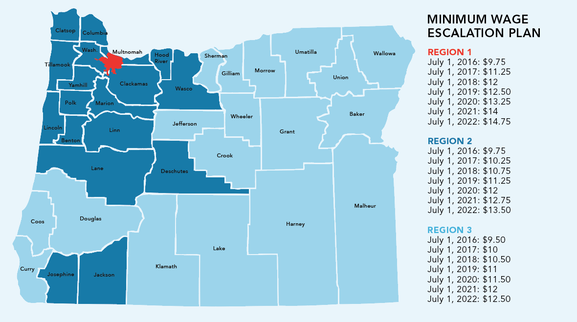

Guest Blog | GNSA What Employers Need to Know Payroll processing has a lot of moving parts. Before paying an employee, you must consider several variables, including the minimum wage, hours worked, overtime, allowed deductions, tax, and more. Understanding federal and state laws regarding payroll is essential to avoid disputes with employees and the government. Keep in mind that if you do not have the resources or bandwidth to understand the legislation or comply with it, an Oregon payroll service might be right for you. Here are vital items employers in Oregon need to know about payroll. Oregon Minimum Wage While the current federal minimum wage is $7.25 per hour, Oregon minimum wage figures are much higher, and can be dependent on a specific locale or city. The minimum hourly rate is $11.50 in urban areas, $12.00 in standard counties, and $13.25 in the Portland metro area. Oregon minimum wage law requires you to pay the most beneficial rate to the employee, which is the state minimum wage. The minimum wage requirement applies to all paid workers, including minors and employees on official training. It increases every July 1st, but this trend will change after 2022. Starting July 1, 2023, the state's minimum wage will increase depending on inflation as per the Consumer Price Index. This inflation-based minimum wage rate is becoming increasingly common in many other states now as well. Workdays and Hours Worked Requirements in Oregon A workday, according to Oregon minimum wage law, is a fixed period of 24 consecutive hours. On the other hand, a workweek is a specified period of seven successive days that occurs regularly. Businesses have to pay employees for all hours worked. Oregon's minimum wage law defines hours worked as all hours an employed person commits to their employer. This includes the time an employee is on duty at the employer's premises or engaged away. Further, Oregon recognizes work requested as well as suffered or accepted unrequested work as hours worked. If an employer doesn't want a worker to perform work, the employer must ensure the employee doesn't do it. Payroll Tax in Oregon Oregon requires employers in or operating within Oregon to withhold tax from wages paid to residents working in or outside the state. They must also do the same for nonresidents who deliver services in Oregon. An employer with paid employees in Oregon needs to register for a business identification number (BIN). Corporations without workers should also have a BIN to report remuneration for corporate officers. Oregon withholding taxes and federal taxes are due on the April 30. Unemployment and transit taxes are due on the last day of the month following a calendar quarter. If you pay federal taxes electronically, you should do the same for your combined payroll taxes. Oregon Requirements for Deductions from Wages Oregon has strict rules governing how an employer can withhold or deduct part of an employee's wages. As the employer, you can only make deductions if:

However, there are many instances where the state prohibits you from deducting or withholding any amount from an employee's wages. Examples include deductions to cover:

Oregon Pay Schedule Rules Every employer in Oregon must establish and observe a regular payday when they must pay all employees the wages due to them. However, section 652.120 allows you to enter into a written agreement with your workers to pay them at a future date. Typically, the payday should not extend beyond 35 days from the day you engaged an employee or since the last regular payday. Employers are free to establish and maintain more frequent pay intervals. Wage Payment Methods in Oregon You can pay your employees by cash, check, or direct deposit. A payment check should be redeemable at face value with no deductions by the employee's bank. If you want to pay via direct deposit, payroll card, ATM card, or any other electronic means, the employee must consent to it. Electronic payment methods should allow the employees to withdraw their net pay once cost-free. A worker who wishes to revoke their consent to electronic deposits must issue you with a written notice. The revocation becomes effective 30 days after you receive it. Oregon Employee Time Reporting Requirements Oregon requires employers only to compensate workers for hours worked. Therefore, you don't have to pay an employee for showing up or reporting if they don't work. Additionally, you don't need to pay a worker the minimum number of hours if you dismiss them before completing their shift. To read the full article (originally posted on gnsadmin.com April 5, 2021), including more info on travel time regulations, on-call time guidance, Oregon final paycheck requirements and statement of wages, visit GNSAdmin.com. About GNSA is a Payroll, Human Resource, and Benefits Administration firm specializing in serving the small to middle market. Started in 1997, GNSA has steadily grown from year-to year as more and more companies have identified GNSA as the premier outsourced service provider. At GNSA we believe that the strength of the United States economy resides in the small to mid-market, therefore GNSA has focused its efforts towards better serving this segment. This guest blog was submitted by GNSA and follows ORLA content submission guidelines. For more information, contact Marla McColly, Business Development Director, Oregon Restaurant & Lodging Association.

Comments are closed.

|

Categories

All

Archives

June 2024

|

Membership |

Resources |

Affiliate Partners |

Copyright 2024 Oregon Restaurant & Lodging Association. All Rights Reserved.

8565 SW Salish Lane Suite 120 | Wilsonville, OR 97070-9633 | 503.682.4422 | 800.462.0619 | Contact Us

Site Map | Accessibility | Privacy Policy

8565 SW Salish Lane Suite 120 | Wilsonville, OR 97070-9633 | 503.682.4422 | 800.462.0619 | Contact Us

Site Map | Accessibility | Privacy Policy

RSS Feed

RSS Feed