|

FOR IMMEDIATE RELEASE Media Contact: Jason Brandt, President & CEO, ORLA, 503.302.5060 Remaining funds present unique opportunities to invest in tourism initiatives Wilsonville, OR – Salem’s Budget Committee approved a stop-gap solution to fund the library through a Cultural and Tourism Fund, finding access to American Rescue Plan Act (ARPA) dollars outside of any restricted lodging tax revenues. The Oregon Restaurant & Lodging Association (ORLA) confirmed with the City Attorney the ARPA funds will be used as a one-time resource to backfill their library shortfall, a legal move within the rules for those federal dollars. Coming out of the pandemic, Oregon received $4.262 billion in ARPA funding, with approximately $2.76 billion going to the state and $1.5 billion distributed to Oregon cities and counties. After Salem uses $1.2 million of their ARPA funds to preserve staff and services for the library for a year, it’s anticipated there will still be close to $2 million remaining in the Cultural and Tourism Fund. “Having such a robust beginning balance in this fund is a great opportunity for us to assist Salem’s hospitality industry in their ongoing recovery efforts post pandemic while potentially driving new lodging tax revenue for the City in support of future fiscal years,” said Jason Brandt, President & CEO of the Oregon Restaurant & Lodging Association. “This is a strategic moment for the region and city collaborations with Travel Salem, the Salem Area Lodging Association, and the Salem Area Chamber of Commerce should be put in motion to invest in creative tourism programs or initiatives local stakeholders feel can drive new tourism traffic.” ORLA continues to support and protect tourism funding across the state, ensuring appropriate, strategic investments are made to drive tourism year-round and help build stronger economies. When tourism investments are driven through collaborative efforts involving all stakeholders, everyone benefits. New tourists result in more dollars through visitor spending and lodging taxes, bringing more revenue to local economies. For more information on the importance of protecting transient lodging tax revenues, visit the Oregon Restaurant & Lodging Association’s website at OregonRLA.org/tlt. Read more on ORLA’s public policy proposals for how ARPA funds could best be leveraged for Oregon’s tourism and hospitality industries. About

The Oregon Restaurant & Lodging Association is the leading business association for the foodservice and lodging industry in Oregon, which is comprised of over 10,220 foodservice locations and 2,000 lodging establishments. As of December 2023, the Oregon Employment Department reports the Leisure and Hospitality workforce totals 208,700 with a total economic impact of over $13.8 billion in annual sales for Oregon. FOR IMMEDIATE RELEASE: April 17, 2024 Media Contact: Jason Brandt, President & CEO, ORLA, 503.302.5060 Mayor proposes dipping into transient lodging tax dollars to fund city’s library Wilsonville, OR– The Oregon Restaurant & Lodging Association (ORLA) is proactively looking into a proposal by Salem Mayor Chris Hoy to use transient lodging taxes to fund around $1.2 million in the library’s budget. Under his proposal, the city would access lodging tax dollars from Salem’s Cultural and Tourism Fund to cover the shortfall in library operations. “Each jurisdiction with a transient lodging tax has both restricted and unrestricted parameters for how our industry tax money can be spent,” said Jason Brandt, President & CEO for the Oregon Restaurant & Lodging Association. “The question here is whether the City of Salem has $1.2 million in unrestricted funds from the transient lodging tax to spend however they deem appropriate. If the City uses the portion of industry taxes restricted by state law for tourism, then ORLA will need to take appropriate action against this proposal.” Reforms passed in the 2003 Oregon Legislative Session established rules for how local governments can spend industry tax dollars. In short, spending on tourism promotion and tourism-related facilities (defined in state statute) was locked in as a percentage of total lodging tax collections on July 1, 2003. And on July 2, 2003, moving forward, any increase in a local lodging tax rate or establishment of a new lodging tax not already in existence must allocate 70 percent of revenues to tourism promotion and tourism-related facilities with the remaining 30 percent serving as unrestricted revenue for the local government to spend however they see fit. Diverting lodging taxes in support of other local government priorities essentially shortchanges the Oregon hospitality industry’s ability to bring visitor dollars to restaurant, lodging, and retail businesses year-round. Protection of industry tax dollars is a priority for ORLA as we remain focused on embracing shoulder and off-season promotions to entice visitors to local communities across Oregon year-round. ORLA serves as the industry’s watchdog on lodging tax spending by local governments across Oregon. We produced a helpful video that our industry members and local government stakeholders can review that explains how local lodging taxes must be expended in accordance with Oregon's state law. View the Oregon Lodging Tax Defined video and visit the Oregon Restaurant & Lodging Association’s website at OregonRLA.org for more information. About

The Oregon Restaurant & Lodging Association is the leading business association for the foodservice and lodging industry in Oregon, which is comprised of over 10,220 foodservice locations and 2,000 lodging establishments. As of December 2023, the Oregon Employment Department reports the Leisure and Hospitality workforce totals 208,700 with a total economic impact of over $13.8 billion in annual sales for Oregon.  FOR IMMEDIATE RELEASE: Contact: Jason Brandt, President & CEO, ORLA 503.302.5060 | [email protected] Reforms enacted over 20 years ago require ongoing collaboration with local governments across Oregon Wilsonville, OR– The Oregon Restaurant & Lodging Association (ORLA) and the Asian American Hotel Owners Association (AAHOA) are collaborating to keep a watchful eye on lodging tax spending by local governments across Oregon. Currently, there are over 100 different local lodging taxes in jurisdictions across the state which generate over $220 million in revenue for city and county governments of all shapes and sizes. “The task of staying on top of local lodging tax spending across Oregon is one of our most crucial roles,” said Jason Brandt, President & CEO for the Oregon Restaurant & Lodging Association. “Our friends and joint members at AAHOA are an important national ally. Oregon Asian Americans own 60% of all hotels in the state and as such, AAHOA serves as a critical partner in navigating the various formulas for our industry taxes while monitoring the way in which those dollars are spent in local economies.” Reforms passed in the 2003 Oregon Legislative Session established rules for how local governments can spend industry tax dollars. In short, spending on tourism promotion and tourism-related facilities (defined in state statute) was locked in as a percentage of total lodging tax collections on July 1, 2003. And on July 2, 2003, moving forward, any increase in a local lodging tax rate or establishment of a new lodging tax not already in existence must allocate 70 percent of revenues to tourism promotion and tourism-related facilities with the remaining 30 percent serving as unrestricted revenue for the local government to spend however they see fit. "It is crucial that local municipalities adhere to state laws mandating the appropriate allocation of local tourism tax revenue," said Taran Patel, AAHOA's Northwest Regional Director. "In light of our members' ongoing recovery from the profound effects of the pandemic, there has never been a more pressing imperative for cities to strategically reinvest tourism tax dollars, leveraging them to actively and effectively promote increased tourism." A continual commitment to relationship building with local governments remains a key objective given reforms have now been in place for over 20 years. During that span, cities and counties see ongoing changes in administrator positions and elected official office holders. “The work we do at ORLA and AAHOA in monitoring lodging taxes starts with city staff and elected leader conversations,” said Brandt. “New administrators often come from other states with little to no familiarity about Oregon’s rules relating to lodging tax. The same is true for volunteer elected officials who cannot be expected to be experts on industry specific issues like lodging taxes at the onset of their service. We’re here to partner whenever possible and determine ways we can grow the pie of revenue overall which benefits both the industry through direct investments in tourism needs while also benefitting the applicable local government by generating more unrestricted tax revenue for city/county budget needs.” For more information on how local lodging taxes must be expended in accordance with Oregon's state law, watch the Oregon Lodging Tax Defined video or visit the Oregon Restaurant & Lodging Association’s website at OregonRLA.org. About ORLA

The Oregon Restaurant & Lodging Association (ORLA) is the leading business association for the foodservice and lodging industry in Oregon, which is comprised of over 10,220 foodservice locations and 2,000 lodging establishments. As of December 2023, the Oregon Employment Department reports the Leisure and Hospitality workforce totals 208,700 with a total economic impact of over $13.8 billion in annual sales for Oregon. About AAHOA AAHOA is the largest hotel owners association in the world, with Member-owned properties representing a significant part of the U.S. economy. AAHOA's 20,000 members own 60% of the hotels in the United States and are responsible for 1.7% of the nation’s GDP. More than one million employees work at AAHOA Member-owned hotels, earning $47 billion annually, and member-owned hotels support 4.2 million U.S. jobs across all sectors of the hospitality industry. AAHOA's mission is to advance and protect the business interests of hotel owners through advocacy, industry leadership, professional development, member benefits, and community engagement. FOR IMMEDIATE RELEASE CONTACT: Jason Brandt, Oregon Restaurant & Lodging Association 503.302.5060 | [email protected] ORLA Files Suit Against City of Albany for Tax Expenditures The motion filed in Linn County District Court alleges misuse of lodging taxes based on state law requirements Wilsonville, OR– The Oregon Restaurant & Lodging Association (ORLA) filed a lawsuit this week against the City of Albany in Linn County Circuit Court. ORLA contends the City has not reinvested lodging tax dollars originally used to pay off remaining debt for the Linn County Fair & Expo Center back into tourism promotions and/or other tourism-related facilities as required by state law. “ORLA, on behalf of our local lodging and restaurant operators, has done everything we can to find agreement with City administrators for over a year in hopes of avoiding legal action,” said Jason Brandt, President & CEO for the Oregon Restaurant & Lodging Association. “Unfortunately, City administrators appear to be undeterred and unwilling to concede dollars previously used to pay off debt for the Linn County Fair & Expo center must be reinvested in tourism promotions and/or tourism-related facilities as required by state law.” Oregon Revised Statute (ORS) 320.350 prohibits local governments from decreasing the percentage of Transient Lodging Tax (TLT) revenues spent to fund tourism promotion and tourism-related facilities once tourism-related facility debt is paid off. “The City has had two choices available to them since retiring debt associated with the Linn County Fair & Expo Center,” said Brandt. “They could have reinvested those dollars in other tourism-related facility projects or tourism promotional campaigns bringing benefits to both residents and visitors, or they could have chosen to reduce the industry tax rate after paying off the debt. Unfortunately, these options have not been embraced and our industry seeks to hold the City of Albany accountable for its failure to comply with state law.” The hospitality industry remains focused on embracing shoulder and off-season promotions to entice visitors to local communities across Oregon year-round. “We know the diversion of lodging taxes in support of other local government priorities shortchanges our ability to bring visitor dollars to our restaurant, lodging, and retail businesses year-round,” said Brandt. “Our promotional campaigns at strategic times of the year to targeted tourism markets can bring significant revenue to our local economies and sustain year-round employment for our hard-working teammates in the industry.” The lawsuit filed with Linn County Circuit Court can be viewed through the following link: Complaint: ORLA v. City of Albany Learn more about how Oregon lodging tax is defined in this video. For more information on the efforts of the Oregon Restaurant & Lodging Association please visit OregonRLA.org. The Oregon Restaurant & Lodging Association is the leading business association for the foodservice and lodging industry in Oregon. A not-for-profit trade organization, ORLA represents approximately 3,000 member units and advocates for over 10,000 foodservice locations and over 2,400 lodging establishments in Oregon.

A Smart Use of Local Lodging Tax Dollars

As of January 1, 2023, a 2% increase in local lodging tax has been in effect in Lane County. How these new revenues will be spent is still undecided. The Board of Commissioners held a meeting back in September to hear public comments in support of proposals including building a new stadium for the Emeralds baseball team and an indoor multi-use stadium. ORLA’s Director of Government Affairs Greg Astley, along with a few ORLA members, provided testimony at the hearing urging Lane County Commissioners to use any new increase in lodging tax toward an indoor multi-use facility. The following summarizes why we think an indoor facility is a smarter use for those tourism revenues: As hospitality businesses continue to try and recover from the two and a half years of the global pandemic, the shutdowns that occurred because of that pandemic and the ongoing issues of inflation, rising gas prices and continued supply chain issues, there is a clear need for more stable, year-round revenue from visitors to help that recovery. Summer demand is already high in Lane County as visitors enjoy outdoor recreation, wine tasting, various festivals and sporting events and other activities undertaken during the summer months when the weather is favorable. During the winter months and shoulder seasons however, especially January through March, visitors are less likely to visit and support our local economy. Therefore, we believe the best use of any new increase in TLT is growing winter travel demand. TLT reinvested in our challenging winter economy is good for local businesses, from hotels to restaurants and retail and will support year-round employment. Additionally, increasing visitor demand in winter will grow TLT revenue for all recipient programs and jurisdictions. Finally, increases in TLT should be used in ways relevant to drawing visitors, putting “heads in beds” and continuing to increase overall TLT revenue. ORLA supports investment in an indoor multi-use sports facility, with the added feature of a hydraulic, banked 200m track. This facility can accommodate a wide range of sports tournaments, events and offer temperature-controlled emergency response in all seasons. This represents a much-needed investment in facilities serving local youth and all ages who participate in healthy activities, while also drawing visitors in winter. The Eugene/Springfield metro area is underbuilt related to active and healthy indoor facility space compared to national averages. Multi-use sports facilities draw visitors, are recession resistant and are good for our community health. Visitors already know and love Eugene and the surrounding areas of Lane County in summertime. Investing in an indoor multi-use sports facility will allow them the opportunity to experience it during the winter months and shoulder seasons helping to support local jobs, the local economy and the overall health of the community. We encourage the use of any increase in the TLT rate to go toward this endeavor. If you have any questions, please reach out to your Regional Representative Terry Hopkins or Greg Astley. Industry Champions / Local Lodging Tax / New GA Team Member

Statewide Hospitality Awards ORLA honored four industry members during the Hospitality Conference in Eugene on September 11, 2022. These awards recognize the outstanding contributions of individuals and businesses serving the hospitality industry and communities throughout the state. Congratulations to the Employee of the Year Jodi Doud (Southern Oregon Elmer's), Lodging Operator of the Year Nick Pearson (Jupiter & Jupiter NEXT), Restaurateur of the Year Emma Dye (Crisp), and Allied Member of the Year Matthew D. Lowe (Jordan Ramis PC). View video profiles of this year’s recipients. Protecting Local Lodging Tax Dollars ORLA's government affairs team is working closely with our leadership teams and operators to review how local lodging taxes are being spent in jurisdictions across the state. Over the past fiscal year, ORLA has filed over 10 public records requests to evaluate the use of lodging tax dollars collected by local governments. Turnover within government positions just like in the private sector result in the need for ongoing education of the state rules governing local lodging taxes. Watch ORLA's explainer video how local lodging taxes must be expended in accordance with Oregon's state law. New ORLA GA Team Member Makenzie Marineau joins ORLA with experience in the non-profit world along with government relations, communication and volunteer engagement skills. Along with expertise in government affairs, she has years of experience working within the hospitality industry in Oregon. In her role as Government Affairs and Regional Leadership Teams Coordinator, Makenzie will be helping the association and its members achieve success through the development and ongoing oversight of regional groups of restaurants and lodging operators as well as programs to benefit the hospitality industry. She will serve as the lead government affairs staff member in the Portland Metro region and will provide administrative support for regional leadership teams outside of the region. As always, if you have any questions about industry issues, please reach out to your Regional Representative or email us. PAC Auction / OLCC Presentation / Lodging Tax Accountability One Big Night in Less than 2 Months ORLA's largest fundraiser of the year will be here in less than 2 months. One Big Night will be held at the Portland Doubletree Hotel, Tuesday, June 7.

Presentation to OLCC Commission ORLA representatives had an opportunity to present an industry update to the seven-member OLCC (Oregon Liquor and Cannabis) Commission last week. The presentation focused on the importance of OLCC staff extending liquor service footprints outdoors through a user friendly online process during Covid, their approach to license fee flexibility, and the emergence of to-go cocktails as another sales opportunity permanently available to the industry in Oregon to increase sales. We also flagged both ongoing inflation concerns and the importance of Economic Injury Disaster Loan extensions in helping our industry just barely keep our heads above water. ORLA remains focused on explaining the nature of invisible piles of debt on the shoulders of our operators while we all start seeing restaurants busy and even bustling. Today's sales numbers hopefully serve as a constant reminder that ongoing relief is necessary and warranted. Industry Coverage in The Hill The Hill published an op-ed from Sean Kennedy, Executive Vice President of Government Affairs for the National Restaurant Association. Sean hit the mark in covering what the industry needs to get back on track. It was a timely article right before industry operators head to DC this week. Accountability for Local Governments on Local Lodging Taxes ORLA remains committed to doing what we need to do in getting local governments to commit to transparency in how they spend industry tax dollars. We are currently in the middle of a disagreement with staff from one city in the Willamette Valley on how much of their lodging tax money is restricted for tourism promotion and facilities. A multitude of other local governments are also on our list in our pursuit of additional transparency. Have questions? Give us a call at 503.682.4422 or email us if you have any questions. | ORLA The Circuit Court decision has been affirmed by the State of Oregon Court of Appeals

FOR IMMEDIATE RELEASE: August 19, 2021 Contact: Jason Brandt, President & CEO, ORLA 503.302.5060 | [email protected] Wilsonville, OR– The importance of appropriately spending local tourism tax revenue was affirmed on August 11 by the State of Oregon Court of Appeals after a case brought forth by Bend lodging operators and the Oregon Restaurant & Lodging Association (ORLA) against the City of Bend. The original suit was argued on May 8, 2018, in Deschutes County Circuit Court with Judge Beth M. Bagley presiding. In the suit, the hospitality industry plaintiffs represented by Josh Newton of Karnopp Petersen LLP argued the City unlawfully redirected restricted Transient Lodging Tax (TLT) revenue, which state law required to be spent on tourism and tourism promotion. The court reasoned that a local ordinance passed in the City of Bend violated ORS 320.350 by decreasing the percentage of total local TLT revenues expended to fund tourism promotion from 35.4 percent to 31.2 percent. “The affirmation by the Oregon Court of Appeals this month upholding the Deschutes County Circuit Court decision means strong protections remain in place for how local lodging tax dollars can be spent across Oregon,” said Jason Brandt, President & CEO of the Oregon Restaurant & Lodging Association. “Our goals remain the same which start with the importance of working with local administrators and elected leaders when disagreements arise. Filing a lawsuit against a local government partner is a last resort and we look forward to turning the page and focusing in on what we can do across Oregon to invest our limited local lodging tax dollars on promotional strategies proven to boost our state’s local tourism economies.” The August 11 decision and details pertaining to the case can be found here. In 2003, the Oregon State Legislature passed lodging tax reforms meant to protect a percentage of revenues for hospitality industry reinvestment. As a result of the reforms, lodging tax collections spent by local jurisdictions on tourism promotion and facilities were ‘locked in’ as a percentage based on what a jurisdiction had been spending or agreed to spend as of July 1, 2003. July 2, 2003 represented a new chapter in Oregon whereby any new increase in a local lodging tax rate or any newly established local lodging tax would have to be spent on tourism promotion or tourism related facilities with 70 percent of revenue collected. The remaining 30 percent can and is commonly spent however a local jurisdiction sees fit free of any restrictions. You can view a short video created by ORLA which works to explain local lodging tax restrictions here: https://bit.ly/TLTdefined. “My firm and I are pleased with the decision by the Oregon Court of Appeals affirming Judge Bagley,” said Josh Newton, attorney for ORLA and the Bend lodging operators. “It is important that local governments abide by state law and honor their agreements with local business.” For more information on the efforts of the Oregon Restaurant & Lodging Association please visit OregonRLA.org. ### The Oregon Restaurant & Lodging Association is the leading business association for the foodservice and lodging industry in Oregon, which before COVID-19 provided over 180,000 paychecks to working Oregonians. The latest available data from the Oregon Employment Department shows current employment levels in the accommodations and foodservice industry totaling approximately 160,000 people as hospitality like many other industries faces the disruptions caused by COVID-19. ORLA Advocacy: Promoting and Advocating for Tourism Investment Plans

[update 7.1.21] - 2021 Legislative Session Win HB 2579 (Dead) – Increases state transient lodging tax rate and provides for transfer of moneys attributable to increase to county in which taxes were collected.

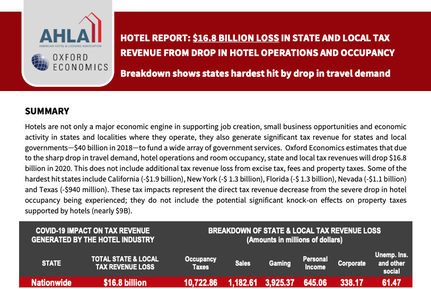

Background HB 2267, from Oregon’s 2003 Legislative Session, was designed to raise revenue for the promotion of tourism in Oregon. First, the bill instituted a 1 percent statewide lodging tax on all lodging properties in Oregon. This money was dedicated to the promotion of tourism through Travel Oregon, acting as Oregon’s tourism department. Second, the bill required any local governments with a lodging tax in place to determine what percentage was currently being used for tourism promotion and maintain at least that level in the future. The percentage is not allowed to decrease. The bill also required any local government that institutes a local lodging tax in the future to use at least 70 percent of the new revenue for tourism promotion. No more than 30 percent of the new revenue can be used for general funds or other non-tourism functions. The Oregon Restaurant & Lodging Association has worked with Local governments to clarify collection laws around Online Travel Companies. This should bring in millions of dollars more annually for tourism promotion. ORLA is also involved in efforts to attract events to Oregon that bring visitors and promote the state. Some examples in recent history were helping to pass legislation that added money to improve college athletic programs and allowing for NCAA March Madness games to be played in Oregon, and protecting tax credit programs that bring film and video production to Oregon. Issue ORLA must ensure that these state statutes remain in place. Any lodging taxes, state or local, need to bring travelers and businesses to Oregon. All retail businesses profit from increased travel; additionally, local government must be encouraged to keep promotional dollars directed to these efforts. Finally, there are always opportunities to attract more events like feature films, major sporting events, concert venues, and wine tours that benefit the industry as a whole. ORLA will work to enhance these efforts, which bring people to Oregon and encourage Oregonians to travel more in and around the state. Position Oregon Restaurant & Lodging Association supports current laws that protect lodging tax dollars going to tourism promotion and tax credits that encourage film and video attraction to Oregon. ORLA believes in protecting the dedicated tourism funds to ensure they continue to be allocated to tourism promotion at the state and local levels. This effort will benefit all retail businesses and local economies throughout our state.  New research shows coronavirus continues to devastate restaurant industry New research from the National Restaurant Association indicates that the restaurant industry has lost $120 billion in sales during the last three months due to the impact of coronavirus in the United States. State mandated stay-at-home policies and forced closures of restaurant dining rooms resulted in losses of $30 billion in March, $50 billion in April, and another $40 billion in May. The latest operator survey conducted by the NRA drew more than 3,800 responses, illustrating the extensive damage to restaurant businesses since the outbreak began. It found that the restaurant industry, which experienced the most significant sales and job losses of any industry in the country in the first quarter of 2020, expects to lose $240 billion by the year-end.  New report by Oxford Economics with state-by-state TLT revenue breakdown As a result of the sharp drop in travel demand from COVID-19, state and local tax revenue from hotel operations will drop by $16.8 billion in 2020, according to a new report by Oxford Economics released today by the American Hotel & Lodging Association (AHLA). Hotels have long served as an economic engine for communities of all sizes, from major cities, to beach resorts, to small towns off the interstate—supporting job creation, small business opportunities and economic activity in states and localities where they operate. Hotels also generate significant tax revenue for states and local governments to fund a wide array of government services. In 2018, the hotel industry directly generated nearly $40 billion in state and local tax revenue across the country. Oregon is expected to see a total state and local tax revenue loss of $171.7 million. Download the AHLA/Oxford Economic Report of the state-by-state breakdown for tax revenue impact and revenue loss. These tax impacts represent the direct tax revenue decrease from the severe drop in hotel occupancy, including occupancy, sales, and gaming taxes. These figures do not include the potential, significant, knock-on effects on property taxes supported by hotels (nearly $9B). At their most recent meeting, the Oregon Restaurant & Lodging Association (ORLA) Board of Directors voted unanimously (with 1 abstention) to support a legislative bill which will originate from Governor Brown’s office in support of a permanent 1.8% statewide lodging tax rate during the 2020 Oregon Legislative Session. Revenue raised by the statewide lodging tax is invested in Travel Oregon’s efforts to strengthen the economic impact of our state’s tourism industry. Oregon’s statewide lodging tax is currently collected at a rate of 1.8% with a reduction in the rate scheduled to take effect as of July 1, 2020 to a permanent rate of 1.5%.

“We appreciate Governor Brown’s proactive outreach to meet with ORLA and some of our key lodging stakeholders in person to discuss the merits of keeping the statewide lodging tax rate at 1.8% permanently,” said Jason Brandt, President & CEO of ORLA. “Our goals for lodging tax rate structures in Oregon are two-fold – protecting all statewide lodging tax resources to create return on investment for the industry through the efforts of Travel Oregon and protecting local lodging tax reforms passed in the 2003 Legislative Session.” Oregon continues to experience healthy growth in tourism spending logging our ninth consecutive year of industry growth in 2018. Compared to 2017, visitor spending was up 4.2% reaching a record $12.3 billion. Industry employment was also up year over year by 2.9% to approximately 115,400. Year over year, hotel room revenue increased by 4.4% as well. “We have seen firsthand what strategic investments in tourism promotion can do when industry tax dollars are put to their most effective use,” said Brandt. “With many other competing priorities in the Capitol, it is essential the association protects the appropriate use of these dollars at both the local and state levels. The economic impacts we are seeing are significant not just for our industry but for our public sector partners as well.” The U.S. Travel Association tracks statewide economic impact throughout the country and assists states in quantifying the value of year over year tourism growth. The most recently available data notates Oregon’s tourism growth at 5.3% when comparing 2016 to 2017, further substantiating the value of healthy tourism growth for Oregon’s public sector. From 2016 to 2017, Oregon experienced visitor spending growth of $652 million. That increase in spending and associated payroll income tax increases equates to as many as 410 firefighter positions, 380 police officer positions, or 380 teacher positions. ORLA continues to focus on the protection of local lodging tax dollars for tourism promotion and tourism related facilities in addition to support given to Governor Brown’s upcoming legislative bill for the statewide resource. Oregon’s local lodging tax structure can be complicated with over 110 different city and county jurisdictions collecting a transient lodging tax outside of the 1.8% statewide tax. Important guidelines have been in place for the past 16 years for how local lodging tax dollars can be spent. To clarify those parameters, ORLA recently produced a new instructional video to assist all stakeholders and the general public in better understanding the rules which govern local lodging tax resources. The new video specific to local lodging taxes (not to be confused with Oregon’s 1.8% statewide lodging tax) can be viewed here:

For more information about the Oregon Restaurant & Lodging Association’s policies on transient lodging taxes, please reach out to Greg Astley, ORLA’s Director of Government Affairs, at [email protected] via email. On June 30, the Oregon Legislature officially came to a close. The 2019 session was marked by hyper-partisanship, two walkouts by Senate Republicans and dozens of new laws affecting the hospitality industry. Several key bills will affect how restaurants and lodging properties conduct business in the near future. Watch for ORLA's full recap of the session coming soon to the Advocacy page.

Here are a few quick updates: HB 2005 – Paid Family and Medical Leave

SB 90 – Plastic Straws on request Plastic straws in restaurants are now only available “on request” unless a customer is using the drive through and then employees may ask the customer if they would like a straw. Effective as of June 13, 2019. HB 2509 – Plastic Bag Ban Single use disposable plastic bags are banned from restaurants and grocery stores. Retailers may charge for paper bags. Effective date is January 1, 2020. Read HB 2509 Enrolled. HB 3137 – Collection of local lodging taxes by Oregon Department of Revenue Provides that transient lodging tax becomes due when occupancy of transient lodging with respect to which tax is imposed ends. This bill will help eliminate the issue of properties collecting and remitting the lodging tax to the state and then if a customer cancels, having to go back and recover the lodging tax paid in order to refund the customer the tax. Effective date January 1, 2020. SB 248 – Increase in certain fees charged by OLCC Fees for OLCC licenses will double effective July 1, 2019. Negotiated separately from this bill is the option to renew an OLCC alcohol license every two years instead of annually. Oregon’s lodging tax investments could be drastically reduced if Senate Bill 595 passes.

If successful, SB 595 would eradicate the critical lodging tax reforms of 2003 by taking 30% of our industry’s 70% of any new or increased lodging tax implemented since July 2, 2003, and allowing local governments to redirect those funds for “affordable workforce housing” projects. The result would allow only 40% of new or increased local lodging taxes to be protected for tourism promotion and tourism-related facilities. ORLA was at the table in November supporting Measure 102, giving communities across Oregon greater flexibility to create the workforce housing they need. ORLA continues to be willing and ready to engage in productive conversations about alternative solutions that can benefit communities and foster economic development without targeting one industry. The Senate Committee on Housing held a public hearing for SB 595 on February 18. We need lodging industry members to take action now! Email members of the Senate Committee on Housing and tell them how important the 70% protections are to growing Oregon’s tourism economy. Urge them to consider alternatives to workforce housing initiatives. • Senator Shemia Fagan, Chair: [email protected] • Senator Dallas Heard, Vice-Chair: [email protected] • Senator Jeff Golden, Member: [email protected] • Senator Tim Knopp, Member: [email protected] • Senator Laurie Monnes Anderson, Member: [email protected] Read more about the bills ORLA is engaged and/or tracking this session at OregonRLA.org/billtracking. If you have any questions on this bill, please reach out to me via email at [email protected] or call me directly at 503.302.5060.

Protecting Our Industry

During this session ORLA will be tracking several bills and engaging on those particularly to the hospitality industry. Members are encouraged to stay informed and engaged on the issues by subscribing to ORLA communications. If you have any questions, contact Greg Astley, Director of Government Affairs, at [email protected]. |

Categories

All

Archives

June 2024

|

Membership |

Resources |

Affiliate Partners |

Copyright 2024 Oregon Restaurant & Lodging Association. All Rights Reserved.

8565 SW Salish Lane Suite 120 | Wilsonville, OR 97070-9633 | 503.682.4422 | 800.462.0619 | Contact Us

Site Map | Accessibility | Privacy Policy

8565 SW Salish Lane Suite 120 | Wilsonville, OR 97070-9633 | 503.682.4422 | 800.462.0619 | Contact Us

Site Map | Accessibility | Privacy Policy

RSS Feed

RSS Feed