Oregon’s Healthy Unemployment Insurance Trust Fund Makes Businesses and Communities Stronger7/19/2023

Oregon has one of the best unemployment insurance (UI) tax systems in the nation. While there are federal requirements all states must follow with their UI trust funds, there is room for state flexibility, and Oregon has taken advantage of this to minimize employer tax rate volatility, protect employers from additional charges, and provide a strong safety net for recessionary times. During strong economic times, the tax schedule increases so we can replenish Oregon’s UI Trust Fund. Once we have strong reserves, the tax schedule drops so employers have lower taxes. Each employer’s individual tax rate is based on the amount of UI benefits their employees receive. Also, Oregon’s UI Trust Fund’s reserves earn interest. Over the last 10 years, UI Trust Fund interest added $797 million. That means about 20 percent of the increase in the UI Trust Fund balance in the past 10 years came from interest earned — not employer payroll taxes. Due to Oregon’s self-balancing system, the more interest earned, the more likely we are to have a lower tax schedule. One way to look at it is, with Oregon’s UI tax system, employers only had to pay 80 cents on the dollar for the benefits paid out. During the Great Recession and the COVID-19 pandemic, many states had to borrow money because their UI Trust Funds were not solvent — employers in those states pay more than $1 for each dollar of benefits paid to workers. Benefits don’t just help laid-off workers. They also support communities and businesses by ensuring that money keeps flowing through the local economy during economic downturns. During the recent Pandemic Recession, Oregon’s UI Trust Fund paid out $859 million in regular UI benefits from April to June 2020 — twice as high as any calendar quarter during the Great Recession. Also, researchers have estimated that every $1 of UI benefits generates about $2 in economic activity in that community. During a recession, this can be a vital support for our economy. Thanks to Oregon's healthy UI Trust Fund, we did not have to borrow any money during the Pandemic Recession, unlike many other states. Those states also faced borrowing costs, restricted options on policy, and higher federal payroll taxes and surcharges for employers. While employers in other states saw additional UI taxes and other costs, Oregon has been a careful steward of employers’ tax dollars. With 2021’s House Bill 3389, lawmakers protected employers from increased payroll taxes that might have resulted from the unprecedented number of Oregonians who received UI benefits during the Pandemic Recession and allowed employers to defer or avoid some tax liability. In addition to short-term tax relief, HB 3389 extended the look-back period for the fund adequacy percentage ratio from 10 years to 20 years and omitted calendar years 2020 and 2021 from the formula. These changes mean:

This editorial wss provided by the Oregon Employment Department. ORLA had a very tangible return on investment proving how advocacy and relationship building efforts can drive bottom line results for businesses when House Bill 3389 passed in the 2021 legislative session. This important bill provided assistance to Oregon employers with both short- and long-term provisions, offering significant relief to employers. Read more about how ORLA's Advocacy Drives Bottom Line Results.

The Oregon Restaurant & Lodging Association Partners with Adesso Capital to Expedite Cash Assistance for Oregon’s Foodservice and Lodging Industry [Wilsonville, OR - 2/13/23] – The Oregon Restaurant & Lodging Association (ORLA), the association representing Oregon's foodservice and lodging industry, is partnering with Adesso Capital to offer the foodservice and lodging industry assistance expediting federal relief funds which can be used for operating capital, payroll, inventory, or other expenses. The assistance includes filing for the Employee Retention Credit (ERC), a tax credit available to businesses that suffered reduced operating capacities or loss of revenue from COVID-19 restrictions. The credit stems from payroll taxes paid in previous years and offers up to $26,000 back per W-2 employee. Applications for ERC benefits pertaining to payroll paid from March 2020 - December 2020 must be sent in no later than April 15, 2024. For payroll paid Jan. 2021 - Sept. 2021, applicants have until April 15, 2025, to file. "We are pleased to be teaming up with Adesso Capital to provide our members with the tools and resources they need to claim this tax credit and ensure their business survives moving forward,” says Jason Brandt, President & CEO, ORLA. “With many small businesses still struggling to stay afloat, it is crucial that these tax credits be made available so that they can continue to provide jobs and support Oregon’s economy.” “I feel for the business owners who weathered COVID restrictions and kept their doors open; they’re truly the champions of the American Dream and we should all ensure they have every tool possible to keep going,” said Damon Maletta, founder of Adesso Capital. “We at Adesso feel it's our job to help businesses take advantage of the ERC, especially because there are no restrictions on how the funds are used, giving power back to the people who know how to use these funds the best. It’s a passion of mine, and I still get excited every time we get that ‘Approved!’ notice for a new client.” Together, ORLA and Adesso have helped the Oregon foodservice and lodging industry receive over $11.4 million in refunds, infusing the local economy with vital resources that reduce unemployment and create new opportunities for community growth. Adesso’s clients average a return of $150,000 per business. Current ORLA members can learn more here. Businesses interested in joining the Oregon Restaurant & Lodging Association can find more details at OregonRLA.org. About Adesso Capital

With over $1 billion secured, Adesso Capital helps US-based businesses secure the critical funds they need to thrive. Thousands of business owners across the country have trusted Adesso to help fund their dreams with government relief programs or financing options like term loans, lines of credit, and SBA loans. Oregon is officially gearing up for another Legislative Session in Salem with newly elected legislators hoping to make a difference for their constituents. As is typical with elections, results rarely if ever align on all fronts with your personal preferences. Regardless of the election outcomes this past Fall, it is our job at the association to build effective working relationships with leaders from both parties.

We had a very tangible return on investment recently which most likely stood out to you as a hospitality operator to prove how ORLA advocacy and relationship building efforts can drive bottom line results for your business – House Bill 3389 in the 2021 Legislative Session. Restaurant and lodging businesses become members of ORLA because they understand the importance of industry representation and intelligence gathering. There are of course other reasons to join ORLA but for me, House Bill 3389 takes the cake. Our hope is the updates below showcase why it is of crucial importance for us to continue to band together to protect, improve, and promote Oregon’s hospitality industry. What Was House Bill 3389? House Bill 3389 was collaborative legislation passed in 2021 to provide short- and long-term pandemic tax relief to Oregon employers while protecting the Unemployment Insurance Trust Fund. This important bill provided assistance to Oregon employers in several ways:

Combined, the short- and long-term provisions of House Bill 3389 provide significant relief to Oregon employers.

Doing our Part to Protect the Integrity of the Unemployment Insurance Trust Fund If you and others you know experienced setting up numerous job interviews for open positions only to have no one show up, you’re not alone. ORLA has been actively working with OED to make sure we’re doing our part as employers to share intelligence about job recruitment efforts. The goal is to make sure recipients of unemployment insurance benefits are actively looking for work and willing to accept work while also protecting the solvency of the trust fund which makes unemployment benefits widely available for those who qualify and need assistance during times of professional transition. The Oregon Employment Department relies on employers to help identify potential fraud and other issues with the Unemployment Insurance system. The current best route for employers to report people who do not show up for work when they are offered a job, turned down an offer of work, or who do not come back after being recalled from a temporary layoff is through the utilization of the following public website at: bit.ly/OEDrefuse. For other types of suspected fraud, the Oregon Employment Department has another, more general form (so some questions may not apply to all scenarios) at bit.ly/OEDfraud. Employers can also report suspected UI fraud to the department’s Fraud Hotline at 1.877.668.3204. | Jason Brandt, President & CEO, ORLA  Guest Blog | Adesso Capital We hear it all the time: Businesses aren’t filing for the Employee Retention Credit (ERC) because of the misconceptions surrounding the program. In fact, less than 20% of eligible businesses have claimed their ERC. Which is why ORLA partnered with Adesso Capital’s team of tax experts to address some common myths about the ERC: Myth 1: I can’t claim the ERC because I’ve already received PPP funds. The most frequent falsehood we hear is that retailers, restaurants, and other hospitality businesses can’t receive funds from both the Paycheck Protection Program and the ERC. This was true at one time. But a change to the CARES Act in December 2020 removed the restriction against applying for both. This vital change went largely under the radar. Myth 2: My business has grown during the pandemic. Isn’t the ERC only for businesses that are hurting? Economic injury isn’t the only condition to receive ERC credits. If your business was affected by operating restrictions or supply chain issues, you’re eligible. Myth 3: My business was deemed an essential business, so I don’t qualify. Even essential businesses were subject to reduced operating hours, or reduced capacity. Just about every “essential” business (and that definition varies from state to state) was forced to operate under pandemic restrictions at some point, making even essential businesses eligible for the ERC. Myth 4: I’m not eligible because employees I had in 2020-21 have since quit, were fired, or were replaced. The Employee Retention Credit is based on the number of employees on the payroll, not specific employees. Turnover in the restaurant business is common but it doesn’t prevent you from claiming what could be tens of thousands of dollars in taxes you’ve already paid. Myth 5: My business wasn’t shut down during the pandemic. For much of the relevant ERC time period, businesses weren’t forced to be closed. The ERC covers 2020 but also three quarters of 2021 – a timeframe when most businesses were back to business as usual. Myth 6: My business’ sales rebounded in the first quarter of 2021, so I’m not eligible. Thanks to a change to the CARES Act, you have the option to look at one quarter prior. This means Adesso can determine eligibility based on lost revenue in 2020. Also, if your business was subject to a full or partial suspension, you may qualify regardless. The truth is, filing for the ERC is complicated. We would hate to find out you missed out on receiving up to $26,000 per employee because you got some bad advice. Or because you believed the myths out there about the ERC program. We know there are tons of things your business could do with the money. Let Adesso take care of the entire refund filing process, from the initial phone call to follow-ups. All you need to do to get started is to schedule a call to see how much you qualify for. This guest blog was submitted by Adesso Capital. For more information on guest blog opportunities, contact Marla McColly, Business Development Director, Oregon Restaurant & Lodging Association.

SBA Announces $83M in New RRF Grants Our partners at the National Restaurant Association (NRA) just announced that the U.S. Small Business Administration (SBA) is releasing $83 million in Restaurant Revitalization Fund (RRF) dollars, which will fund the 169 applications at the front of the application queue. Operators receiving funds should receive notification today. Funds should be released within the next week and must be used before the RRF program expires in March 2023. More details can be found from the NRA here. SBA’s release can be found here. Today's press release from the National Restaurant Association: Washington, D.C. (Nov. 23, 2022) – Today, the Small Business Administration (SBA) announced the release of $83 million dollars in unobligated Restaurant Revitalization Fund (RRF) grants to 169 operators with pending applications. The National Restaurant Association has been requesting these funds be released, and Executive Vice President of Public Affairs Sean Kennedy made the following statement in response: “The SBA’s action represents the final chapter of our nearly three-year effort to secure dedicated federal pandemic relief dollars for local restaurants. Today’s announcement is great news for those 169 operators fortunate enough to receive an RRF grant, but hundreds of thousands more are struggling with uncertainty. “We must continue to look forward because the enormous challenges of the industry will continue beyond today. From the recruitment of employees to the constantly rising costs for food, running a restaurant right now is a daily struggle. There are steps the government can take to support restaurants in every community, and we will continue to press for solutions at the federal, state, and local level.” According to the SBA, the grants are being released to operators in the order their applications were received. Operators receiving funds should receive notification today and SBA will begin transmitting the grants next week. They have until March 2023 to spend the money. The Association was first to lay out the plan for a restaurant industry recovery fund to Congress in April 2020. Congress eventually set aside $28.6 billion dollars for the RRF in the American Rescue Plan Act. After this money was distributed, more than 177,000 applications were left in limbo at the SBA. The Government Accountability Office (GAO) released a report in July, noting SBA was holding unobligated RRF funds and the Association was first to send a letter to SBA Administrator Isabella Casillas Guzman requesting that the unobligated money be released to unfunded applicants. The restaurant industry was the hardest hit by the pandemic. In the initial shutdowns, more than eight million industry employees were laid off or furloughed. The industry still has not recreated 565,000 jobs lost at that time, which is the largest current employment deficit caused by the pandemic among all U.S. industries. More than 90,000 restaurants closed permanently or long-term because of the pandemic. About the National Restaurant Association

Founded in 1919, the National Restaurant Association is the leading business association for the restaurant industry, which comprises nearly 1 million restaurant and foodservice outlets and a workforce of 14.5 million employees. Together with 52 State Associations, we are a network of professional organizations dedicated to serving every restaurant through advocacy, education, and food safety. Contact: Vanessa Sink | [email protected] Paid Leave Info | UI Refund Checks | Proposed Labor Rule

Oregon Employment Department Refund Checks ORLA's biggest win during Covid at the state level was in House Bill 3389 where unemployment insurance (UI) tax reform passed. House Bill 3389 was collaborative legislation passed in 2021 to provide short- and long-term pandemic tax relief to Oregon employers while protecting the Unemployment Insurance Trust Fund. This important bill provided assistance to Oregon employers in several ways:

More Independent Contractors May Become Employees - Proposed Labor Rule Earlier this week, the U.S. Department of Labor issued a proposed rule focused on classifying more workers as employees rather than independent contractors. The rule would 1) rescind the current independent contractor rule and 2) utilize a new “economic realities” test to determine if a worker is truly an independent contractor. This test includes factors such as investment, control, opportunity for profit or loss, and whether the work is integral to the employer’s business. The Department intends to identify more workers as employees, and therefore eligible for standard minimum wage, overtime, and other protections through the Fair Labor Standards Act. In the press release, the Department says misclassification affects a “wide range of workers in the home care, janitorial services, trucking, delivery, construction, personal services, and hospitality and restaurant industries.” Comments on the proposed rule are due by November 28. For more insight on the potential impacts of this rule, read a recent editorial regarding California's law. Oregon Paid Leave As you are well aware, Oregon’s Paid Family and Medical Leave Insurance program (PFMLI) goes into effect January 1, 2023, and is funded by employer and employee contributions. Employers with less than 25 employees are not required to contribute to the program, but their employees are. Employers will be required to participate in the program or provide an equivalent plan. ORLA is actively looking into private sector solutions for the industry and will keep you posted. In the meantime, ORLA developed a PFMLI one-pager that helps answer some questions regarding Oregon’s new Paid Leave program. You can also find this on OregonRLA.org here:

Restaurant Economic Insights The latest insights from the National Restaurant Association shows overall consumer spending in restaurants trended higher in August, inflation-adjusted (real) sales remained down from early-summer levels. Eating and drinking places registered total sales of $86.2B on a seasonally adjusted basis in August. In inflation-adjusted terms, that was $1.3B below the recent peak registered in May 2022. As always, if you have any questions, feel free to reach out to your Regional Representative. Inflation / Job Loss / Travel Forecast

More than two years into the pandemic and we're still realizing the effects of Covid on travel, supply of goods, and inflation. We appreciate the work our national partners do to provide valuable insights and data highlighting the ongoing economic issues facing our industry. RESTAURANTS This week, the National Restaurant Association released an updated summary of the Misery index based on the May jobs and sales reports. While job growth is still slow, sales are continuing to grow. American restaurant owners and operators are experiencing the impact of several global factors influencing food supply. The war in Ukraine, India’s record heat wave, and delayed planting in China last year mean that wheat is in short supply. With wholesale food prices already up nearly 18% in the last 12 months, the growing list of unavailable or items in short supply is adding pressure to an already strained industry. Highlights from the June 2022 Misery Index:

LODGING A recent survey commissioned by the American Hotel & Lodging Association (AHLA) shares how new concerns about gas prices and inflation are impacting Americans’ travel plans in a variety of ways. Majorities say they are likely to take fewer leisure trips (57%) and shorter trips (54%) due to current gas prices, while 44% are likely to postpone trips, and 33% are likely to cancel with no plans to reschedule. 82% say gas prices will have at least some impact on their travel destination(s). The survey of 2,210 adults was conducted May 18-22, 2022. Other key findings include:

AHLA recently relaunched its Hospitality is Working campaign with a focus on reigniting travel across the nation and highlighting hotels’ positive economic impact in cities across the country. With travel ramping back up, hotels have embarked on an unprecedented hiring spree to recruit hundreds of thousands of workers for more than 200 hotel career pathways. Bottom line, restaurant and lodging operators are feeling the same economic pressures that our customers and guests are, and we’re always going to work hard so we can keep serving them, our employees, and our communities. Stay strong, serve well! ERC Eligibility / National CEO Presence / Board Nominations

Eligibility Clarification for 2021 Q3 Employee Retention Tax Credits The law states there are two criteria by which an employer may qualify for the Employee Retention Credit:

AHLA and NRA CEOs to Speak at ORLA's Hospitality Conference Mark your calendars and plan on attending the ORLA Hospitality Conference September 11-12 in Eugene. We are excited to host both CEOs from our national affiliates for the first time at an ORLA event. Michelle Korsmo, President & CEO for the National Restaurant Association and Chip Rogers, President & CEO for the American Hotel & Lodging Association will be speaking in person during the kickoff lunch on Sunday. This is a rare opportunity to hear insights directly from these industry leaders on legislative activity in Congress, industry trends, emerging issues, and projected industry recovery. In addition to the general sessions, we have eight breakout sessions including two that will offer a deeper dive on restaurant and lodging advocacy. ORLA Board Nominations Committee Convenes in July Active ORLA members provide the backbone for all association efforts and we remain fortunate in having committed restaurant, lodging, and allied members who serve on ORLA’s Board of Directors. The ORLA Board is made up of 10 restaurant member representatives, 10 lodging member representatives, and 3 Allied member representatives. Board members serve 3 year terms and attend 4 board meetings each year. Those serving are eligible to serve two consecutive terms before reaching their term limit. For ORLA’s upcoming fiscal year beginning October 1 there are 3 openings on the board due to term limits – 1 restaurant, 1 lodging, and 1 allied position. If you are interested in being considered for ORLA Board service please reach out to ORLA President & CEO Jason Brandt. Sysco Sponsors Teacher Flex Fund Thanks to our partners at Sysco, the Oregon Hospitality Foundation had the opportunity to extend a small grant application in support of the ProStart program across the state. The Oregon ProStart Teacher Flex Fund encouraged teachers to apply for a $500 grant for to prepare for the 2022–2023 school year. At the teacher's discretion, these funds can be spent on much-needed products or equipment within the classroom to help facilitate their culinary program. Allocations from the $5,000 Flex Fund were made on a first come, first serve basis, and will be dispersed later this month. To learn more about how ProStart is helping foster our next generation of industry leaders, or to see how you can support this valuable career technical education program, visit OregonRLA.org/prostart. Questions? Feel free to contact your association. RRF Replenishment / OSHA Updates / H-2B Visas / US Labor Department Investments

We are seeing signs of sales getting close if not reaching pre-pandemic levels for some Oregon operators. Of course sales numbers don’t tell the whole story for our restaurants given the cost of goods and the ongoing impacts of a marketplace driven by historic leverage in the hands of employees. On the lodging side it continues to be a tale of two realities with operators seeming to do quite well in secondary markets with Portland still working to find its footing with the delay in corporate/conference travel. Spring/Summer live events and the return of the full fledged Rose Festival events for a month from late May through late June will certainly help Portland turn the page. RRF Replenishment Votes Possible in House, Senate The U.S. House of Representatives is expected to vote on legislation to replenish the Restaurant Revitalization Fund as early as this Wednesday. Details on the size of the bill, and whether it is funded with new government spending or reallocating existing federal dollars remain unknown. Meanwhile, if the Senate is able to reach agreement on legislation to fund COVID treatment programs, Democrats are expected to offer an amendment to replenish the RRF. Senate Republicans have been clear in calling for any COVID spending to be fully offset by cuts in other government programs, and will vote against RRF replenishment if this condition is not met. ORLA has been working with the National Restaurant Association on your behalf to urge that Congress not treat the 177,000 restaurants waiting for COVID grants as hostages to battles over government spending. The National Restaurant Association sent a letter to the Hill this morning in support of RRF votes and posted a press release urging support from Congress. We will keep you informed if a vote occurs and when the next grassroots activation will launch. OSHA Update on Workforce Housing One of the many unintended consequences of agency rules during Covid was the impact of workforce housing restrictions on our resort communities around the state. Oregon OSHA was focused on preventing the spread of Covid in agricultural worker housing specifically, but their rules also prevented resorts around Oregon from housing hospitality employees within residential vacation homes. The Covid rule limited the number of workers who can be housed in resort vacation homes–and those limits did not exist for vacation travelers from different households using those same homes. ORLA pointed out this inequity over the course of the past week and thankfully Oregon OSHA responded. OSHA just released a Workplace Advisory Memo on April 1, 2022, that removes these workforce housing limitations in our industry. H-2B Visas American Hotel & Lodging Association President & CEO Chip Rogers (who will be joining us in person at September’s ORLA Hospitality Conference in Eugene) shared the following good news this week on H-2B Visas. A number of ORLA members utilize Visas for seasonal employment needs and expanding capacity has been a priority for the industry. The Department of Homeland Security (DHS) and Department of Labor (DOL) announced they would make available an additional 35,000 H-2B visas for the second half of fiscal year 2022 (FY22), which begins April 1. Of these, 23,500 visas will be available for returning workers, while 11,500 are reserved for nationals of Haiti, Honduras, Guatemala, and El Salvador. In December, for the first time ever the Departments released an additional 20,000 H-2B visas for the first half of the fiscal year. These additional visas will provide critical help to seasonal resorts as we enter the busy summer travel season, and they suggest that the Biden Administration recognizes the acute workforce shortage we are facing. AHLA will continue to push for legislation and policies that will help fill open jobs and keep us on the road to recovery. US Labor Department Investments This week the National Restaurant Association shared more details on President Biden’s federal budget proposal which includes an 18% increase in U.S. Department of Labor funding from 2022 levels ($2.2 billion more) with $400 million proposed to go towards the hiring of additional staff within the department’s workforce protection agencies. Here are the cliff notes from the administration's proposals that are more industry specific: Labor & Workforce

Food Supply Chain and Competition

Technology and Competition

Access to Credit

Healthcare

For more information: We look forward to sharing more about workforce development efforts in future reports. There is a lot of work going into improving connections between industry operators and high school/community college classrooms. Give us a call at 503.682.4422 if you have any questions. | ORLA  Since its rollout last year, ORLA has consistently reported on the potential benefits of the Employee Retention Tax Credit (ERTC). The benefit is still available but time, and patience, is critical. Application for ERTC is open to any qualified employer who has filed a 941 tax form from March 12, 2020 (when the program started) through September 30, 2021 (when the program ended). This credit helps any qualified employer– not just restaurants and lodging operators– put their hard-earned money back into operations. Just ask John Barofsky, current ORLA Chair and co-owner of Beppe & Gianni’s Trattoria in Eugene. “Being a small independent operator, the ERTC was an unexpected but welcome boost to my operation’s ability to stay open and maintain staff through the pandemic. Although at first the process of the credit seemed daunting, the time I spent was well worth the return. The ability to defray payroll costs and tax payments had a great impact on my cash flow and bottom line.” Another ORLA member who benefitted from ERTC is Drew Roslund with the Overleaf Lodge & Spa and The Fireside Motel, both in Yachats, Oregon. “The ERTC was comparable in size and scope to the Paycheck Protection Program for many organizations. It was tough waiting seven to eight months for refunds but just knowing that we qualified gave us enough confidence to keep team members employed and increase wages, especially during the busy summer season on the Oregon coast. Roughly the equivalent of a month’s worth of gross revenue, we were able to lock in some necessary incentive pay for key staff and even tackle a few deferred maintenance projects.” To review, the original ERTC program was enacted by the CARES Act in 2020 and allows a tax credit of up to 50 percent of each employee’s share of social security qualified wages, per year. With the Consolidated Appropriations Act of 2021, the ERTC program was expanded to allow a tax credit of up to 70 percent of each employee’s share of social security qualified wages, per quarter. The 2021 Act added a 500-employee maximum [1] for employers who could access the ERTC program. As of this writing, the final change in the ERTC storyline came with the passage of the Infrastructure Investment and Jobs Act in 2021, which terminated the ERTC on 9/30/21, instead of terminating on 12/31/21. That last change effectively repealed an employer’s tax credit for Q4-2021, but ORLA members are strongly encouraged to research and apply for all ERTC benefits that are due to you. Even though the program ended one quarter earlier than originally planned, ERTC is available to qualified employers and wages for a portion of seven quarters - March 12, 2020, through September 30, 2021. Employers that did not claim the ERTC on their original Form 941 may retroactively claim the credit by filing Form 941-X. It is important to note that employers have three years from the date the original return was filed, or two years from the date the taxes were paid, to file Form 941-X and claim the full credit. Two areas of caution for operators: First, with the high volume of ERTC applications pouring in across all industries, it is not uncommon to wait nine months or more for refunds to be processed and received. Second, for those operators who applied for and received a tax credit for Q4-2021, the repeal of ERTC for that particular quarter triggers a negative situation where employers that already claimed an advance payment of the credit for wages paid after September 30, 2021 and received a refund on those wages must repay that refund. Employers that held back payroll tax deposits for Q4-2021 in anticipation of the ERTC for that period must deposit those amounts retained on or before the relevant due date for wages paid on December 31, 2021 (regardless of whether the employer actually pays wages on that date).[3] Note, this article serves as a general guideline and should not be construed as tax advice. Owners/operators should always seek their own tax counsel to take full advantage of accounting treatments, including ERTC, that minimizes tax liability and maximizes tax credits and refunds. If you are looking for assistance with this process, consider reaching out to Adesso, a new ORLA partner helping industry members navigate the complex and time-consuming ERC filing process. Visit AdessoCapital.com/ORLA for more information or contact your ORLA Regional Representative. You can also listen to ORLA's Boiled Down podcast episode #41, ERC: How to Get the Money You May Be Owed. ORLA hopes you are able to join many other operators who have found profitable results from the Employee Retention Tax Credit program. Good luck and many happy returns. | Tom Perrick, Advocate for the Hospitality Industry This article originally appeared in the Spring issue of Oregon Restaurant & Lodging Association Magazine, pg. 16. 1 How To Claim The Employee Retention Credit For The First Half Of 2021, Journal of Accountancy, April 5, 2021 2 Tri-Merit, LLC 2021 3 BDO U.S., For Employers Who Took ERTC for Fourth Quarter 2021 Wages, December 2021).  This week, Congress finally reached a bipartisan agreement on their annual spending bill. However, the agreement is silent on replenishing the Restaurant Revitalization Fund (RRF), meaning no new funds will be directed to complete the mission and fund the 177,000 applications still pending. Over 2,500 of those applications still pending are here in Oregon. We are waiting for the dust to settle in Washington to identify if there are other avenues to replenish this much-needed program. Unfortunately, this decision from Congress is a huge blow to our efforts and the path forward is very uncertain. From the start of this pandemic, ORLA and our partners at the National Restaurant Association have pursued an “all-of-the-above” strategy for the industry, diving into every issue at the federal, state, and local level that could help or hurt us. From cocktails-to-go to worker shortages, we have had a seat at the table for every major policy debate underway and we will continue to advocate on behalf of our industry and its members. You’ll be hearing more from us and the National Restaurant Association on the outlook for RRF, but in the meantime, there are plenty of other issues we will be focused on and we will continue to need your input and your help along the way. If you have any questions, please reach out to your Regional Representative or ORLA Director of Government Affairs, Greg Astley.  The COVID pandemic has impacted virtually every business in every category, but none so much as the hospitality industry. Restaurant owners and lodging operators are facing the most daunting challenge in anyone’s memory, and with many outdoor dining spaces closed for the winter, the forecast is even more uncertain. My heart breaks every time I see another restaurant or lodging establishment close its doors for good. I think of the jobs that are lost and the dreams that are dashed. I think of the communities that are diminished in so many ways. The Oregon Restaurant & Lodging Association doesn’t want to see even one more of our members shut down—so we’ve launched a program that comes to the rescue of Oregon restaurant and lodging establishments. It’s called the COVID Cash Lifeline™, and it’s designed to deliver exactly what our state’s restaurants and lodging establishments need to recover and return to business as usual. COVID Cash Lifeline™ Part 1: the Easy ERC™ The Employee Retention Credit (ERC) is a federal initiative designed to help entrepreneurs. Eligible businesses retroactively qualify for up to $26,000 per W-2 employee and will need to prepare and file amended Form 941s. Sound complicated? Most small business owners think so—which is why less than 25 percent of eligible businesses have filed for the potentially hundreds of thousands of dollars in COVID relief for which they qualify. And it doesn’t help that some of the CPAs who work for restaurant and lodging operators are unaware of the ERC or don’t understand the eligibility requirements. The Easy ERCTM is the answer. With the Easy ERCTM, busy business owners can turn to our COVID Cash Lifeline™ partner Adesso Capital to file for their ERC funds. Adesso’s team of tax experts can estimate how much ERC money a restaurant or lodging operator qualifies for with a ten-minute phone call to our COVID Cash Lifeline™ ERC Support Center at 888.856.0630. Then the Adesso team handles the entire complex and time-consuming filing process. They take care of all the ERC paperwork while business owners focus on running their establishments. Then Adesso monitors the progress of the filing until the owner receives their funds. Adesso has helped thousands of restaurants and small businesses across the U.S. secure tens of millions in ERC funding, with an average of $125,000 in ERC assistance per filing. What kind of difference would a cash infusion of $125,000 make for a struggling restaurant or lodging establishment? COVID Cash Lifeline™ Part 2: Immediate Cash Financing is so hard to come by for restaurant and lodging operators. Big banks turn down 75 percent of loan applications for small businesses. And even those entrepreneurs fortunate enough to get financing have to wait. And wait. Now the wait is over. Working with Adesso Capital, Oregon restaurant and lodging operators can get the cash they need in as little as two days. Adesso Capital offers innovative business financing options and preferred rates from its network of lending partners.

And while restaurant and lodging operators await the receipt of their ERC funds, they can get a head start on that money with an ERC advance loan. Business owners can borrow against their anticipated ERC relief funds and put their money to work right away. COVID Cash Lifeline™ Part 3: Concierge Treatment I can’t think of anyone who works harder than a restaurant or lodging operator. They’re at it 24 hours a day, seven days a week ensuring our favorite dish tastes just the way we like it, our evenings out are magical, and our overnight stays hit the mark. It’s payback time. Our COVID Cash Lifeline™ gives these hard-working entrepreneurs the personal attention and responsive service they can’t get from big banks or traditional lenders. The tax experts and lending professionals at Adesso Capital will show them the four-star service they deserve but so rarely receive. Our Commitment to Oregon Restaurant and Lodging Operators Every restaurant and lodging operator is a hero of mine. It’s time these hard-working folks had a hero of their own, and our COVID Cash Lifeline™ is a good place to start. We’re going to keep at it so we can ensure that Oregon’s restaurant and lodging establishments come through the pandemic and come back stronger than ever. | Jason Brandt, President & CEO, Oregon Restaurant & Lodging Association COVID Cash Lifeline™ and Easy ERCTM are trademarked by Adesso Capital. AdessoCapital.com/ORLA  The Oregon Health Authority (OHA) announced today Oregon will remove general mask requirements for indoor public places no later than March 31. This would include restaurant customers and employees. OHA shared in a release, "By late March, health scientists expect that about 400 or fewer Oregonians would be hospitalized with COVID-19, the level of hospitalizations the state experienced before the Omicron variant began to spread. Mask requirements for schools will be lifted on March 31." State health officials say Oregon "needs to keep mask requirements in place for now as COVID-19 hospitalizations crest and Oregon’s health care system strains to treat high numbers of severely ill patients." Officials at OHA also filed a permanent rule requiring masks indoors in public places. This new rule replaces a temporary rule that expires tomorrow, February 8. As a reminder, the filing of a permanent rule was the only way health officials could extend the current temporary mask rule past its expiration date and until mask rules would no longer be needed to reduce transmission of COVID-19 and prevent the Omicron crisis from further overwhelming Oregon’s health care system. For questions or for more information, contact your Regional Representative.

NOTE: ORLA's blog will be going offline for upgrades the last week in October.

[October 22, 2021] - Meals Tax Fight | Free Training | Continued Push for RRF Local Meals Tax Fights Continue - We are neck deep in local opposition campaigns in both Cannon Beach and Newport in support of our local restaurants doing business in those communities. As you’ve heard before, we’ll most likely know later in the evening on November 2 whether either of these proposed 5% meals tax proposals pass by will of the voters. Here’s the latest media coverage from earlier this week. Free Covid Online Training Extended – We have made the decision to extend access to the free online training we created at the association to assist restaurant and lodging operators and their staff with the challenging customer service dynamics when dealing with mask mandates across the state. We will keep these Guest Service Safety trainings (restaurant and lodging versions in both English and Spanish) available online for free through at least the end of the calendar year. Make sure to take advantage for your own operation and feel free to spread the word and share the following link so others in our industry can access this free resource thanks to a sponsorship from Anheuser Busch. ORLA Media Event – Your state association in conjunction with several other state associations around the nation will be holding media events to continue pressing the need for restaurant revitalization funding for all eligible applicants. We want to thank Gabriel Pascuzzi, Chef & Owner of Mama Bird for stepping up and representing 2,592 restaurant businesses like his who remain out in the cold with no restaurant revitalization funding after applying for federal financial relief. We’ll do our best to make an impression in the media this coming week and keep the chorus going as we press federal elected leaders to make good on their promise. Here for Oregon Partnership – The Oregonian is our latest sponsor of the Oregon Tourism Leadership Academy program and we want to thank Oregonian Media Group President John Maher and their Vice President of Brand and Strategic Partnerships Amy Lewin for thinking big and launching their “Here for Oregon” initiative. The Oregonian is launching this new effort to help share the good across our great state. Powered by the incredible teams and tools of The Oregonian/OregonLive, they are taking the stories created every day and building a new place dedicated to lifting and celebrating Oregon. This multi-media approach offers a custom blend of community-driven content that is distinctly Oregon. It's an extraordinary aggregate for joy, awareness, and connection across the state. Whether you live in Pendleton, Pleasant Hill or Portland, there’s a place for you here and we want to help celebrate what the Oregonian is working to accomplish. As they begin to roll out their efforts, John and Amy are inviting their community partners to join them in building, from the ground up, stories of the people, the places, the experiences and the diversity of culture and skills that inspire innovation and community. Share Oregon. “Like” and “Follow” @HereisOregon on Facebook, Instagram, Twitter and YouTube Get the good stuff. Subscribe to Here is Oregon weekly e-newsletter. Show you’re here and tag good news in your community with #HereisOregon.

[October 4, 2021] - Foundation Updates | Industry Recovery Trends | OTLA

Oregon Hospitality Foundation Updates - This past week, ORLA’s Executive Director of the Oregon Hospitality Foundation Wendy Popkin announced she has accepted a new role with the Washington County Visitors Association as Vice President of Destination Sales. We hope you all join us in celebrating Wendy’s contributions to the Foundation over the past nine years. In conversations with Wendy and Foundation Board members, we are moving forward with a plan to hire two new full time positions in support of the hospitality foundation. One position will be an executive coordinator for foundation governance while also serving as our ProStart Liaison for Oregon’s 40 participating high schools. The other position will be a Workforce Development Coordinator focused on creating stronger connections between industry leaders and high school and community college classrooms – think guest speaking opportunities, job shadow coordination, career/job fair involvement, and experiential field trips. Reach out to ORLA if you know someone interested in these positions. National Restaurant Trends - The latest economic trends in the restaurant survey based on a feedback from 4,000 restaurants across the nation. The NRA's infographic and associated letter sent to DC leadership focus on the importance of preventing new taxes on small businesses as our industry continues to grapple with the impacts of the enduring pandemic. Activity in DC continues to be touch and go and our Government Affairs team will continue keeping all lines of communication open with our partners at AAHOA, AHLA, and NRA as developments unfold.

[September 24, 2021] - Fight Against Meals Taxes / Chair's Getaway / Conference Program

Fights Against Meal Taxes Continue - The ORLA professional team led by Steve Scardina and Terry Hopkins in their regions of the state and supported by Greg Astley, Tom Perrick, and Glenda Hamstreet in our Government Affairs Department are working hard to defeat meals taxes appearing on the November ballot in the cities of Cannon Beach and Newport. Our websites for the campaigns are up and running and our success in defeating both proposals is largely dependent on our ability to keep local restaurants in both communities engaged and in the forefront. It is critical that ORLA take a back seat to the local names and faces that make up a local restaurant industry while fully leveraging ORLA’s association structure to assist our local members in fighting effectively against tax proposals when they are opposed by members in cases like this. In the past 4 years, we have successfully defeated two other restaurant tax proposals – one in Jacksonville and one in Hood River County. We hope to defeat these two tax proposals and should have results to share on November 2 or 3. Vote No Sales Tax on Meals! ORLA Hospitality Conference Success - Earlier this week ORLA held a 2-day in-person conference for industry members at the Riverhouse in Bend. Feedback so far has been very positive, citing keynote and breakout session messages on target and insightful for the hard-hit hospitality industry. ORLA members also had the opportunity to vote in several new members of the Board of Directors. Save the date for next year's event on Sunday & Monday, September 11 and 12 at the Graduate hotel in Eugene. Chair’s Getaway - We are off and running in creating a great experience on Oregon’s north coast for our Chair’s Getaway event on Sunday, November 7 which will be co-hosted by Incoming Chair John Barofsky and Outgoing Chair Masudur Khan. We want to take a moment to thank Shannon McMenamin and her team at the Gearhart location for working with us to put together the Reception and Multi-Course Dinner on site. Also, a big thanks to Outgoing ORLA Chair Masudur Khan for making the SaltLine Hotel available for overnight stays and our sponsors at US Foods (thanks Randy) and Pacific Seafood for their food donations. We also have America’s Hub World Tours joining us as a Transportation Sponsor this year for those who prefer a shuttle bus between the hotel and the restaurant. The Chair’s Getaway event has 50-60 people in attendance and is an opportunity to raise funds for ORLAPAC under the direction of Greg Astley, ORLA’s Director of Government Affairs. I hope you consider making a donation to ORLAPAC and join us for this great reception, dinner, and overnight stay following on November 7. Register here to reserve your seats – we expect this will sell out so act soon.

[September 17, 2021] - Win for Lottery Retailers / Vaccine Mandates / EIDL Updates

Win for Lottery Retailers – ORLA’s membership includes a segment that cares deeply about the association’s advocacy for lottery retailer issues. ORLA in partnership with many other stakeholders was able to secure a win with the Governor committing in writing to prohibit any expansion of state sponsored gambling on mobile devices with an exception for the options already available on cell phones. The following two letters spell out the request made by us and our partners to legislative leadership and the Governor’s response essentially putting a moratorium on any gambling expansions on cell phones for the duration of her term in office. Vaccine Mandates – We expect to have our hands full in the coming months as the potential for emerging vaccine mandates continues to be debated primarily at the local levels of government outside of President Biden’s announcement this past week. We have been made aware that King County in Washington State will move forward with a vaccine mandate but has decided to again target specific businesses with the mandate as opposed to all businesses. It remains unclear how the new vaccine mandate will be enforced and how the role of restaurant and other industry operators will be defined for those industries impacted. The King County mandate will go into effect in late October. Our reports show the NYC mandate has a vaccine verification compliance rate of less than 30% meaning as many as 70% of operations were not verifying vaccine status at the door. In one of ORLA’s recent surveys we asked operators what types of mandates they would proactively comply with. Under 40% said they would comply with vaccine verification and we suspect the reason is driven by the challenges posed by putting our frontline staff in the position of asking for those verifications universally to dine indoors and the uncertainty of what happens when customers are denied indoor dining service due to a mandate. As a reminder, we openly shared our survey results and our deep concerns about compliance rates with Multnomah County Chair Kafoury and the Governor’s Office. We’re hoping that step keeps the industry from being targeted while we continue our advocacy and support for vaccines and their importance. EIDL Program Updates – The Small Business Administration’s Deputy District Director for Portland Sam Goldstein provided us at ORLA with the latest updates on EIDL. The SBA's COVID EIDL Program Summary serves as a review of where we are to date on EIDL expansion. Another webinar presentation is coming up on September 23; register here. The SBA is continuing to accept loans and modification to existing loans. New applications and increases in existing loans resulting in total amounts to be approved >$500K can be submitted immediately. Decisions on requests >$500K will begin October 8, 2021. Main Update: Increase in maximum loan amount from $500,000 to $2,000,000 (policy) Key Changes in Effect as of September 8, 2021:

[Click the "Read More" link for archived blog updates]

National Restaurant Association Releases 2021 Mid-Year State of the Restaurant Industry Update8/31/2021

Positive trends improve industry outlook; uncertainty and waning consumer confidence could impact long-term rebuilding

FOR IMMEDIATE RELEASE Contact: Vanessa Sink, Media Relations Director, National Restaurant Association Washington, D.C. (August 31, 2021) – Today, the National Restaurant Association released a mid-year supplement to the 2021 State of the Restaurant Industry Report, which illustrates the continued impact of the COVID-19 pandemic on the restaurant industry. The report provides an updated look at key indicators and trends influencing the industry’s recovery as of June/July 2021, including the current state of the economy, workforce, and food and beverage sales. Key findings include:

“Faced with one of the most devastating and disruptive events of our lifetime, the restaurant industry has taken significant strides toward rebuilding over the first half of 2021,” said Tom Bené, President and CEO of the National Restaurant Association. “Consumer expectations around dining out have changed, and the industry is continually adapting to not only meet, but exceed, these expectations. Restaurant operators, along with their partners throughout the supply and distribution chain, remain focused on providing diners with a safe and enjoyable experience, amid rising food and labor costs and challenges related to the pandemic. Given these factors, our outlook through the end of the year is one of cautious optimism.” Labor and Food Costs Remain Top Challenges July marked the seventh consecutive month of staffing growth, translating to a net increase of 1.3 million jobs in the first half of 2021. Despite these increases, eating and drinking places remain nearly 1 million jobs or 8% below pre-pandemic employment levels. Operators also continue to grapple with higher input costs, with wholesale food prices increasing at their fastest rate in seven years.

Technology, Outdoor Dining, and Alcohol To-Go Are Here to Stay The pandemic catalyzed many changes in the restaurant industry including the rapid consumer adoption of technology for online ordering, electronic payment, and order pickup. Consumers want to see restaurants continue incorporating technology and are keen to continue using outdoor dining. In 31 jurisdictions, thanks to approved legislation, consumers will be able to continue ordering alcoholic beverages with their takeout.

The Threat of Delta In the first half of 2021 industry trends were positive, but there is still a long road ahead. A National Restaurant Association survey, conducted Aug. 13-15, found that the delta variant of COVID-19 threatens to reverse the gains made in the first six months of the year.

“The trends from the first half of the year are promising, but a lot of uncertainty remains in regard to the delta variant, consumer confidence, and ongoing labor challenges,” said Hudson Riehle, Senior Vice President of Research for the National Restaurant Association. “We expect restaurant pent-up demand will remain high in the coming months. However, in this state of flux, maintaining the availability of on-site dining with few capacity restrictions will be critical to keeping the overall sales momentum going forward, especially for full service operators.” The National Restaurant Association will continue to monitor the effect of COVID-19 on the industry in the coming months and plans a full State of the Restaurant Industry Report in early 2022. Click here to download the 2021 State of the Restaurant Industry Mid-Year Update, sponsored by Sage Intacct. ### About the National Restaurant Association Founded in 1919, the National Restaurant Association is the leading business association for the restaurant industry, which comprises 1 million restaurant and foodservice outlets and a workforce of 15.6 million employees. We represent the industry in Washington, D.C., and advocate on its behalf. We sponsor the industry's largest trade show (National Restaurant Association Show); leading food safety training and certification program (ServSafe); unique career-building high school program (the NRAEF's ProStart). For more information, visit Restaurant.org and find us on Twitter @WeRRestaurants, Facebook and YouTube. PRESS STATEMENT: August 11, 2021

Statewide Mask Mandate Must Prevent More Business Restrictions Statement from President & CEO Jason Brandt: We can’t overstate how exhausted the hospitality industry is from an unthinkable health crisis spanning 18 months and counting. A new statewide mask mandate taking effect in 2 days must not lead to any other statewide business regulations. The industry is nowhere near recovery and has a long road ahead after all statewide restrictions were officially lifted 42 days ago. ORLA will work directly with Oregon OSHA and will advocate for a focus on ensuring appropriate signage is in place at businesses in addition to their oversight role for employee safety. For more information on the efforts of the Oregon Restaurant & Lodging Association please visit OregonRLA.org. ### The Oregon Restaurant & Lodging Association is the leading business association for the foodservice and lodging industry in Oregon, which before COVID-19 provided over 180,000 paychecks to working Oregonians. The latest available data for May of 2021 from the Oregon Employment Department shows current employment levels in the accommodations and foodservice industry totaling 153,200 people. Guest Blog | BYOD, Inc. Most of the conversations I am having with restaurant colleagues these days involve any number of terms: RRF, PPP, Covid-19, recovery, consumer confidence, and many more. However, at my own restaurants the conversations center around one thing: staffing. In 25 years, I’ve never seen an employment pool as shallow as it is right now. While the economy is seeing wonderful recovery (the unemployment rate fell by another .3% last month adding almost 550K jobs, and the economy grew by 6.4% in Q1 and continues to skyrocket), we in the hospitality industry are not experiencing the same boom. Reuters reports that 5.6% of restaurant workers quit their jobs in April (an all-time high according to Gordon Haskett Research Advisors) and the bureau of labor statistics shows the hospitality industry came out of April still down more than 2.8 million workers from where it was pre-pandemic, with an unemployment rate of 10.8% compared to the national level of 5.5%. On top of that, I haven’t spoken to an operator in months where the phrase “severely understaffed” doesn’t come up. Though there are multiple drivers (unemployment benefits, governmental pandemic regulations, large wage increases in industries that weren’t shutdown, etc.) behind this situation, and we can all debate them until we are blue in the face. The reality of the situation is that a smaller and shallower hospitality employment pool is here to stay. With that sobering fact readily apparent after the last several months, we also are hearing a lot from “experts” stating the only way to attract workers back is to raise wages. With efforts from groups like the IRC as well as state and national government to push a $15/hour minimum wage it seems a bit like the industry is being pushed into accepting this new reality by bully pulpit and the peanut gallery. The problem seems insurmountable, especially considering the fact that industry wide we lost 110,000 restaurants permanently last year and almost $240 billion. However, the building blocks of an alternative solution to “raising wages and just keep raising them” are already in many other industries. In the 1950’s the manufacturing and agricultural industries employed 1 in 3 Americans workers, but in 2009, it was closer to 1 in 8. What happened, you ask? Automation. We began to use machines, computers, and finally data to evolve how those industries work. Now I know I just lost some of you. For years people have told me how backward the restaurant industry is, and how technological behind we are. We’ve been slow to adopt new technologies and sometimes burned by the ones that we have. I hear the argument that while spending millions of dollars on technology might work for a big factory doing $1 million dollars a day in revenue, it can’t work for a restaurant doing $1 million in revenue annually. But that supposes that automation requires large physical infrastructure, expensive software programs, large implementation teams, and a number of other hurdles that make it very difficult for an industry that is made up of more than 60% independent operators to consider implementation. Automation is something that the restaurant industry has championed for years (just ask McDonald’s), but it has approached it from the standpoint of unit replicability, when what we need to focus on as an industry is how automation applies to a single unit. Simply put, are there tasks that technology can do (perhaps better than humans) that can be easily and inexpensively implemented? The answer is a resounding yes – with machine learning and artificial intelligence. Why couldn’t an AI build a schedule better than an assistant manager? Crunch data and predict sales and staffing at better rate? Coordinate your ordering for you? Essentially remove all of the mundane “office” jobs that an operator deals with on a daily basis so that they can focus on more important tasks? If a manager could skip 50% of their paperwork to spend more time training the limited staff that they already have (because an AI did it for them), could that staff begin to handle a higher workload? If consumer interfaces could start with technology as a welcome funnel (QR codes, AI engaged CRM’s that auto-seat customers) could that allow restaurant to do more with less staff? In the end, what I believe will come out of the pandemic is not necessarily higher wages, but a greater reliance on technology as an interface between management and staff as well as restaurants and their customers. Technology isn’t the only solution to the current job market, but it certainly seems like a more palatable one. | Samuel Short Sam is the Chief Strategy Officer for BYOD, Inc., a Restaurant-focused Artificial Intelligence company. Sam also owns a restaurant group in Michigan and has spent the last 25 years in the restaurant industry. He served on the board of the Michigan Restaurant and Lodging Association for many years. This guest blog was submitted by BYOD, Inc. For more information on guest blog opportunities, contact Marla McColly, Business Development Director, Oregon Restaurant & Lodging Association.

[update 7.1.21] 2021 Legislative Win for ORLA Senate Bill 317A passed, making permanent the ability for bars and restaurants to offer mixed drinks for takeout or delivery if the guest also purchases a substantial food item.

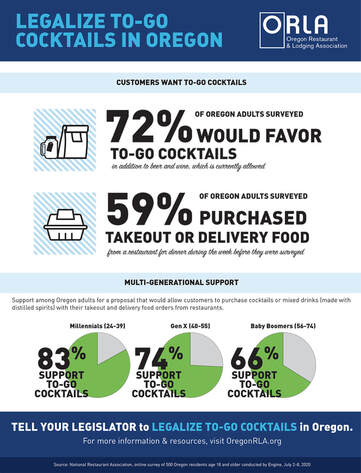

Restaurants and Bars Among Hardest Hit by COVID-19 Pandemic [July 20, 2020 - Wilsonville, OR] – The Oregon Restaurant & Lodging Association (ORLA), in partnership with the National Restaurant Association, recently completed a statistically significant survey around To-Go Cocktails, drinks made with distilled spirits for takeout, pickup or delivery to go along with meals purchased by guests. The survey, conducted July 3-6th, shows 72% or nearly three in four Oregonians, said they would favor a proposal allowing customers to purchase cocktails or mixed drinks (made with distilled spirits) with their takeout and delivery food orders from restaurants. This is in addition to beer and wine, which is currently allowed. Support is highest among those between the ages of 24-39 at 83%, with respondents between the ages of 58-74 showing the least support at 66%. Twenty-eight percent of adults said they strongly favor the proposal. Fifty-nine percent of Oregon adults said they purchased takeout or delivery food from a restaurant for dinner during the week before they were surveyed. ORLA President and CEO Jason Brandt said, “This is so encouraging for our members who have struggled just to stay open and keep people employed.” Brandt continued, “This has been an incredibly difficult time when restaurants and bars have struggled to deal with the challenges of being shut down, having to pivot to offer only takeout, pickup or delivery and then trying to invite guests back into dining rooms and make them feel safe and comfortable. Knowing almost three out of four Oregonians support the option to purchase cocktails or mixed drinks to go with their meals means some restaurants and bars who might have previously had to close down actually have a chance to make it now.” Allowing customers to purchase cocktails or mixed drinks (made with distilled spirits) for pickup, takeout or delivery requires a statutory change, meaning the Oregon Legislature would need to make the change to state law. Thirty other states currently offer To-Go Cocktails including Washington and California. “From a public safety perspective, if more businesses are able to offer the service of delivery of alcohol to their customers, the need for those customers to physically go into stores and businesses is reduced, thus reducing the risk of community spread of COVID-19,” said Brandt. Recognizing the need to help those who may have difficulty with alcohol addiction, ORLA’s website outlines a number of resources available to individuals, as well as training information to aid in prevention. More information on these resources and trainings can be found at OregonRLA.org/crisis-services-and-training. For more information please contact Greg Astley, ORLA Director of Government Affairs at 503.851.1330.  Effective today, June 30, face covering and distancing rules are eliminated in alignment with the full reopening of our economy. Governor Brown’s announcement last Friday was welcome news to Oregon's businesses ready to open back up at full capacity. Earlier this week we received confirmation from OR-OSHA Director Michael Wood that mask and distancing mandates will be eliminated (with certain exceptions, including health care, public transit, and airports). However, not all of Oregon OSHA’s COVID-19 requirements are going away immediately. "For the rule addressing all workplaces, examples of measures that will remain in place longer include optimization of ventilation, notification of a positive case in the workplace, and proper steps to take if an employee must quarantine." Here's more information to pass along: ORLA has received several questions from members regarding rule updates. Here are a few FAQs that were confirmed:

ORLA will continue to work with Oregon OSHA as part of their rules committee to continue addressing the details involved with unraveling the remainder of the COVID-19 directives. As always, you can reach out to your ORLA Regional Representative for questions. There is no light switch. It will take years to build back what was lost.

FOR IMMEDIATE RELEASE: June 25, 2021 Contact: Jason Brandt, President & CEO, ORLA 503.302.5060 | [email protected] Wilsonville, OR– Today’s announcement from Governor Kate Brown announcing a full reopening of Oregon’s economy no later than Wednesday, June 30 is welcome news. Our state’s restaurant and lodging establishments have a long road ahead as small businesses continue the hard work of regaining their footing after 15 months and 13 days of historic and over-reaching government regulation. Permanent closures, workforce access issues, partial re-openings, and ever-changing administrative rules and emergency orders have left a permanent mark on the approach to doing business in Oregon. “We never could have imagined the gravity and depth to which government regulations would dictate how we live in a free society when industry shutdowns and capacity restrictions first went into effect on Tuesday, March 17 of 2020,” said Jason Brandt, President & CEO of the Oregon Restaurant & Lodging Association. “Here we are 15 months later picking up the pieces and doing whatever we can to help Oregon’s extraordinary hospitality industry find its identity once again and it will take time. From a workforce access crisis and supply chain constraints to debt accumulation and back rents and mortgages coming due, historic industry challenges remain and will persist in the years ahead.” To date, Oregon has permanently lost over 1,400 foodservice locations statewide and some lodging establishments remain closed. Both restaurant and lodging operators continue to face wide ranging marketplace dynamics resulting in different realities in different regions of the state. As a rule of thumb, the more reliant a region is on business travel, the harder the economic hit. “The Portland Metro region in particular will need ongoing support to bring back the top tier hospitality experiences our overnight guests have come to expect in our state’s largest city,” said Brandt. “Our hats are off to our partners at Travel Portland, the Portland Business Alliance, and officials at the City of Portland who are inspiring Portlanders to usher in a new transformative chapter with their ‘Here for Portland’ campaign. Ongoing cleanups, increased office worker mobility, and cultural activities can and will make a big difference. As Mayor Wheeler has said, do not bet against Portland or its people.” One challenge remains clear statewide – no matter the region, the workforce access crisis is deep and relentless. Restaurants and lodging establishments in all regions of the state are currently forced to reduce operating hours, minimize menu options and cordon off available rooms respectively. “To put it plainly, there are too many Oregonians on the sidelines,” said Brandt. “And this reality has opened up a new frontline of advocacy activity for ORLA – we must be at the table in assisting our state in addressing the child care deserts that exist in all 36 counties in Oregon, we must address the extension of unemployment benefits to those who are not making a concerted effort to find their next job, and we must protect the rights of our frontline workers who choose to wear a face covering at work and respect that choice and embrace it.” For more information on the efforts of the Oregon Restaurant & Lodging Association please visit OregonRLA.org. ### The Oregon Restaurant & Lodging Association is the leading business association for the foodservice and lodging industry in Oregon, which before COVID-19 provided over 180,000 paychecks to working Oregonians. The latest available data for May of 2021 from the Oregon Employment Department shows current employment levels in the accommodations and foodservice industry totaling 153,200 people. |

Categories

All

Archives

June 2024

|

Membership |

Resources |

Affiliate Partners |

Copyright 2024 Oregon Restaurant & Lodging Association. All Rights Reserved.

8565 SW Salish Lane Suite 120 | Wilsonville, OR 97070-9633 | 503.682.4422 | 800.462.0619 | Contact Us

Site Map | Accessibility | Privacy Policy

8565 SW Salish Lane Suite 120 | Wilsonville, OR 97070-9633 | 503.682.4422 | 800.462.0619 | Contact Us

Site Map | Accessibility | Privacy Policy

RSS Feed

RSS Feed