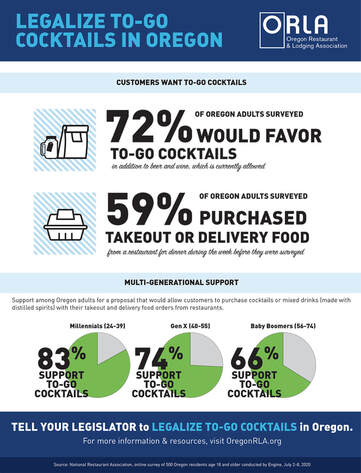

Restaurants and Bars Among Hardest Hit by COVID-19 Pandemic [July 20, 2020 - Wilsonville, OR] – The Oregon Restaurant & Lodging Association (ORLA), in partnership with the National Restaurant Association, recently completed a statistically significant survey around To-Go Cocktails, drinks made with distilled spirits for takeout, pickup or delivery to go along with meals purchased by guests. The survey, conducted July 3-6th, shows 72% or nearly three in four Oregonians, said they would favor a proposal allowing customers to purchase cocktails or mixed drinks (made with distilled spirits) with their takeout and delivery food orders from restaurants. This is in addition to beer and wine, which is currently allowed. Support is highest among those between the ages of 24-39 at 83%, with respondents between the ages of 58-74 showing the least support at 66%. Twenty-eight percent of adults said they strongly favor the proposal. Fifty-nine percent of Oregon adults said they purchased takeout or delivery food from a restaurant for dinner during the week before they were surveyed. ORLA President and CEO Jason Brandt said, “This is so encouraging for our members who have struggled just to stay open and keep people employed.” Brandt continued, “This has been an incredibly difficult time when restaurants and bars have struggled to deal with the challenges of being shut down, having to pivot to offer only takeout, pickup or delivery and then trying to invite guests back into dining rooms and make them feel safe and comfortable. Knowing almost three out of four Oregonians support the option to purchase cocktails or mixed drinks to go with their meals means some restaurants and bars who might have previously had to close down actually have a chance to make it now.” Allowing customers to purchase cocktails or mixed drinks (made with distilled spirits) for pickup, takeout or delivery requires a statutory change, meaning the Oregon Legislature would need to make the change to state law. Thirty other states currently offer To-Go Cocktails including Washington and California. “From a public safety perspective, if more businesses are able to offer the service of delivery of alcohol to their customers, the need for those customers to physically go into stores and businesses is reduced, thus reducing the risk of community spread of COVID-19,” said Brandt. Recognizing the need to help those who may have difficulty with alcohol addiction, ORLA’s website outlines a number of resources available to individuals, as well as training information to aid in prevention. More information on these resources and trainings can be found at OregonRLA.org/crisis-services-and-training. For more information please contact Greg Astley, ORLA Director of Government Affairs at 503.851.1330. ORLA Advocacy: Promoting and Advocating for Tourism Investment Plans

[update 7.1.21] - 2021 Legislative Session Win HB 2579 (Dead) – Increases state transient lodging tax rate and provides for transfer of moneys attributable to increase to county in which taxes were collected.

Background HB 2267, from Oregon’s 2003 Legislative Session, was designed to raise revenue for the promotion of tourism in Oregon. First, the bill instituted a 1 percent statewide lodging tax on all lodging properties in Oregon. This money was dedicated to the promotion of tourism through Travel Oregon, acting as Oregon’s tourism department. Second, the bill required any local governments with a lodging tax in place to determine what percentage was currently being used for tourism promotion and maintain at least that level in the future. The percentage is not allowed to decrease. The bill also required any local government that institutes a local lodging tax in the future to use at least 70 percent of the new revenue for tourism promotion. No more than 30 percent of the new revenue can be used for general funds or other non-tourism functions. The Oregon Restaurant & Lodging Association has worked with Local governments to clarify collection laws around Online Travel Companies. This should bring in millions of dollars more annually for tourism promotion. ORLA is also involved in efforts to attract events to Oregon that bring visitors and promote the state. Some examples in recent history were helping to pass legislation that added money to improve college athletic programs and allowing for NCAA March Madness games to be played in Oregon, and protecting tax credit programs that bring film and video production to Oregon. Issue ORLA must ensure that these state statutes remain in place. Any lodging taxes, state or local, need to bring travelers and businesses to Oregon. All retail businesses profit from increased travel; additionally, local government must be encouraged to keep promotional dollars directed to these efforts. Finally, there are always opportunities to attract more events like feature films, major sporting events, concert venues, and wine tours that benefit the industry as a whole. ORLA will work to enhance these efforts, which bring people to Oregon and encourage Oregonians to travel more in and around the state. Position Oregon Restaurant & Lodging Association supports current laws that protect lodging tax dollars going to tourism promotion and tax credits that encourage film and video attraction to Oregon. ORLA believes in protecting the dedicated tourism funds to ensure they continue to be allocated to tourism promotion at the state and local levels. This effort will benefit all retail businesses and local economies throughout our state. The 2021 Oregon Legislative Session was held remotely for the most part because of COVID-19 interruptions. The inability to meet in person coupled with the introduction of almost 4,000 bills this session meant there was a lot that did not get done. Legislative leadership primarily focused on police reform, housing, and social justice. For the hospitality industry, ORLA gained some victories to help our members and managed to help kill some bad bills that would have negatively impacted operators. Below is a summary of the key legislation from the 2021 session for our sector. Legislative Wins SB 317A – Allows holder of full on-premises sales license to make retail sales of mixed drinks in sealed containers for off-premises consumption.

HB 3361 (Passed) – Requires third-party food platform to enter into agreement with food place before arranging delivery of orders from food place or listing food place on application or website.

HB 3178 (Passed) – Temporarily removes condition for being deemed "unemployed" that individual's weekly remuneration for part-time work must be less than individual's weekly unemployment insurance benefit amount.

HB 3389 – Extends look-back period used to determine Unemployment Compensation Trust Fund solvency level from 10 years to 20 years.

HB 2205 (Dead) – Establishes procedure for person to bring action in name of state to recover civil penalties for violations of state law.

HB 2365 (Dead) – Prohibits food vendor from using single-use plastic food service ware when selling, serving or dispensing prepared food to consumer.

HB 2521 (Passed) – Requires transient lodging tax collector to provide invoice, receipt or other similar document that clearly sets forth sum of all transient lodging taxes charged for occupancy of transient lodging.

HB 2579 (Dead) – Increases state transient lodging tax rate and provides for transfer of moneys attributable to increase to county in which taxes were collected.

HB 2593 - Permits Office of Emergency Management to enter into agreement with nonprofit organization representing sheriffs under which organization is authorized to administer program to produce and sell outdoor recreation search and rescue cards.

HB 2818 – Allows payment from Wage Security Fund to be made to wage claimant for wages earned and unpaid in event that Commissioner of Bureau of Labor and Industries has obtained judgment in action or has issued final order in administrative proceeding for collection of wage claim.

HB 2966A – Extends grace period for repayment of nonresidential rent between April 1, 2020, and September 30, 2020, until September 30, 2021, for certain tenants.

HB 3058 (Dead) – Increases distance from certain parts of public places and places of employment in which person may not smoke, aerosolize or vaporize from 10 feet to 25 feet.

HB 3296 (Dead) – Increases privilege taxes imposed upon manufacturer or importing distributor of malt beverages, wine, or cider.

HB 3351 (Dead) – Establishes increase in statewide minimum wage rate beginning on July 1, 2022.

SB 650 (Dead) – Creates Public Assistance Protection Fund.

SB 750 (Passed) – Authorizes Oregon Liquor Control Commission to grant temporary letter of authority to eligible applicant for any license issued by commission.

HB 3177 (Dead) – Limits types of restrictions that Governor may impose on certain businesses during state of emergency related to COVID-19 pandemic.

SB 483A (Passed) – Creates rebuttable presumption that person violated prohibition against retaliation or discrimination against employee or prospective employee if person takes certain action against employee or prospective employee within 60 days after employee or prospective employee has engaged in certain protected activities.

SB 582A - Establishes producer responsibility program for packaging, printing and writing paper and food serviceware.

Other Bills SB 515 (Passed) – Requires employee of certain licensed premises who is permittee to make report if permittee has reasonable belief that sex trafficking is occurring at premises or that minor is employed or contracted as performer at premises in manner violating Oregon Liquor Control Commission rules.

SB 569A (Passed) – Makes unlawful employment practice for employer to require employee or prospective employee to possess or present valid driver license as condition of employment or continuation of employment.

For more information on ORLA's policy positions and priorities, reach out to Greg Astley, Director of Government Affairs.

Oregon Hospitality Industry Continues Push for Midnight Curfew and 100-Person Cap Removal10/28/2020

Safe Adjustments Needed to Regulations for Restaurant and Lodging Establishments

Wilsonville, OR– The Oregon Restaurant & Lodging Association is convinced two key regulations are ready for adjustments based on recurring COVID-19 weekly workplace outbreak reports. The weekly reports, available through the Oregon Health Authority (OHA) website, consistently show negligible outbreaks occurring in foodservice and lodging operations. “We review the weekly reports from OHA religiously and can see the care being taken by our operators in controlled and highly regulated environments they manage,” said Jason Brandt, President & CEO for the Oregon Restaurant & Lodging Association. “It is time, regardless of county phase, to allow operators the ability to stay open until midnight and to allow larger venues with ample square footage more flexibility in safely managing their capacity.” Currently, the Oregon Health Authority requires all foodservice operations in Oregon to close at 10pm regardless of their current phase of operation. In addition, all foodservice and event venues including lodging event space must limit their indoor capacity to 100 people including staff. “On the surface we realize a 100-person limitation sounds like an appropriate preventative measure to mitigate virus spread in Oregon,” said Brandt. “However, large scale venues have the ability to provide ample physical distance between associated parties of 10 or less and can accommodate more employees with hours while still operating safe, controlled environments.” ORLA is focused on facilitating communication between the Governor’s office and small businesses operating restaurants and lodging establishments across Oregon. A recent push this past week to communicate stories with the Governor’s office resulted in over 100 small business stories being shared about how a midnight curfew would help save restaurants. ORLA hopes to share similar stories about the impact of the 100-person indoor cap as well and the ripple effect it has on local economies throughout the state. “Some of the loudest voices in our industry on the importance of removing the 100-person indoor cap rule are coming from businesses who don’t have space to accommodate over 100,” said Brandt. “This showcases the ripple effect that hits smaller businesses when larger venues can’t accommodate larger groups in a community. Without the additional flexibility there is less activity and commerce in local communities and our operators rely on that foot traffic to stay afloat.” For more information on the efforts of the Oregon Restaurant & Lodging Association please visit OregonRLA.org. ### The Oregon Restaurant & Lodging Association is the leading business association for the foodservice and lodging industry in Oregon, which before COVID-19 provided over 180,000 paychecks to working Oregonians. Currently, approximately 55,000 of those workers, or 30%, do not have work available to return to. Contact: Jason Brandt, President & CEO, ORLA 503.302.5060 | [email protected]  More information is now available on the “Health, Economic Assistance, Liability Protection, and Schools (HEALS) Act” released earlier this week by Senate Republicans. As a reminder, the House introduced the HEROES Act proposal in May, which passed along party lines. Discussions are expected to now begin in earnest as Congress faces the July 31 deadline for enhanced pandemic unemployment insurance benefits. Part of the Republican proposal would reduce these benefits from $600 per week to $200 per week on top of state administered aid until the end of September at which time the maximum benefit will be 70% of the recipient current wages -- but this will be a starting point for the negotiations. Read the National Restaurant Association’s summary of the proposal and the American Hotel and Lodging Association’s analysis of the HEALS Act. Many of the hospitality industry’s priorities are included in the HEALS Act, including:

If you haven't yet, please take action on the National Restaurant Association's Blueprint for Restaurant Revival and/or the American Hotel and Lodging Association's Hotel Priorities Day of Action, thank you! At their most recent meeting, the Oregon Restaurant & Lodging Association (ORLA) Board of Directors voted unanimously (with 1 abstention) to support a legislative bill which will originate from Governor Brown’s office in support of a permanent 1.8% statewide lodging tax rate during the 2020 Oregon Legislative Session. Revenue raised by the statewide lodging tax is invested in Travel Oregon’s efforts to strengthen the economic impact of our state’s tourism industry. Oregon’s statewide lodging tax is currently collected at a rate of 1.8% with a reduction in the rate scheduled to take effect as of July 1, 2020 to a permanent rate of 1.5%.

“We appreciate Governor Brown’s proactive outreach to meet with ORLA and some of our key lodging stakeholders in person to discuss the merits of keeping the statewide lodging tax rate at 1.8% permanently,” said Jason Brandt, President & CEO of ORLA. “Our goals for lodging tax rate structures in Oregon are two-fold – protecting all statewide lodging tax resources to create return on investment for the industry through the efforts of Travel Oregon and protecting local lodging tax reforms passed in the 2003 Legislative Session.” Oregon continues to experience healthy growth in tourism spending logging our ninth consecutive year of industry growth in 2018. Compared to 2017, visitor spending was up 4.2% reaching a record $12.3 billion. Industry employment was also up year over year by 2.9% to approximately 115,400. Year over year, hotel room revenue increased by 4.4% as well. “We have seen firsthand what strategic investments in tourism promotion can do when industry tax dollars are put to their most effective use,” said Brandt. “With many other competing priorities in the Capitol, it is essential the association protects the appropriate use of these dollars at both the local and state levels. The economic impacts we are seeing are significant not just for our industry but for our public sector partners as well.” The U.S. Travel Association tracks statewide economic impact throughout the country and assists states in quantifying the value of year over year tourism growth. The most recently available data notates Oregon’s tourism growth at 5.3% when comparing 2016 to 2017, further substantiating the value of healthy tourism growth for Oregon’s public sector. From 2016 to 2017, Oregon experienced visitor spending growth of $652 million. That increase in spending and associated payroll income tax increases equates to as many as 410 firefighter positions, 380 police officer positions, or 380 teacher positions. ORLA continues to focus on the protection of local lodging tax dollars for tourism promotion and tourism related facilities in addition to support given to Governor Brown’s upcoming legislative bill for the statewide resource. Oregon’s local lodging tax structure can be complicated with over 110 different city and county jurisdictions collecting a transient lodging tax outside of the 1.8% statewide tax. Important guidelines have been in place for the past 16 years for how local lodging tax dollars can be spent. To clarify those parameters, ORLA recently produced a new instructional video to assist all stakeholders and the general public in better understanding the rules which govern local lodging tax resources. The new video specific to local lodging taxes (not to be confused with Oregon’s 1.8% statewide lodging tax) can be viewed here:

For more information about the Oregon Restaurant & Lodging Association’s policies on transient lodging taxes, please reach out to Greg Astley, ORLA’s Director of Government Affairs, at [email protected] via email.

Oregon’s lodging tax investments could be drastically reduced if Senate Bill 595 passes.

If successful, SB 595 would eradicate the critical lodging tax reforms of 2003 by taking 30% of our industry’s 70% of any new or increased lodging tax implemented since July 2, 2003, and allowing local governments to redirect those funds for “affordable workforce housing” projects. The result would allow only 40% of new or increased local lodging taxes to be protected for tourism promotion and tourism-related facilities. ORLA was at the table in November supporting Measure 102, giving communities across Oregon greater flexibility to create the workforce housing they need. ORLA continues to be willing and ready to engage in productive conversations about alternative solutions that can benefit communities and foster economic development without targeting one industry. The Senate Committee on Housing held a public hearing for SB 595 on February 18. We need lodging industry members to take action now! Email members of the Senate Committee on Housing and tell them how important the 70% protections are to growing Oregon’s tourism economy. Urge them to consider alternatives to workforce housing initiatives. • Senator Shemia Fagan, Chair: [email protected] • Senator Dallas Heard, Vice-Chair: [email protected] • Senator Jeff Golden, Member: [email protected] • Senator Tim Knopp, Member: [email protected] • Senator Laurie Monnes Anderson, Member: [email protected] Read more about the bills ORLA is engaged and/or tracking this session at OregonRLA.org/billtracking. If you have any questions on this bill, please reach out to me via email at [email protected] or call me directly at 503.302.5060.

Protecting Our Industry

During this session ORLA will be tracking several bills and engaging on those particularly to the hospitality industry. Members are encouraged to stay informed and engaged on the issues by subscribing to ORLA communications. If you have any questions, contact Greg Astley, Director of Government Affairs, at [email protected]. ORLA Advocacy: Seeking Smarter Approaches

The debate over minimum wage has been front and center in the media this past year, both nationally and in Oregon. In March of 2016, Governor Kate Brown signed into law a new 7-year minimum wage escalation plan for Oregon with the first of seven minimum wage increases effective July 1, 2016. The plan includes 3 regions with different escalation methodologies over the course of those seven years. For more information, see Oregon's Minimum Wage Escalation Plan. Oregon is above the national average in unemployment rates, and for minor-aged workers, it’s even higher. While the rhetoric swirls on all sides of the minimum wage discussion, raising the minimum wage actually gives little buying power. Rather, it creates a reduction in available hours among lower skilled workers, and the goods and services they use increase in cost. Research shows that raising the minimum wage hurts the least-skilled and least-experienced jobseekers the most. Read more about how raising the minimum wage hurts the least-skilled and least-experienced jobseekers the most. Additionally, watch The Real Faces of the 'Fight for $15' on YouTube. Boosting Employment Opportunities for Younger Workers Oregon added tens of thousands of new jobs while recovering from the Great Recession of the 21st Century, but recent job growth completely overlooked younger workers. There were actually fewer workers from the age group 14 to 21 years in 2012 than in 2010, according to a study done by the Oregon Employment Division entitled “Endangered: Youth in the Labor Force.” Yet studies have consistently shown that when teenagers enter the job market earlier in life, their earning potential increases over their lifespan. Additional increases in the minimum wage, over and above current indexing, will create employee management concerns and potential pricing increases in the very industries that have long been training grounds for employees newly entering the workforce. Compromise and Economic Strength is the Answer If backers of higher minimum wages want to help those living solely on minimum wage, they should address the issue through the legislative process and work towards meaningful compromise. There are provisions in the Federal Fair Labor Standards Act, and in more than 40 states currently, that would help businesses manage their hours through the consideration of tipped employees and minor-aged workers. Most people listed as minimum wage workers in Oregon are either tipped employees making and reporting over $20 per hour in combined income, or are minors who live with their parents and are gaining much-needed work experience. If the legislature worked in concert with Oregon’s business community to grow the economy, all citizens would benefit. The focus needs to be on income growth and job creation through a prosperous economy; that’s how government benefits too through increased revenues and lower unemployment. ORLA’s Policy on Minimum Wage The Oregon Restaurant & Lodging Association (ORLA) supports efforts to remove the annual indexing, or at the least add language that considers economic factors like unemployment rates. ORLA is opposed to any increases in the minimum wage that do not take into account the factors of entry level workers or tipped employees. For more information, see Oregon's Minimum Wage Escalation Plan. View a map of 2018 minimum wage rates across the country. Oregon's Minimum Wage Continues to Rise

The 7-year minimum wage escalation plan for Oregon went into effect with the first increases on July 1, 2016. The plan includes 3 regions with different escalation methodologies over the course of those 7 years. The wage scale is as follows: STANDARD: Includes portions of Multnomah / Clackamas / Washington Counties not within the Portland Urban Growth Boundary as well as Marion, Clatsop, Polk, Josephine, Jackson, Deschutes, Lincoln, Benton, Linn, Lane, Tillamook, Yamhill, Columbia, Hood River, and Wasco Counties. • July 1, 2016: $9.75 • July 1, 2017: $10.25 • July 1, 2018: $10.75 • July 1, 2019: $11.25 • July 1, 2020: $12.00 • July 1, 2021: $12.75 • July 1, 2022: $13.50 PORTLAND METRO: The Portland Metro rate applies to employers located within the urban growth boundary (UGB) of the metropolitan service district. This includes portions of Multnomah / Clackamas / Washington Counties and cities including Portland, Gresham, Troutdale, Fairview, Hillsboro, Beaverton, Tigard, Tualatin, Sherwood, Forest Grove, Wilsonville, Lake Oswego, West Linn, Oregon City, Gladstone, Happy Valley, Milwaukie, and Damascus. Use Metro's Urban Growth Boundary lookup tool to determine if your address is within the UGB. • July 1, 2016: $9.75 • July 1, 2017: $11.25 • July 1, 2018: $12.00 • July 1, 2019: $12.50 • July 1, 2020: $13.25 • July 1, 2021: $14.00 • July 1, 2022: $14.75 The Urban Growth Boundary is expanded through the process outlined in Title 14 of the Urban Growth Management Functional Plan. The process involves a needs assessment every 6 years, and as-needed review based on local jurisdiction input on a more frequent basis. For questions about the process of UGB expansions, contact Tim O’Brien at Metro. NONURBAN: Includes Baker, Coos, Crook, Curry, Douglas, Gilliam, Grant, Harney, Jefferson, Klamath, Lake, Malheur, Morrow, Sherman, Umatilla, Union, Wallowa, Wheeler counties. • July 1, 2016: $9.50 • July 1, 2017: $10.00 • July 1, 2018: $10.50 • July 1, 2019: $11.00 • July 1, 2020: $11.50 • July 1, 2021: $12.00 • July 1, 2022: $12.50 ORLA will continue to educate Oregon’s lawmakers on the value of tip credit as a solution to bring stability to the industry and solve wage inequality issues. |

Categories

All

Archives

June 2024

|

Membership |

Resources |

Affiliate Partners |

Copyright 2024 Oregon Restaurant & Lodging Association. All Rights Reserved.

8565 SW Salish Lane Suite 120 | Wilsonville, OR 97070-9633 | 503.682.4422 | 800.462.0619 | Contact Us

Site Map | Accessibility | Privacy Policy

8565 SW Salish Lane Suite 120 | Wilsonville, OR 97070-9633 | 503.682.4422 | 800.462.0619 | Contact Us

Site Map | Accessibility | Privacy Policy

RSS Feed

RSS Feed